The best yields in town

Summary: Yields for unlisted non-residential property compare favourably to the government bond yield and the ASX 200. Prospects in Adelaide and Perth look less favourable as economic conditions are patchier in both cities. But investor activity looks strong in Sydney and Melbourne, with demand rising. Across cities, yields on offer in the primary and secondary markets range from 7.75% to 10.44%. Unlisted funds are another way to access non-residential property, with industrial funds performing strongly. |

Key take-out: Commercial property offers a way of diversifying an income stream and could lift a portfolio's average yield. |

Key beneficiaries: General investors. Category: Commercial property investment. |

In a yield-thirsty world it pays to look for alternatives. That's especially the case for the Aussie market. In doing so, commercial and industrial property shouldn't be overlooked either as a direct investment or investment in an unlisted fund. It can't be – the yields on offer are simply too high and very attractive on a comparative basis.

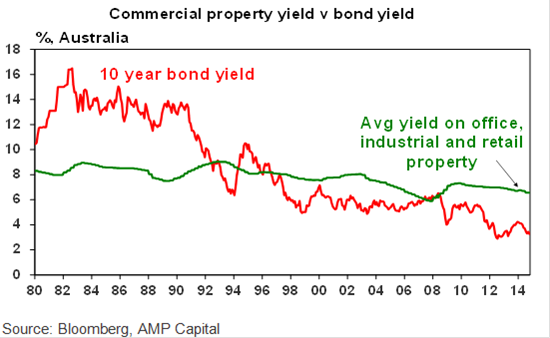

Chart 1: Commercial Property vs bond yield

Chart 1 above shows the returns to unlisted commercial property, on average, that have been available since 1980. At around 8% that compares well to the government bond yield of around 3.3%. Indeed the spread between yields on commercial property and government bonds – known as the risk premium – is at a record. That's normally a very positive sign for the commercial sector, similar in concept to the comparison of the bond yield to the equity market earnings yield. In effect you can earn much more on commercial property.

Here too, it's important to note that yields on commercial property are also extremely attractive relative to the equity market. Consider that the average dividend yield of the ASX 200 is 4.3%. For some of the big yields stocks like banks, that's obviously higher at about 5.3% – grossed up maybe 6.1% and 7.5% respectively. Still attractive, but if you're looking to diversify your income stream and perhaps lift the average yield of your portfolio in the process, then commercial property is certainly worth a look. Note the stability of that income return since 1980.

Certainly investor interest in A-REITS (the listed property sector) has been strong this year. A-REITS offer a dividend yield of 4.37% and have put on 18% so far this year, easily outperforming gains on the All Ordinaries of about 3% to be at their highest level since late 2008. There is a clear weight of money flowing into the commercial property sector and that's unlikely to change given the economic backdrop and outlook.

What do we face? While data from the Australian Bureau of Statistics is no longer reliable, the broad array of indicators shows the economy is doing well – especially in the retail space. For what it's worth, and I realise not much, the official retail trade figures are solid. By itself that doesn't mean much but it is consistent with what we're hearing from other sources. NAB's business survey for instance shows a recent lift in both conditions and confidence in the retail sector. Then on the interest rate front, rates look like they will be on hold for a very long time indeed. All of this is supportive of the commercial property sector – the same factors effectively that are supporting residential property.

Within the commercial space, some of the highest returns available are perhaps within the industrial sector. Table 1 below from Knight Frank gives you a sample of what is on offer (for direct holdings of property) in the major capital cities.

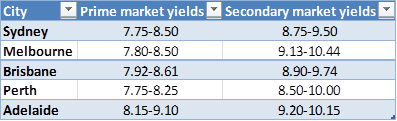

Table 1: Industrial yields major cities

Source: Knight Frank

As you can see from Table 1, the yields on offer in the primary market (generally newer and well tenanted) range between 7.75% and 9.1%, while in the secondary market (older – between 10 and 20 years and not as well tenanted) that rises to between 8.5% and 10.44% depending on your city.

It's important to remember that these are net yields – net of insurance, rates etc. Now obviously industrial and commercial property is not a risk-free investment. But then again, neither are government bonds. To be honest I would suggest government bonds can be a much more risky investment and they don't offer anywhere near the returns to compensate for that risk. Now in addition to that, the fundamental backdrop in the industrial space does look highly favourable and there are certainly good opportunities, although it's fair to say that positive backdrop may not be uniformly spread.

So for instance, prospects in Adelaide and Perth don't look as favourable. In both cities, economic conditions are patchier. Perth is hit by the fading mining boom and Adelaide by the decline of the automotive industry. Consequently, rental growth has been flat and vacancies are rising, although it should be noted that Knight Frank report investor activity has still been strong in Adelaide – sales over the last two years nearly double the average of the four years prior!

Despite this, there is no point swimming against the tide at this stage and I suspect there may be safer ground found in Sydney and Melbourne. Perhaps even Brisbane, although softer economic activity there suggests this may only occur with a lag.

For Sydney and Melbourne however, investor activity looks strong. In Sydney, industrial supply is at its second lowest in a decade, according to data compiled by Knight Frank. While vacancies are currently a little above average, leasing demand has picked up markedly to be at its strongest since July 2013. Meanwhile, investor interest is strong with increasing interest from foreign investors.

For the Melbourne market it's a similar story. Investment demand in particular is surging, up 220% over the year! The dynamics here are a little different to Sydney however. Vacancies are high – the highest in about four years, although how long this excess lasts is uncertain as take-up rates are accelerating as well (up 26% in the six months to October). In addition to that, supply growth is about 8% below average.

If direct holdings are not your preference, unlisted funds are an easier way to access the commercial property space, with returns on offer generally high and more stable than the listed or A-REIT sector.

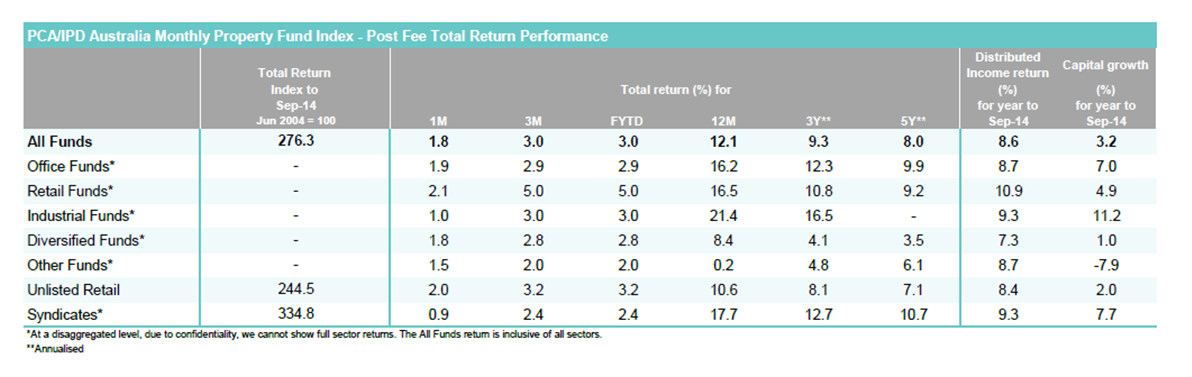

Table 2: Property Fund index returns (IPD)

Source: IPD

The above table shows total returns from each sector and as you can see, industrial has outperformed over the last 12 months. As mentioned above, the outlook for both retail and industrial is positive with the broader non-mining economy accelerating and interest rates set to remain low. I suspect office funds will continue to lag, given high vacancy and the current low non-mining investment rates seen in the broader economy. That will turn, but in the meantime there is probably lower hanging fruit.