The 'big four' are overvalued

| Summary: Bank shareholders are enjoying a rewarding reporting season, but are fortunate economic conditions are sufficiently favourable to support lower provisioning as a replacement for income-driven profit growth. The downtrend in provisioning reduces bank resilience to economic and financial shocks, and the tapering of QE is likely to reduce buying momentum in banks as yields have become less attractive. The current pricing of major banks assumes fair – or better – economic and financial conditions ahead. |

| Key take-out: At current prices, the upside in overvalued big bank stocks is speculative, because it depends on continued positive sentiment from income investors. |

| Key beneficiaries: General investors. Category: Income. |

Recommendations: Neutral. |

Three of the ‘big four’ banks reported full-year earnings over the last week and three of the six high-yielding equities in the Clime Income Portfolio are banks. So there’s no better time to discuss the outlook for shareholder returns in bank stocks. How are the large banks travelling and what should investors do? Let me discuss.

A rewarding reporting season for major bank shareholders

The three September-balancing banks have reported FY13 results. They delivered earnings and dividends which either met or exceeded expectations, and investors bid the share prices to record highs. The market also liked, or chose to see, positive broader themes behind each result. Commonwealth Bank (ASX:CBA) released its September quarter update this morning, reporting $2.1 billion in cash earnings – a 14% year-on-year increase. The result pushed its shares 1.5% higher to a peak of $78.40, although they fell back slightly during the day.

National Australia Bank’s (ASX:NAB) troublesome UK operations were seen as having turned around; ANZ Banking Group’s (ASX:ANZ) result surprised on the upside and management used this to rebuff criticism about its Asian strategy; and Westpac Banking Corporation’s (ASX:WBC) strong capital generation funded another special dividend despite pressure on banks from the regulator APRA to bolster capital ratios.

The three September results are well-covered in StocksInValue. In summary:

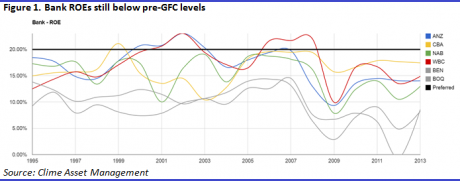

- Profitability as measured by return on equity improved, though remains well below pre-GFC levels due to recapitalisation during the crisis and elevated regulatory capital since.

- Net interest income growth remained weak at low to mid-single digit, reflecting historically slow credit growth as firms and households shy away from new debt and deleverage. Loan growth was mainly in residential mortgages, with business lending yet to recover.

- Net interest margins surprised slightly on the downside and declined moderately, though remain above 2%.

- Cost efficiency surprised on the upside despite weak revenue growth. Fifteen to 20 years on from the mass branch closures of the 1990s, banks continue to find new ways to bear down on costs. The ability of banks to keep finding cost savings to drive earnings and dividend growth has been remarkable.

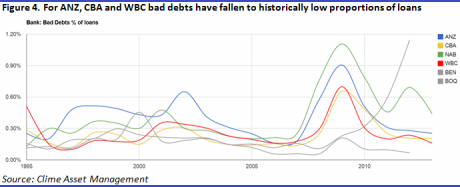

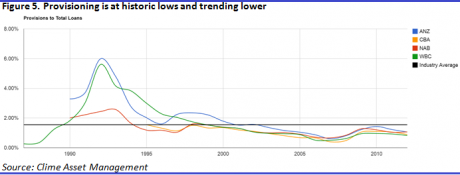

- Bad debts expense fell at all three majors and substantially at NAB and WBC. Banks continue to benefit from conservative underwriting and sector exposure during and post the GFC. Provisioning fell across the board, reflecting growth in property prices in major lending markets, a benign economic outlook, and a need to bolster profit and dividend growth in the absence of meaningful net interest income growth.

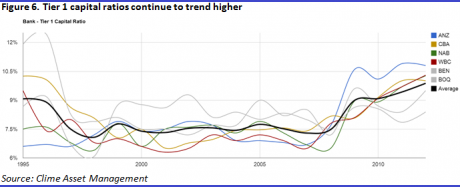

- Average Tier 1 capital ratios continued to trend higher due to strong organic capital generation powered by modest loan growth.

Banks are now fully valued and investors should be cautious

The latest bout of buying capped some 15 months of share price appreciation, driven by a surging appetite for above-average fully franked dividend yields in a world of historically low – and inadequate for retirees - interest rates on fixed interest alternatives.

