The dividend handbook: What you must know

| Summary: Australian stocks are among the best dividend payers in the world. Moreover, they are a reliable inflation beater over historical timeframes. |

| Key take-out: The historical growth in dividends in Australia has been 1.1% per year greater than the rate of inflation – a very attractive proposition for a long-term investor. |

| Key beneficiaries: General investors. Category: Investment portfolio construction. |

Over recent years we have become used to very generous dividends in the Australian market – they are the backbone of many income-based share portfolios.

Indeed, with a dividend yield for the wider market working out currently at 4.15% pre-franking (and 5.48% if you include franking benefits), we enjoy dividends that are roughly twice as high as Wall Street.

As cash rates sit at 50-year lows, dividends have lifted across the board as shareholders have chased key high paying stocks. In turn, these stocks have been bid up. Take the rapid rise of Commonwealth Bank, for example.

As we discovered just last week, John Abernethy went looking for a rate of 8% pa in his Eureka income portfolio two years ago and finished with powerful returns of 46% over the period.

But, is the era of high dividends typical? Should we expect it to last?

One way to get a sense of what has happened is to look at the history of returns from sharemarkets – and in this case looking way back to the end of the 1800s. There are four elements that we will consider:

- What has the average annual yield been from investing in shares?

- What is the average annual growth in dividends over time?

- What appears to be the impact of franking credits?

- What has been the total return from investing in shares for investors?

Total returns from investing in shares

The short answer to the fourth question is that the long-run total return from investing in shares appears to have been around 11% to 15% a year – that is, the return including both dividends and capital growth.

The most significant study of this that I am aware of in the Australian context is the 2007 study “A Re-Examination of the Historical Equity Risk Premium in Australia” by academics Brailsford, Handley and Maheswaran. The study looked at sharemarket returns between 1958 and 2005, and found that the average annual return over that period was 14.5%, or a return of 8.9% a year after inflation (keeping in mind that there was a period of particularly high inflation during the 1970s).

Importantly, the sharemarket data that goes back before 1958 was considered less reliable. The study did make a calculation of sharemarket returns from 1883 to 2005 and found that the return was 11.8% a year (8.6% a year after inflation). Of course, the data to 2005 does not include the period of the global financial crisis. However, given the long timespans of the data (123 years and 47 years), it would not have had a major impact on these average annual returns.

Average annual yield

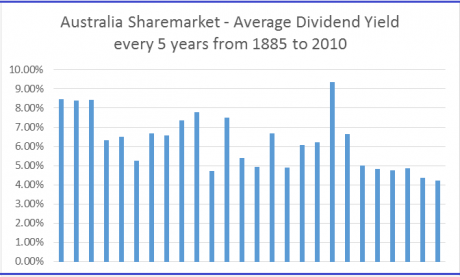

A bicentennial publication, “Australian Historical Statistics” includes tables of sharemarket data dating back to 1875, when the All Ordinaries Index was at the level of 5.4. The first report of dividend yields was 1882. To put together a random sample of dividend yields over time, the average dividend yield of the market every five years has been used, starting at 1885 and going through to 2010 (this time including the GFC). The following chart shows that data:

The average dividend yield over this period is 6.2% per year. It should be noted that no adjustment has been made for franking credits following their introduction in July 1987. It is also worth keeping in mind that a criticism of the early Australian sharemarket data was that early estimates of dividend yield may have only been based on companies that actually paid dividends, thereby excluding non-dividend paying companies and tending to overstate actual dividend returns.

Growth in dividend income

As a broad generalisation, there are two types of income streams from investments: those income streams that grow (for example, shares and property) and those that do not (cash and fixed interest/bond returns). Many commentators and advisors rightly point out the value of the income from shares growing over time, but the question is, how quickly has this income grown?

The London Business School/Credit Suisse publication “Global Investment Yearbook” took a close look at dividends in its 2011 edition. It considered the question of dividend growth, and found that in Australia, over the period 1990 to 2010 (this data includes the period of the global financial crisis), dividend growth had average 1.1% on top of inflation per year. This is a critical figure and clearly a very attractive result for someone planning any long-term investment approach – an income stream that ‘outperforms’ inflation over the long run.

Across the world, the report found that dividend growth was 0.8% a year higher than inflation. As a warning though, some countries (Japan and Germany) had sharemarket dividend growth that had fallen below inflation over this period.

What about franking credits?

Assuming an average level of franking across the Australian market of 75%, and a current dividend yield of 4.15% (source: ASX 200 index State Street Global Advisors), then franking credits add a further 1.33% per year – taking the gross (cash plus franking credits) yield of the market to 5.48%.

Conclusion

A long-run look at historical Australian sharemarket data lets us paint a picture of what has happened in the past – and might provide some useful reference points for the future.

The average dividend yield has been 6.2% a year (looking at the period 1885 to 2010), compared to a gross (including franking credit) yield of 5.48% currently. The historical growth in dividends in Australia has been 1.1% per year greater than the rate of inflation – a very attractive proposition for a long-term investor.

Finally, long-run total returns (dividends and capital growth) from investing in shares have averaged 11% plus per year over long time periods in Australia.

Scott Francis is a personal finance commentator, and previously worked as an independent financial advisor. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.

Frequently Asked Questions about this Article…

Australian stocks are renowned for their generous dividends, often yielding higher returns compared to other markets like Wall Street. This makes them an attractive option for income-focused investors.

Historically, dividends in Australia have grown at a rate 1.1% higher than inflation, making them a reliable option for long-term investors looking to beat inflation.

The average dividend yield in the Australian market has been around 6.2% per year over the long term, although current yields, including franking credits, are about 5.48%.

Franking credits enhance the value of dividends in Australia by providing tax benefits. With an average franking level of 75%, they can increase the gross yield of dividends significantly.

The long-term total return from investing in Australian shares, including both dividends and capital growth, has averaged between 11% to 15% per year.

While data from 1958 onwards is considered reliable, earlier data may be less so. However, long-term studies suggest consistent returns, with an average annual return of 11.8% from 1883 to 2005.

Australian dividend growth has been strong, averaging 1.1% above inflation annually from 1990 to 2010, compared to a global average of 0.8% above inflation.

While historical data shows strong dividend performance, future expectations should be tempered with caution, considering market fluctuations and economic conditions.