The dangers of portfolio home bias and how to handle it

A friend calls up and wants to borrow some tools. “We only have four but three of them are at school,” you reply. The friend clarifies terms and heads over, peering into the craggy, beaten box as you open it. “All I can see is an adjustable spanner,” you say. “Yeah. Now you know how Philip Lowe feels.”

There’s only one thing worse than a joke about central bankers and that’s actually being one. You have one tool - interest rates - which can be either lowered or increased but cease to be effective beyond a certain point. Used poorly, they can do some serious damage.

In many countries, the interest rate spanner has ceased to be useful. Japan, Sweden, Denmark and Switzerland have negative interest rates. A further 21 countries are sitting on zero and Australia isn’t that far behind.

This is a matter of concern for RBA Governor Lowe, who is worried that local rate cuts won’t have the stimulatory impact that they once did (speculative property booms aside).

This week, NAB chief economist Alan Oster suggested that if the government prioritises a budget surplus over fiscal stimulus, the cash rate mid-next year could be as low as 0.25%. Lowe appears similarly inclined, telling a conference last month that “monetary policy cannot deliver medium-term growth” and that “we risk just pushing up asset prices.” Been there, done that.

Growth weak, rates tumbling

Interest rates have their limits and Australia might be about to test them. With Australian economic growth the weakest since the global financial crisis, retail sales growth negligible and non-existent real wages growth, Lowe wants the government to use almost-free money to stimulate the economy to fix up the joint. The Government, meanwhile, prefers a budget surplus.

Investors can make up their own minds about tools but face a more demanding task. Whilst we may escape a recession the threat of one is increasing. Were it to eventuate, it would be a novel experience for many; the last recession was in 1990/91, the one “we had to have”.

This is an issue of risk management, of planning for something that may not happen, rather than predicting that it will.

According to the ASX Australian Investor Study of 2017, just 8% of the adult population own international shares. Among Australian investors 75% hold only domestic shares.

InvestSMART data supports these findings. Aided by 28 years of unbroken economic growth, Australian investors have a severe case of home bias.

Chart 1 - Equity markets home bias by country

.png)

Source: Corrine Ng, APN Property Group, via Livewire. Data from Vanguard, IMF’s Coordinated Portfolio Investment Survey (2014), Barclays, Thomson Reuters Datastream, and FactSet

*Singapore and Hong Kong domestic equity holdings based on Eastspring Investment Asia Investor Behaviour Study 2015.

The issue is even more pronounced than the chart above makes it appear. Just two sectors – financials and resources – account for over half the ASX’s total market capitalisation. The big four banks, meanwhile, comprise nearly one fifth of it.

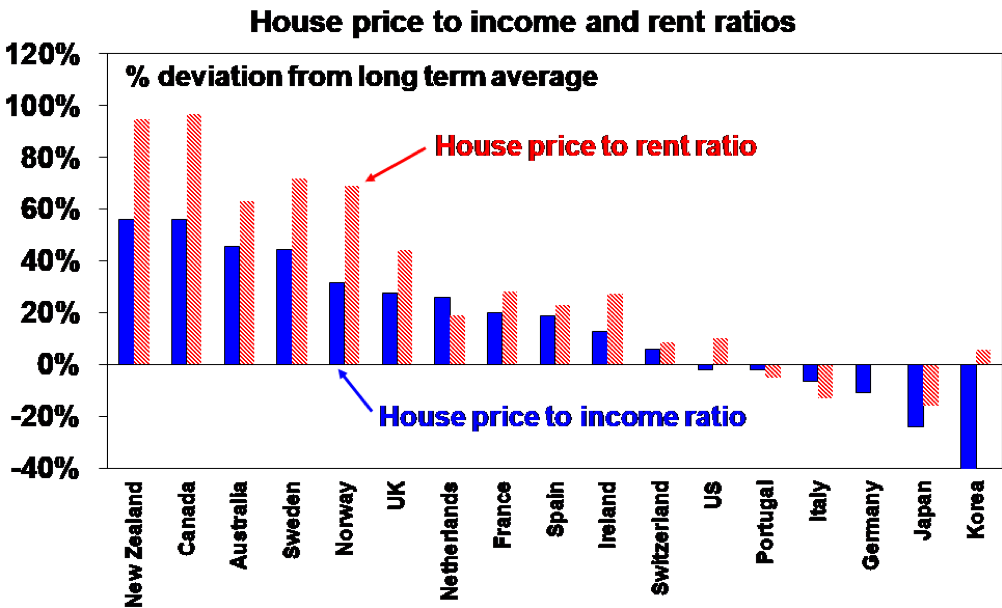

Bank loan books are heavily weighted to Australia’s residential property markets which, by most accounts, are among the most expensive in the world. According to the 2019 International Demographia Housing Affordability Survey, the median multiple of house prices-to-income is 5.7 times in Australia compared with 3.5 in the US and 4.8 in the UK.