The rally in Australian major bank share prices can therefore be directly linked to quantitative easing (QE) and ultra-low cash rates in the US, Europe and Japan. The upshot is banks, with the exception of ANZ, now trade at premiums not only to my FY14 valuations but also to FY15 in two cases.

Figure 7. Major bank share prices and valuations

Share price as at close 4/11/13 | FY14 valuation | FY15 valuation | |

ANZ | $33.51 | $34.32 | $36.07 |

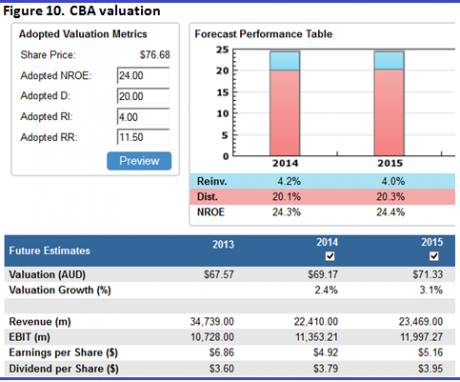

CBA | $76.10 | $69.17 | $71.33 |

NAB | $35.43 | $34.58 | $35.56 |

WBC | $34.16 | $30.37 | $31.44 |

Source: StocksInValue.com.au

Note the FY15 valuations, being further out in the uncertain future, are more subject to change than the FY14 valuations. I have included them to demonstrate the very full pricing of the banks, especially CBA and WBC.

The capital upside in bank stocks, at these levels, is somewhat speculative because it depends on continued buying for yield despite overvaluation or full valuation. And this depends on the maintenance of those macro themes forcing fixed interest alternatives lower: continued QE, easy money setting internationally, and stimulatory monetary settings locally.

I would never advise an investor buy a stock for yield regardless of valuation. Doing so invites inevitable disappointment when market sentiment on the stock changes. Understand, share prices do not rise in a straight line forever and above-average returns revert to mean returns eventually, usually via a period of negative or negligible returns. Valuations act as an anchor to share prices, which means prospective returns on overvalued banks are negative. Buying these stocks at current levels eats into the investor’s capital growth and means having to wait for longer to earn an adequate return for the risks assumed.

Unfortunately buying bank stocks for yield in Australia has gone beyond normal crowd behaviour, seen as stocks and sectors move into and out of popularity, to become an unquestioned cultural norm for generations of retirees. This reflects the inadequacy of fixed interest yields as a generator of income in retirement, which in turn reflects weak global economic recovery and overly indebted governments post-GFC. I see vast numbers of investors buying banks without attention to valuation, an understanding of how to value a bank, or even an understanding of what intrinsic value is and why it is risky to overpay for any stock – even a blue-chip bank.

This behaviour, being cultural, is self-reinforcing as people do what everyone else is doing because they are doing it. Meanwhile, advisers of all kinds, from stockbrokers to financial planners, have a vested interest in getting their clients into bank stocks at any price. Because the yields on banks are attractive, bank stocks are the easiest of sells for stockbrokers looking for their next commission, and I see reams of broker research designed to find new reasons to buy at current prices. Much of this research extrapolates recent pleasing share price appreciation and dividend growth into the future. The key hidden selling point here for brokers is the feeling of comfort clients gain when buying a widely held, popular stock going up in the market. The practice reminds me of the old Wall Street saying “You’ll never get fired for recommending IBM”. It is the same in Australia with bank stocks.

Other financial advisers generate the same feelings of comfort by installing their clients in these most popular of stocks. The result for the adviser, at least until the stocks disappoint, is increased customer satisfaction, renewals and new business.

The key point is all this behaviour occurs without a proper sense of bank valuations or how to value a bank. The ‘big four’ are not wildly overvalued and I am not predicting disaster or being alarmist. I would just advise investors to understand stocks tend to stay fully valued or overvalued until some catalyst occurs to change market sentiment, and these sentiment changes tend to be sudden and unpleasant – especially for recent buyers at the highest, most overvalued levels.

As Wall Street rises night after night on expectations for prolonged QE, easy money and surplus liquidity, even when or because economic data and company earnings disappoint, I am becoming increasingly concerned QE will not end well. At best the eventual tapering of QE will induce substantial market volatility. It is not possible to observe the discounts in US bond yields from QE nor, therefore, the rises in yields which could occur in expectation of or response to tapering.

