Projecting value on four growth stocks

| Summary: Intrinsic valuation is a theoretical assessment of a company’s value derived away from the stockmarket. At current levels, BHP Billiton, McMillan Shakespeare, Westpac and Mineral Resources are trading below their forecast price valuations for both 2014 and 2015. |

| Key take-out: If real interest rates stay below inflation for an extended period, this could create a highly elevated level for equity prices (above intrinsic value) that could be present for some time. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendations: BHP Billiton: Outperform. McMillan Shakespeare: Neutral. Westpac Bank: Outperform. Mineral Resources: Outperform. |

This week I am reviewing four of the holdings in the Clime Growth Portfolio to derive an intrinsic valuation for each.

From this I will be able to suggest both buy and sell prices for these shares. The intrinsic value of each share is determined by evaluating the “normalised return on equity” (NROE) and each stock’s specific required return (RR). Generally the NROE is taken from market expectations, while the RR is an assessment of individual stock risk (equity risk premium) that is derived from bond yields that are affected by the general level of interest rates.

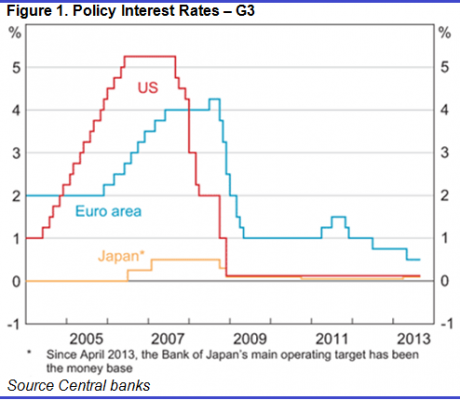

So on my way to disclosing each company’s intrinsic value I believe it is important to highlight the significance of the current monetary settings of central banks around the world. Much has been written about Quantitative Easing (QE) and the likelihood of tapering in the US, but much less has been written about the historically low cash rates. These low cash rates have now endured for so long that many commentators cannot see they are a reflection of problems, and are not normal.

Importantly, I draw your attention to recent forward statements by central banks across Europe and the US disclosing “forward guidance” to hold cash rates at historically low levels. Indeed, we are in the fifth year of cash rate settings whereby real interest rates (i.e. adjusted for inflation) are negative. The forward guidance from the Federal Reserve, the European Central Bank and the Bank of England is for cash rates to remain at current levels until 2015-16.

This guidance is both positive and concerning. It is positive because it suggests that short-term interest rates will remain low for the foreseeable future. The borrowing costs of businesses, mortgagees and consumers should remain low for a few more years. Bond yields should remain in check so long as QE does not taper quickly. However, the problems with this policy are significant.

Savers and retirees are being offered interest rate returns that are barely above inflation. Economic conditions are actually reflecting the interest rate settings. That is, economic growth is stalling and unemployment remains high. Low cash rate settings suggest poorly performing economies and low company earnings growth. Guidance that this policy will stay for another two to three years suggests significant and intransigent economic problems. Therefore, equity markets have lifted because of low interest rates and in spite of the poor economic conditions that make low interest rate settings absolutely appropriate.

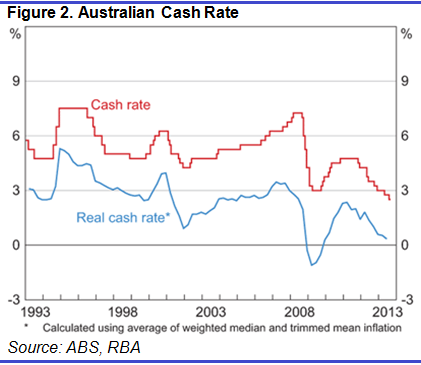

The cash rate policy of overseas has infiltrated the Australian economy through our elevated exchange rate and the Reserve Bank has had little choice but to respond by cutting cash rates here. The latest cash rate adjustment in August to 2.5% takes real cash rates to virtually zero, putting insurmountable pressure on retirees.

So, from an equity market valuation perspective, we have a great battle of logic. That battle, simply stated, is between the likelihood of sustainable economic recovery against the likelihood of higher interest rates in the future. Over time, company earnings will grow faster than interest rates and equities will outperform fixed interest investments.

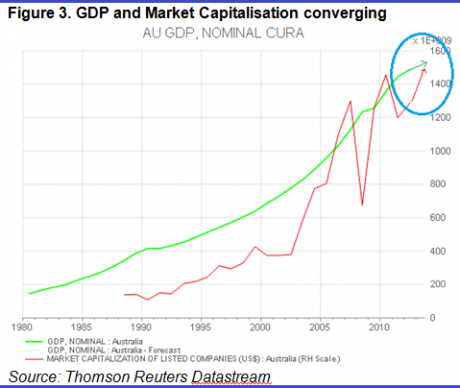

However, the battle becomes blurred when real interest rates are held at below inflation for an extended period. That policy will place continued upward price pressure on risk assets and it may create a highly elevated level for equity prices (above intrinsic value) that could be present for quite a while.

As for those scribes that forecast the market going much higher than present, I merely suggest that they are forecasting an index that is pushed by “interest rate” tail winds and not by value or earnings. That sort of forecasting works until it doesn’t, and the tail wind could easily change to a headwind caused by a sentiment shift that is impossible to forecast. To this point it is worth reflecting on the following chart (Figure 3), which measures GDP to the All Ordinaries Index.

