The cycle favours Aussie markets

Summary: Comments from Numbersmith Research principal Robert Vagg highlight three key waves that indicate the Australian market is set to thrive over the next three years. These include the current good good value of the All Ords comparative to its history, the fact that growth tends to happen in the middle five years of a decade, and that the market has further to go in its current up-cycle, which began in 2012. |

Key take-out: Using these cycles an Australian market rally can be predicted between 2012 and 2019. |

Key beneficiaries: General investors. Category: Shares. |

Malcolm Turnbull says we live in the most exciting of times with boundless opportunities, yet it's hard to find anyone else who has a bullish view of Australia's medium term prospects.

So it was a pleasant surprise to hear Robert Vagg, Principal of Numbersmith Research, who analyses longer-term market cycles, tell the Australian Investors Association one-day seminar this month that our share market appears set to thrive over the next three years.

As a market trend and momentum monitor, I'm sceptical about using cycles for share market guidance because the duration and amplitude of cycles vary too greatly to be useful as a forecasting tool.

But Robert Vagg begs to differ. In his view there are three long term underlying waves that drive bull and bear markets. And they each have regular patterns.

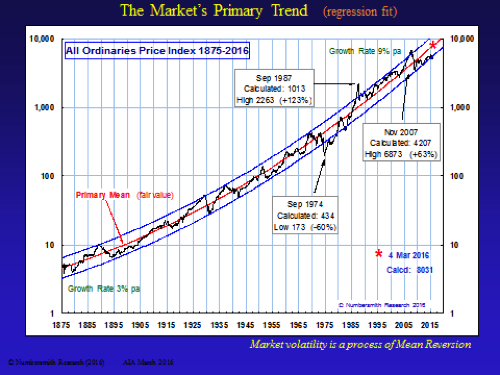

The longest is a primary trend as shown below. It indicates the Australian All Ords share index has never been a better buy, except for the period surrounding the 1974 crash. That's because it recently breached the lower limits of its curvilinear trend line channel of the last 140 years.

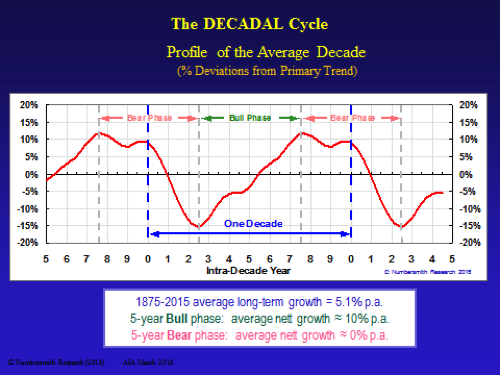

The second cycle is decadal. Robert says history shows much stock market growth typically occurs between the third and eighth year of each decade. The remaining five years that revolve around the turn of each decade generally show minor growth and conclude with a one to two year slump in share prices. So we are presently within a decadal upcycle (2013-2018).

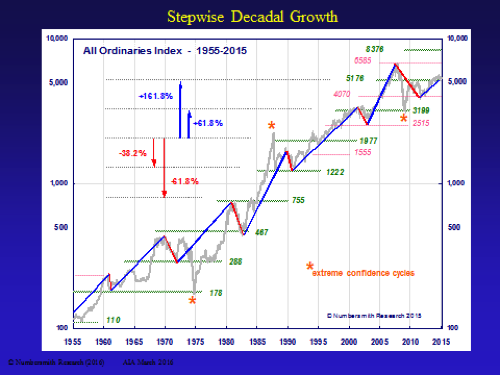

The third cycle follows a natural rhythm. Robert says markets tend to progress through a set of primary resistance levels, where each is 61.8 per cent higher than the one below. Normal progress through this cycle sees the market move two steps up and then one step down, resulting in the major rallies averaging around 161.8 per cent and falls averaging around 38.2 per cent (which also happen to be Fibonacci numbers that are common in nature – read more by clicking here.). The latest up-cycle started in 2012 and on historical precedence has a lot further to run.

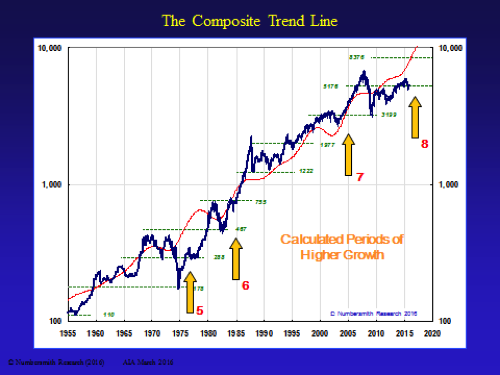

Robert combines these three market cycles to produce a composite underlying trend line (coloured red below) that suggests the Australian share rally beginning in June 2012 will continue through to 2019. Indeed recent market doldrums are a buying opportunity before the All Ords index catches up with its cyclical imperative.

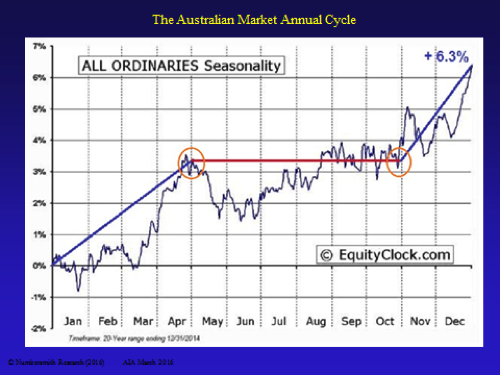

Finally, an Annual Cycle shows that typically there is little change in the market's position at the end of October from where it was at the beginning of May, with the November to April period contributing almost all of the growth experienced in the average year.

If the underlying trends that Robert describes continue in the long and short term, then a trend and momentum following strategy should catch that wave. Let's hope Robert's identified trends eventuate over the next three years because it's more fun holding a listed share fund that is surging than to be sitting on cash to avoid a crash.

Finally, some advice for Malcolm Turnbull. If Robert Vagg's annual market cycle holds in 2016, July is a bad time to bring forward a federal election since it would follow the worst two months of the year for the Australian share market. By contrast, December is the strongest point in the annual share market cycle. Studies show that voter support for incumbents is closely aligned to how the stock market fares (read more on this by clicking here).

Percy Allan is Editor of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds see www.markettiming.com.au.