Returns on bank shares could revert to lower rates even if bank earnings and dividends continue to meet expectations. The tapering of QE will give Australia’s central bank the latitude to restore its cash rate to more normal levels as our economy improves with the post-election recovery in consumer and business confidence. Local bond yields and term deposit rates will rise with the cash rate. At the margin bank stocks will become relatively less attractive and buying momentum will slow.

In any case the yields are less attractive than they were, reducing the compensation to buyers for equity risk. This table compares FY14 fully franked yields at current prices with yields a year ago.

Figure 8. Major bank dividend yields now and a year ago

FY14 forecast dividend (fully franked) per share | Closing share price 4/11/13 | FY14 dividend yield 4/11/13 | Closing share price 4/11/12 | FY14 dividend yield 4/11/12 | |

ANZ | $1.72 | $33.51 | 5.1% | $25.02 | 6.9% |

CBA | $3.79 | $76.10 | 5.0% | $57.36 | 6.6% |

NAB | $2.01 | $35.43 | 5.7% | $24.90 | 8.1% |

WBC | $1.82 | $34.16 | 5.3% | $25.20 | 7.2% |

Source: StocksInValue.com.au

Reduced resilience

There could also be earnings disappointment. The downtrend in provisioning for bad and doubtful debts cannot continue much further and reduces the sector’s resilience to economic shocks and downturns. Sometimes these can be difficult to foresee. At other times they are more obvious, like any renewed $A appreciation to above parity with the US, to use a present-day example. Investors should understand banks are highly leveraged and cyclical plays depend on the economic conditions where they operate. In the past, historically low provisioning has preceded higher provisioning and detractions from earnings. Banking income growth depends directly on consumer and business confidence. Unemployment rates and property prices are crucial. Presently there are rumours of deteriorating credit standards as some banks chase business lending market share at a time of very weak growth; we will not know for sure until the next recession if standards have fallen, but I have always found these rumours to be true in the past.

The ratio of assets to equity on a bank’s balance sheet is much higher than for industrial companies, exposing shareholders to serious write-offs of shareholders’ equity in response to only a small percentage of loan write-offs. The unprecedented capital strength of Australia’s banks is reassuring but in the interests of capital preservation investors should demand a significant margin of safety when buying banks and certainly never overpay.

In conclusion, overvalued banks are not good stocks to own when there is an economic or financial shock. I have included the valuation metrics below for those that are interested. The current pricing of major Australian banks assumes fair economic and financial conditions ahead. Now is not the time to buy.

Source: StocksInValue.com.au

Source: StocksInValue.com.au

Source: StocksInValue.com.au

Source: StocksInValue.com.au

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Editor's Note: In an article published on July 31, 2013, Two stock picks for the earnings season, Sam Fimis gave an outperform recommendation on Commonwealth Bank of Australia.

In an article published on September 18, 2013, Projecting value on four growth stocks, John Abernethy gave an outperform recommendation on Westpac Banking Corp.

On October 2, 2013, Collected Wisdom reported an outperform recommendation on National Australia Bank.

Clime Income Portfolio Statstics

Return since June 30, 2013: 11.17%

Returns since Inception (April 24, 2012): 39.66%

Average Yield: 7.13%

Start Value: $150,754.88

Current Value: $167,594.76

Dividends accrued since June 30, 2013: $2,589.14

Clime Income Portfolio - Prices as at close on 5th November 2013 | ||||

| Hybrids/Pseudo Debt Securities | ||||

| Company | Current Price | Margin over BBSW | Running Yield | Franking |

| MXUPA | $83.60 | 3.90% | 7.75% | 0.00% |

| AAZPB | $96.30 | 4.80% | 7.66% | 0.00% |

| MBLHB | $78.20 | 1.70% | 5.47% | 0.00% |

| NABHA | $73.90 | 1.25% | 5.18% | 0.00% |

| SVWPA | $92.25 | 4.75% | 7.99% | 100.00% |

| RHCPA | $104.50 | 4.85% | 7.15% | 100.00% |

| High Yielding Equities | ||||

| Company | Current Price | Dividend | GUDY | Franking |

| TLS | $5.14 | $0.29 | 8.06% | 100.00% |

| AAD | $1.99 | $0.13 | 6.55% | 0.00% |

| CBA | $77.00 | $3.79 | 7.03% | 100.00% |

| WBC | $34.35 | $1.82 | 7.57% | 100.00% |

| NAB | $35.80 | $2.01 | 8.02% | 100.00% |

| SKI | $1.70 | $0.12 | 7.08% | 0.00% |