The clock is ticking on Australia's housing boom

Speculation continues to drive the Sydney and Melbourne housing markets but history shows that investors can rarely shine so bright for long. What follows a boom is often a bust and this episode is unlikely to be any exception.

Investors have been at the heart of every housing boom over the past three decades but rarely more so than in the latest episode.

Speculation has driven the Sydney market into the stratosphere but also boosted Melbourne prices significantly. By comparison, cities without strong investor activity have experienced little price growth.

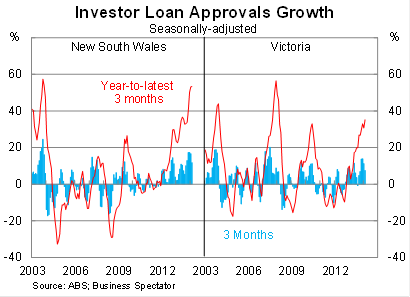

Sydney and Melbourne are the two cities where investors have been the most active. Investor loan approvals in Sydney are 53 per cent higher over the year to the latest three months, while in Melbourne investor demand has increased by 35 per cent.

History suggests that growth of this magnitude is high but far from unprecedented. In New South Wales, growth peaked higher during the early 2000s, while in Victoria investors went bananas just prior to the global financial crisis.

More importantly investor demand displays a clear boom-bust cycle. Investor activity is inherently volatile, and also unreliable, often rising extensively over a number of months before declining sharply.

Some booms have lasted longer, supported by low interest rates, strong economic growth and first home buyer grants, but others have been short and sweet.

For example, the investor-driven boom in New South Wales that burst in 2004 was followed by poor investor demand that stretched five years. Similar (though less severe) weakness was experienced in Victoria from 2004 to 2007.

By comparison, in Victoria the decline in investor demand in 2008 was sharp but relatively short-lived due to exceptionally generous first home owner boosts by the state and federal government.

The size of each downturn appears driven by three factors: size of the boom, how long the boom lasted and the interest rate environment.

The current investment boom in New South Wales has lasted 26 months. By comparison, the boom in the early 2000s lasted for 37 months. But the current boom is rapidly approaching the dizzying heights of that earlier boom and, given the generous interest rate environment, there is a distinct possibility that the investor boom in Sydney could persist for another year.

In Victoria, the current boom has lasted 16 months and has obviously not been as frenzied thus far.

Victoria’s population growth is strong, providing a solid base for investment, but their economy continues to be relatively subdued. Low interest rates will encourage speculation but history shows that investment cycles in Melbourne housing are relatively short.

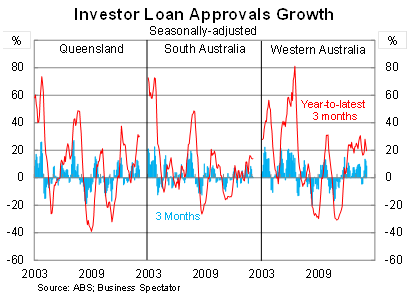

Of course, Melbourne and Sydney are not the only cities to experience strong investment cycles. In fact, our smaller cities have often had incredible booms (and busts) as they play catch up to Australia’s more populated cities.

The current expansion in Western Australia has lasted for 29 months but has yet to show the frenzied behaviour that we’ve seen on the east coast. Investor activity has actually been fairly muted since growth peaked in 2006. As the economy rebalances, economic activity in Western Australia will continue to slow and this will weigh on investor sentiment.

Investor activity has picked up significantly in Queensland in recent months, suggesting that investors may soon turn their attention north. But to date, the pick-up has been mild compared with previous booms. Despite low interest rates, it seems unlikely that investor growth in south-east Queensland will return to its property-spruiker led high in the early 2000s.

Last week I noted that growth in investor loan approvals had begun to slow. Monthly trend growth had slowed from 3.9 per cent in September to 1.1 per cent in February (Growing pains in the housing market’s transition phase, April 9). The big question is whether this is early evidence that investor activity is becoming exhausted or simply a transition to a more sustainable level of growth.

What is clear however is that there are danger signs for the Australian housing market (Prepare for a sharp house price punishment; April 9). Speculation in Sydney is rampant, though not unprecedented. Simply by virtue of being centred in Sydney, national investor activity has been stronger than in recent boom periods.

Households have benefited from price gains over the past year but those gains will be unwound once investors flee the market.

Perhaps more troubling is the timing. Rarely has a boom in investor activity been centred on such a flimsy economy. The outlook for the Australian economy continues to be subdued, with investor sentiment completely out of whack with expectations for growth.

Furthermore, there is a very real possibility that investor demand may deteriorate just as mining investment collapses, providing a double-whammy for both households and the Australian economy.