That’s bad enough. In Sydney and Melbourne, which dominate the national market, the median house price-to-income ratio is 11.7 and 9.7 respectively.

Source: OECD, AMP Capital, via Livewire

According to Shane Oliver at AMP Capital, “The surge in prices relative to incomes has seen household debt relative to household rise from the low end of OECD countries 25 years ago to the high end now. These things arguably make residential property Australia’s Achilles heel. But that’s been the case for 15 years or so now.”

Between 2009 and 2011, when an Australian dollar was worth more than its US counterpart, we repeatedly made the case for international stock exposure. For members that adopted this strategy, things worked out pretty well.

It is now time to make the same case, not to take advantage of a high dollar but as protection against a potential recession.

Many Australian investors have a virulent case of home bias. The concentrated nature of our local market doubles down on this risk. Being heavily weighted to resources and the big banks, our portfolios are often inadvertently highly exposed to China, which supports our resources sector, and the residential property market, which props up the major banks.

Over the last 15 years, this has stood us in good stead, to the point where many investors are reluctant to reduce their exposure to these two high-performing sectors. The risk of a downturn hasn’t gone away but it has become harder to see, hidden behind the share price performance of the big banks and miners over the past decade.

We’ll leave it to members to determine the extent of their home bias risk, although the InvestSMART portfolio health check tool can help. We’ll also assume you’ve made the decision to free up some funds through the sale of locally-listed shares or deploying some cash to reduce your exposure to the Australian economy. What do you do next?

A simple, cost effective way of gaining access to international markets is through Exchange Traded Funds (ETFs). They provide you with instant diversification around the globe and take away the risk of you choosing the wrong company to invest in.

An even simpler way is to invest in the InvestSMART International Equities Portfolio. It’s a portfolio managed by our chief market strategist, Evan Lucas and invests in a selection of ETFs chosen to give you the right international exposure. The portfolio is also part of the capped fee range where the management fee is capped at $451pa.

Finally, a word on currency risk, which can have a big impact on your portfolio. Over time, the impact of currency movements evens out. If you’re investing for seven years or more - the minimum recommended time frame of the capped fee International Equities Portfolio, for example - you don’t have much to worry about.

Click here to find out more about the InvestSMART International Portfolio and how you can easily add international exposure to your portfolio.

Frequently Asked Questions about this Article…

Portfolio home bias refers to the tendency of investors to favor domestic over international investments. For Australian investors, this is concerning because it leads to overexposure to local sectors like financials and resources, which can increase risk, especially if the domestic market faces downturns.

With weak economic growth and low interest rates, the Australian economy is under pressure. This situation suggests that investors should consider diversifying their portfolios internationally to mitigate risks associated with potential local economic downturns.

International diversification helps reduce the risk associated with being overly reliant on the Australian market, which is heavily concentrated in financials and resources. By investing globally, investors can protect themselves against local economic fluctuations and gain exposure to different growth opportunities.

ETFs are investment funds that trade on stock exchanges, much like stocks. They offer a simple and cost-effective way to gain exposure to international markets, providing instant diversification and reducing the risk of picking individual underperforming companies.

Currency risk can impact the value of international investments due to fluctuations in exchange rates. However, over a long-term investment horizon, such as seven years or more, the effects of currency movements tend to even out, minimizing their impact on your portfolio.

The InvestSMART International Equities Portfolio offers a managed selection of ETFs that provide international exposure. It is designed to diversify your portfolio globally and is part of a capped fee range, ensuring cost-effective management with a fee capped at $451 per year.

Australia's housing market, with high property prices and household debt, poses a risk to investment portfolios heavily weighted in domestic banks and resources. Diversifying internationally can help mitigate this risk by reducing reliance on the local property market.

Investors can use tools like the InvestSMART portfolio health check to evaluate their home bias risk. This assessment helps determine the extent of domestic exposure and guides decisions on reallocating investments to achieve better diversification.