The axe will fall hard on mining jobs

What's next for resource sector employment? The mining sector gobbled up resources during the investment boom, but projects have finished and conditions have shifted. Now we need the non-mining sector to absorb job cuts in the resource sector.

A lot will depend on the characteristics of mining sector workers. On-site resource construction employment is estimated to have increase from around 15,000 in the mid-2000s to around 90,000 in 2013. Construction, however, accounts for a mere fraction of total resource sector employment, which is estimated at around 240,000 or about 2 per cent of total national employment.

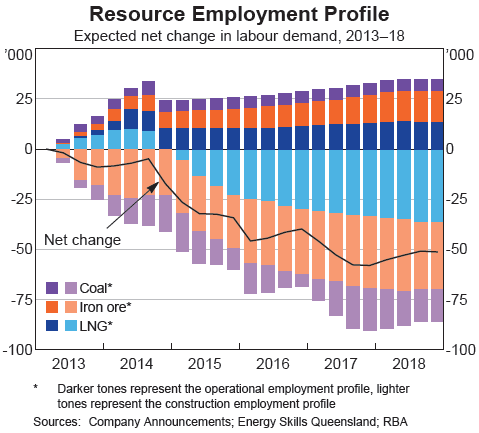

But now that most of the major investment projects are completed, mining sector employment is expected to fall sharply. Resource sector employment is expected to fall by around 40,000 between 2014 and 2018 -- jobs within construction are set to fall by more than that but be partially offset by higher employment in operational areas.

A new paper from the Reserve Bank touches upon these employment dynamics and assesses recent developments in construction employment.

Utilising household level data and information from the banks' business liaison program, the RBA finds that a “majority of people who moved into resource construction jobs had previous experience in other types of construction”.

According to the author, “these workers have skills that should allow them to transfer back to non-resources sectors, such as residential and civil construction”. That's good news, but there is a range of issues that could affect the smoothness of this transition.

First, will the Australian economy be in a position to absorb these job losses without pushing the unemployment rate higher? At present, the economy is failing to absorb population growth let alone additional unemployment resulting from structural shifts.

Second, the RBA notes that “the smoothness of this transition will also depend … on geographical labour mobility”. Resource sector employment was concentrated in Western Australia and Queensland, but most of the new opportunities are expected outside those states.

The extent to which this transition can take place depends in part upon the characteristics of those employed in resource sector construction jobs. Are they better or less educated than average? How are their qualifications or their age relative to the broader economy?

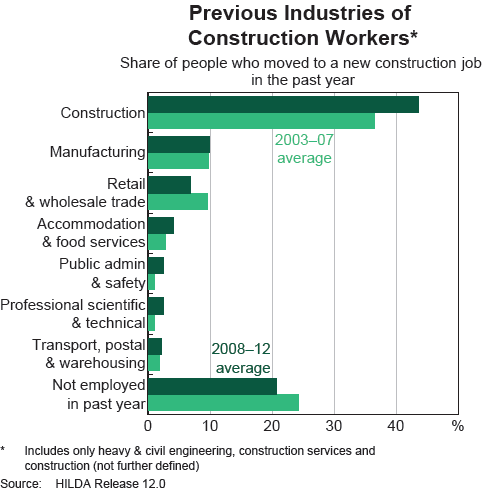

Data from the annual Household, Income and Labour Dynamics in Australia survey allows us to consider these issues. The data show that during the 2008 to 2012 period, 45 per cent of people starting new resource construction jobs were previously employed in the construction sector. This was 10 percentage points higher than during the 2003 to 2007 period.

The resource sector also took people from manufacturing and retail & wholesale trade. Around 20 per cent of new workers in resource construction had been previously unemployed.

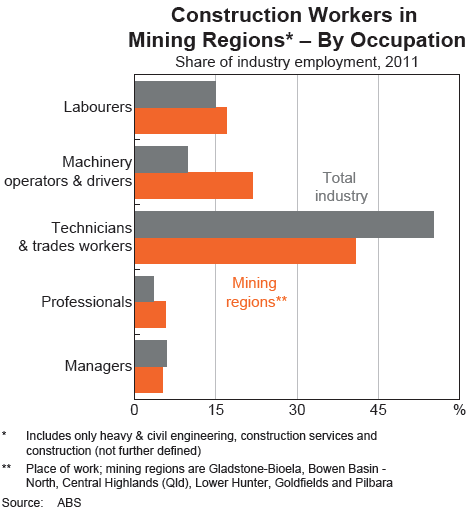

Census data reveals that, compared with the construction industry as a whole, “construction workers in mining regions were more frequently employed in lower-skilled rather than higher-skilled occupations despite having similar previous experience”.

The broad implication of this point is that skilled workers were happy to move into lower-skilled occupations, presumably due to the fact that they paid more. A higher share of construction workers in the mining states worked as labourers or machinery operators and drivers than across the broader construction sector.

Construction workers within the resource sector skewed slightly older than for other types of mining but with similar qualifications. Greater experience could put these employees in a good position when they are forced to transition to other construction projects or sectors.

We can draw a few conclusions from the data.

First, residential and non-residential construction appears to be the key to absorbing these job losses. That will require many workers to migrate back east and in most cases accept lower paid positions.

Second, it remains unlikely that the pick-up in non-mining construction -- whether residential or non-residential -- will be sufficient to offset the decline in mining investment activity. Both residential and non-residential investment is small in comparison to mining investment.

The RBA is more optimistic on this front -- otherwise they'd have lowered rates again -- but there's good reason to believe that the rebalancing process will not be as smooth as the RBA would prefer. There's also the risk that job losses within the mining sector will be much larger than anticipated, particularly given the risk that many of the iron ore juniors will shut up shop or drastically cut costs to keep their head above water.