Four value growth stocks

Intrinsic valuation is a theoretical assessment of a company’s value derived away from the stock market (i.e. market price). At its core, it is the focus upon the profit returned from the employment of shareholders’ equity. In particular, the valuation is driven by return on equity (profit divided by average shareholders’ equity) and the earnings generated from retained profits.

As an investor, I like to see the logical management of profit. Companies that can generate a high return on equity and have an ability to grow through reinvestment of part of those profits back into themselves are highly regarded. This where shareholders are rewarded by solid growth in dividends that come out of solid growing profits. In particular, I do not want to see the continuous raising of new capital from shareholders but rather I like to see growth funded from retained profits.

So let’s consider the four companies, derive an assessment of their value, and project the growth in their valuation over the coming year. In doing so I will outline my assumptions, for without those key inputs an investor would simply have no idea as to the reasonableness of the valuation.

BHP Billiton Limited (ASX: BHP)

The StocksInValue intrinsic valuation for BHP is currently about $36, and this is forecast to grow towards $39.15 by June 2014. To derive this valuation I have converted forecast US dollar reported earnings back to $A. I have accepted market profit forecasts (adopted NROE) and used a conservative required return (RR) of 12.9%. Therefore, current prices do offer a reasonable return of more than 10% when expected dividends are added to the forecast value. This value will lift if the $A weakens from this point, but will fall if the $A revalues.

Source: StocksInValue.com.au

McMillan Shakespeare Limited (ASX: MMS)

MMS updated the market last week following the election, but has not guided the market concerning the likely levels of its profit in 2013/14. However, it is worth remembering that a company is a perpetual entity and good-quality businesses should not be solely assessed on current year earnings that are affected by “one-off” events.

Having said that, I have chosen to be conservative in my assessment of profits and have forecast a drop to circa $50 million this year before a solid recovery in 2014/15. Noteworthy is that MMS is currently tendering on both the WA and NSW public health tenders. Given the upheaval in the market there may be very few alternative bidders for these contracts.

My valuation of about $12.50 for June 2014 suggests a purchase price of about $11, that will be enhanced should a dividend be declared at the October AGM.

Source: StocksInValue.com.au

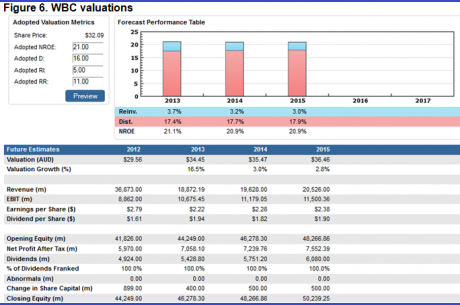

Westpac Banking Corporation (ASX: WBC)

The solid lift in bank share prices has once again caught the attention of international hedge funds that claim Australian banks are expensive on international comparisons. That may well be true, but banks across Europe are really poor comparisons with many owned or underwritten by their governments. Indeed many remain undercapitalised. That is not the case in Australia, although the current bank prices, particularly that of Commonwealth Bank, leave little margin of error for investors. As for WBC, I still see some value in the shares and the 2014 valuation of $35.47 will come into focus should the 2013 result be as expected. I still perceive a 10% return from this share over the coming 12 months and so remain a happy holder.

Source: StocksInValue.com.au

Mineral Resources Limited (ASX:MIN)

MIN has certainly been subjected to a big price rerating by the market, but it has been apparent in the intrinsic valuation for many months. The decline in May to about $8 certainly presented value investors with a great entry point.

Currently the expected valuation at June 2014 is $13.41, but you will note I have a very conservative NROE of 24% against market forecasts that suggest 30% in this current year. The direction of iron ore prices remains subject to conjecture, and so does the $A. I retain MIN in the portfolio as I expect another 10% growth over the next 12 months, even with the high RR of 14%.

Source: StocksInValue.com.au

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Growth Portfolio Statistics

Return since June 30, 2013: 11.03%

Returns since Inception (April 19, 2012): 30.58%

Average Yield: 6.11%

Start Value: $141,128.64

Current Value: $156,696.54

Dividends accrued since June 30, 2013: $1,722.33

Clime Growth Portfolio - Prices as at close on 17th September 2013 | ||||||

| Company | Code | Purchase Price | Market Price | FY14 (f) GU Yield | FY14 Value | Safety Margin |

| BHP Billiton | BHP | $31.37 | $36.14 | 4.86% | $38.85 | 7.50% |

| Commonwealth Bank | CBA | $69.18 | $73.60 | 7.36% | $68.69 | -6.67% |

| Westpac | WBC | $28.88 | $32.47 | 8.01% | $35.47 | 9.24% |

| Woolworths | WOW | $32.81 | $34.81 | 5.75% | $35.86 | 3.02% |

| The Reject Shop | TRS | $17.19 | $17.62 | 3.89% | $16.98 | -3.63% |

| Brickworks | BKW | $12.70 | $12.53 | 4.79% | $12.49 | -0.32% |

| McMillan Shakespeare | MMS | $16.18 | $11.67 | 6.00% | $12.47 | 6.86% |

| Mineral Resources | MIN | $8.25 | $12.03 | 7.84% | $13.41 | 11.47% |

| SMS Management & Technology Limited | SMX | $4.55 | $4.64 | 6.47% | $5.29 | 14.01% |