The big issues facing the economy in 2015

What are the big issues facing the Australian economy in 2015? At first glance, the narratives that defined 2014 have yet to run their course. Expect the property market, the federal budget, commodity prices and the exchange rate to drive economic discussion this year.

Sydney homeowners and investors did well during 2014 but this year they face a much sterner test. At this stage, three factors appear likely to weigh on the housing market over the second half of 2015.

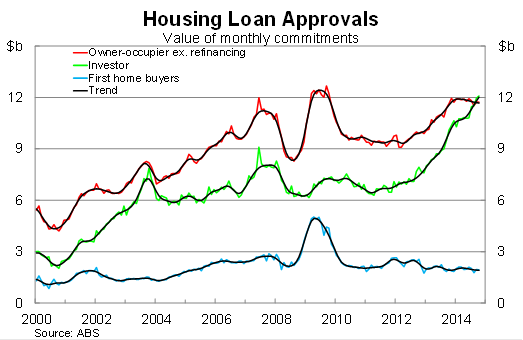

First, activity within lending markets has been elevated for the past two years. Owner-occupier activity eased considerably in the final months of last year and it is only a matter of time before investor activity -- which is currently at an unprecedented level -- follows suit.

Historically, lending activity and house prices have moved in step, providing some considerable downside risk for the Australian property market.

Second, APRA announced back in December that they will review lending practices towards investors in the first quarter and financial institutions with annual investor lending growth materially above 10 per cent will be asked for a ‘please explain.'

Macroprudential policies will be on the lips of many investors. Not simply because of the recent steps by APRA but also because of the Murray inquiry, which recommended an increase in the capital held by banks and a lifting of the risk weights applied to mortgage loans.

Third, the broader economy remains weak, employment continues to track well below population growth and Australian incomes will continue to suffer the effects of the sharp fall in the terms-of-trade. Low interest rates have supported property prices -- and will continue to do so -- but income growth will offset much of those benefits during 2015.

The federal budget is another issue that will refuse to go away. We've been discussing it since May and we won't finish debating the merits of the 2014-15 Budget until the next one is ready for publication.

Will the Coalition change tack? Will they find a more equitable solution to our long-term budget problems? Or will they continue with the same strategy that proved so disastrous last year?

The public now realise that the problem extends much deeper than simply spending too much. We're also struggling to generate enough cash to meet the needs of the Australian people.

This will eventually create an opportunity to discuss widespread tax reform but I don't expect that view to gain much traction this year. The Coalition simply does not have the political capital and the Labor Party is enjoying a great deal of success with their populist platform.

The most important political narrative though will be whether Prime Minister Tony Abbott can hold on to power. The party needs a swift change in policy direction to regain their lost ground but their strong stance on the Rudd/Gillard merry-go-round makes it very difficult for them to follow suit.

The narrative that caught most analysts by surprise last year was the sharp fall in iron ore prices. Expect prices to continue to ease this year -- albeit at a slower pace -- and expect further consolidation within the sector.

Chinese growth will continue to moderate -- though remain elevated by the standards of developed countries. China will continue to rebalance their growth model towards consumption and away from commodity-intensive infrastructure investment.

The implications for Australia are clear: both commodity prices and export volumes will be weaker than iron ore producers expected when the investment boom began. Firms will be caught out -- some will fail -- and the mining sector may be a very different beast this time next year.

Offsetting these effects partially will be a weaker exchange rate. The Australian dollar fell sharply against the US dollar -- and more importantly the trade-weighted index -- over the second half of last year. That should continue this year as the Federal Reserve looks to raise interest rates, capital flows to Australia will ease due to fewer investment opportunities and the RBA will cut rates again.

Naturally, Australians will be focused on domestic economic issues but certain international stories will capture our imagination. When the Federal Reserve raises interest rates -- probably in the first half of this year -- it will mark the symbolic end of the global financial crisis.

Except if you live in Europe, where the crisis continues to unfold. Discussion in Europe will be dominated by renewed focus on the sustainability of government debt within the periphery. After years of harsh and unsuccessful austerity measures, it's time to review the situation and acknowledge where existing policy has failed.

The first step though will be addressing the growing threat of deflation, which appears almost certain following the sharp fall in global oil prices. That may prove only temporary but symbolically it will highlight the utter failure of the ECB, the European Union and the International Monetary Fund to generate sustainable growth.

The Australian economy faces a number of headwinds and that will be reflected in the narratives that dominate discussion this year. There remains no shortage of other narratives that deserve recognition; for example, youth unemployment is one story that deserves to gain greater traction. It's about time we started a discussion about productivity as well.