Two stock picks for the earnings season

| Summary: Hitting another record share price high today, Commonwealth Bank is continuing to build investor momentum. Meanwhile, blood products group CSL is tipped to achieve solid capital growth. |

| Key take-out: Commonwealth Bank shareholders may get another dividend boost, while investors in CSL can expect further earnings per share growth. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendation: Outperform (under review). |

My two best picks for reporting season remain Commonwealth Bank (ASX: CBA) and CSL Ltd (ASX:CSL).

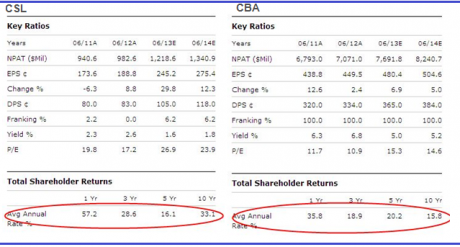

“Where is the value on those two, Sam?”, I hear you say. Well, you’re not exactly wrong. Both aren’t trading on the lowest of multiples, both on a relative and absolute basis. (CSL – FY13 price-to-earnings of 26.9x; CBA – FY13 price-to-earnings of 15.3x). Yet in my opinion, these two are likely to surprise on the upside.

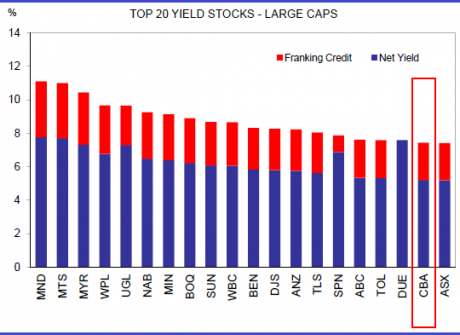

Let’s take a look at CBA first. Cast your mind back to February when it released its first-half 2013 profit result. The market was expecting a solid cash profit, yet what they didn’t expect was a 20% jump in the dividend to $1.64 a share. CBA decided to give investors what they wanted…fully franked dividend growth. That move alone forced the other banks to lift their game on the dividend paying front.

It might just be the same story this around with the company mentioning it is offering to sell the management rights to three of its real-estate investment trusts to the trusts themselves. By doing so, the company may experience a double benefit, strengthening an already strong balance sheet while reducing the regulatory burden, as it would no longer own any part of the trusts. Analysts have estimated the rights to the three trusts to be as much as $650 million. Putting the rights to the trusts aside, CBA has a payout ratio of 80% and you might just find that investors begin to flock to the biggest bank, and the best when their result is announced.

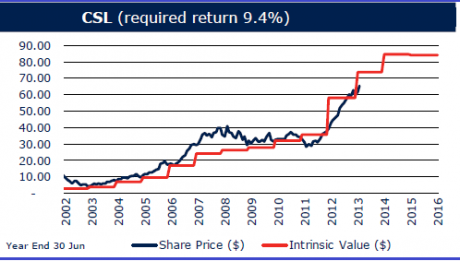

Having a look at CSL Ltd (ASX:CSL), you need to forget about the yield. It’s all about capital growth for this company, and whether they can maintain their earnings growth rate. According to Morningstar, a profit of $1.218 billion is expected. It seems as if analysts across the board are reluctant to recommend the stock at current multiples. When I first entered the industry I had one fund manager tell me to ignore the price-to-earnings ratio. “Sam, it’s all about the price-to-growth ratio”.

Earnings per share are expected to grow by 20% for FY13 and by 11% in both FY14 and FY15. That figure seems rather conservative to me. There is a reason why this company constantly trades at a premium to the health sector and index, and that is because it rarely disappoints.

Sam Fimis is a private client adviser with Patersons Securities and author of Premiership Portfolio: 6 Step Guide to Succeeding in the stockmarket. For more information visit www.premiershipportfolio.com. This article was first published on July 29.