The Chinese dragon is breathing smoke, not fire

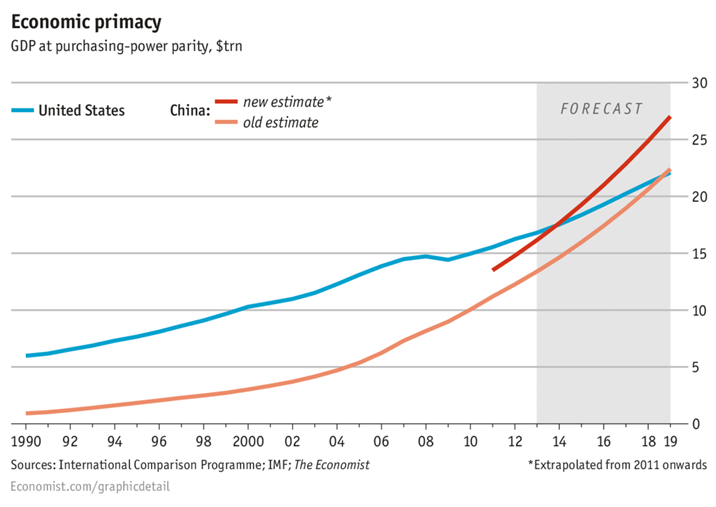

The Economist has published a short but headline-grabbing piece crowning the dragon, which argues the Asian powerhouse is about to overtake the United States as the world’s most pre-eminent economy at the end of this year. That’s five years earlier than the previous prediction by the International Monetary Fund.

According to the forecast, the Chinese economy, as measured in purchasing power parity (to better reflect cost of living in different countries), will grow larger than the United States in the next seven months. It is worth noting that China held the title of the world’s largest economy until 1890, when the US overtook it.

The revised estimation is based on new data from the International Comparison Program -- a partnership of official statistics agencies hosted by the World Bank -- which calculated the cost of living in 199 countries. China’s PPP exchange rate is 20 per cent higher than previously thought.

So is this a big deal? Symbolically yes, but it does not change the world economic pecking order in reality. The United States is still the world’s most pre-eminent economic power by a wide margin, regardless of whether China’s GDP as measured in PPP will be larger at the end of this year.

If we want to assess China’s economic importance and spending power internationally, the market-based exchange rate is still a much better measure. If we use this traditional method of calculation, it will take China at least another 10 years to overtake the United States as the world’s largest economy.

China’s GDP is about $8.2 trillion and the size of the US’s is $15.7trn. So the Chinese economy is only about half the size of the US, according to the prevailing market exchange rate. If we look at it on a per capita basis, an average Chinese citizen earns $US6000 ($A6466) a year, a bit over 10 per cent of your average American, at $US51,000.

If we want to assess the true economic strength of the country, it is not enough to look at GDP in isolation, though it is an important indicator. Even in China, commentators and analysts are talking about the quality of growth, not merely the quantity.

On this front, there is no question the US is still leading the pack. Silicon Valley is still the Mecca of innovation and the home to some of the best known global brands such as Google and Apple. And while China is showing some promising signs in catching up with the United States in areas such as e-commerce, telecommunications and biotechnology, it is still decades behind in many other areas.

Alan Greenspan, the former US Federal Reserve Chairman, said recently in China that the country’s phenomenal growth in productivity was based on imported foreign technology and it could not last forever.

Apart from technology, the US still dominates the global financial market. The yuan may be rising but the greenback is still the undisputed, leading international hard currency. New York remains the global financial hub that attracts even some of the best Chinese companies to list there. It will take China decades, if not longer, to develop a sound legal and regulatory framework to support Shanghai to rival New York.

It is only a matter of time before China overtakes the United States as the world’s largest economy. Basic law of arithmetic will see to that due to a larger population and a higher growth rate. But it will take much longer for China to compete with the US in terms of the quality of their respective economies -- let alone for your average Mr Wang enjoying the living standards of Mr Smith.

It is too soon for China bulls to pop the champagne.