The American consumer is back

The Federal Reserve’s decision to pull the trigger and begin its taper received further justification after household consumption rose by more than expected in November. Data from October and November suggest that consumption may have increased at its fastest pace in almost eight years over the December quarter.

Real household spending rose by 0.5 per cent in November, to be 2.6 per cent higher over the year. Strong growth in both October and November suggest that consumption will rise by around 1 per cent in the December quarter.

But that could understate things; if spending rises further in the month of December, consumption in the national accounts would rise at its fastest pace in almost eight years.

Since consumption is around two-thirds of the US economy, spending growth of 1 per cent in the December quarter results in a 0.7 percentage point contribution to GDP growth (twice the contribution that consumption made in the September quarter). Not surprisingly a number of market analysts raised their expectations for the December quarter following the new information.

The pick-up in spending coincides with improving labour market conditions and provides further evidence that the federal government shutdown in October had little impact on household spending or confidence. In fact given the growth in payrolls, it seems reasonable to suggest that the only sector significantly affected by the shutdown was the government itself.

The resilience shown by the US economy following the government shutdown provided sufficient evidence that their economic recovery had become sustainable, prompting the Federal Reserve’s decision to begin tapering its asset purchase program on 1 January.

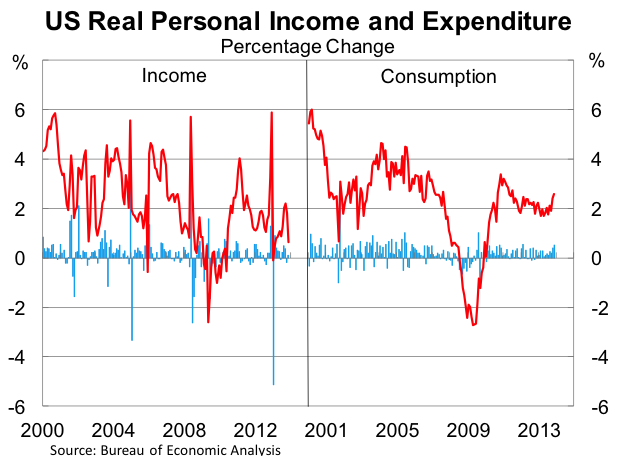

I have seen some comment suggesting that the recent consumption growth is unsustainable because it has not been matched by income growth. It is unsustainable but only because growth in the past two months is high by historical standards. Income growth though isn’t as weak as many believe and concerns about inflation are not that concerning at all.

It is true that income growth has been weak in recent months, with real disposable income rising by 0.1 per cent in November to be 0.6 per cent higher over the year.

However, for much of 2013 income and spending growth has been fairly similar once you adjust for special factors that caused excessive volatility for income growth in December 2012 and January 2013 (see first panel in the graph above). Since February, real personal spending has increased by 2.1 per cent while real incomes are up by 1.9 per cent.

Households are feeling better about themselves right now and for many families it is the first time in years that things are going well. Asset price gains in the share market and housing have left households feeling wealthier, despite modest income growth, and allowed them to stock up on and replace durable goods (televisions, washing machines, cars etc).

But it goes a bit deeper than that. If it was just spending on durable goods driving growth I might be more pessimistic. However, spending on non-durable goods has increased to its fastest pace in seven years since August. Usually that is a good sign but more importantly a more sustainable sign that conditions have improved.

Where the more pessimistic interpretation has merit is with regards to inflation, the pace of which has slowed significantly over 2013. But I believe the problem with inflation has been overstated (An inflationary kick in the US jobs market, December 11).

The personal consumption expenditure (PCE) deflator was largely unchanged in November, to be 0.9 per cent higher over the year. The core measure, which removes volatile items such as food and energy, rose by 0.1 per cent and is now 1.1 per cent higher over the year. Both results are well below the Fed’s upper threshold for inflation of 2 per cent annual growth.

Despite improvement there remains considerable slack in the US labour market, resulting in insufficient wage pressures. Businesses still do not need to compete for the best talent given there is no shortage of people interested in any available position.

This is not ideal for the Federal Reserve but their recent actions suggest they are not that concerned about low inflation.

My view is that if job creation in 2014 is similar to that of 2013 (almost 200,000 additional jobs per month), then wage pressures will begin to pop up in a range of industries, albeit slowly. Inflation expectations also remain around the ideal level for the Fed.

Consumption growth will not continue at a 4 per cent annual pace because that level of growth has proved historically unusual. But that does not mean that consumption growth in 2014 will not be considerably stronger than what we have seen throughout much of the recovery.

The big hurdle for household spending in 2014 will be whether it can prove resilient and maintain its momentum after the Fed begins to unwind its asset purchases. That is a big unknown but I remain cautiously optimistic regarding US consumption next year particularly given the government shutdown had no visible impact on spending or confidence.