The alternatives to bank hybrids

Summary: Last year the four major banks issued $5.9 billion of hybrid notes, and the market is now signalling that it is possible to have too much of a good thing. Demand for ANZ's recent hybrid note issue that pays 3.6% is surprising, given CBA PERLS VII notes were offering a slightly higher margin at the time. It appears NAB does not believe there is now enough demand for the hybrid issue it flagged in mid-December. |

Key take out: There are other ASX-listed notes available – some are subordinated while others are senior ranking. When assessing these, consider the size of the credit margin and whether the coupon is deferrable. |

Key beneficiaries: General Investors. Category: Hybrid securities. |

The search for yield has led a number of investors back into the share market but what of the fixed income market and hybrid notes?

In recent years, investors appeared to develop an insatiable appetite for hybrid notes listed on the ASX and issued by the four major banks, in particular. Hybrid securities or Additional Tier 1 capital were seen as offering superior yields to bank term deposits without the price volatility of bank shares.

In 2012, investors gobbled up $3.2 billion of hybrid notes issued by the four major banks. In 2013 the issuance total climbed to $5.7 billion and last year it reached $5.9 billion.

Macquarie Bank, the regional banks and other regulated financial institutions have also issued hybrid notes along the way. In fact, of the $32 billion of ASX listed notes issued by financial institutions, 75% are hybrids.

As with all good things, it is possible to have too much. And the market is signalling that now.

CBA's PERLS VII hybrid note listed in October last year totalled $3.0 billion – the largest issue yet seen. And with a credit margin of just 2.80% over the 90 day bank bill rate, it also came to market with the tightest margin seen since the GFC.

With a further $1.07 billion of hybrid issuance coming to the market at the same time, from Macquarie Bank, Bendigo and Adelaide Bank and Challenger, it was all too much. Investors got indigestion.

The market price of all four issues fell below face value upon listing, and prices have yet to get back there. The CBA PERLS VII issue was the worst affected, falling below $95.00 at one point.

In this market environment, NAB in mid-December flagged its intention to launch a new hybrid issue following its first quarter update last week. And after the close of market on Friday of the Australia Day long weekend (January 23), ANZ launched a minimum $750 million hybrid note issue – Capital Notes 3.

Last Tuesday, ANZ upsized the issue to $850 million and set the credit margin to be paid over the 180 day bank bill rate at 3.60%, after indicating that it would pay up to 3.80%. The outcome of the bookbuild process that set the issue size and credit margin is surprising, given that CBA PERLS VII notes were offering a 3.70% credit margin at the time, based on a market price of $95.75.

In fact, with investors holding a mark to market loss of more than 4% on the PERLS VII notes, it is surprising that there was sufficient investor demand to upsize the Capital Notes 3 issue by $100 million and set a yield of just 6.00%. The yield on the PERLS VII was 6.27% per annum.

It appears that NAB does not believe there is now sufficient investor demand to launch the hybrid issue it flagged in mid-December. At the time, it did say any issue would be subject to market conditions.

No follow-on announcement has been delivered by NAB and it may now be some time off. Put simply, there is no pressing need for NAB or any of the major banks to issue hybrid notes this year.

While there may be regulatory pressure for the banks to increase capitalisation levels, increasing Additional Tier 1 capital may not help. David Murray's Financial System Inquiry made it clear that increased capitalisation should be in the form of real equity – Common Equity Tier 1 capital. On that basis hybrids do not qualify.

While there is some $4.9 billion of hybrid notes falling due in 2016 and the banks are usually keen to replace the issues to be called well ahead of time, there is no need to do so until early next year.

So for investors with maturing term deposits, looking for higher yields elsewhere, what opportunities exist among notes already listed on the ASX?

Beyond hybrids

Separate to the list of hybrids on the ASX, there are a range of listed notes: Some are subordinated but not as deeply subordinated as hybrid notes (in other words the notes are higher ranking in a liquidation), and some are senior ranking. These notes can offer superior risk adjusted returns.

There are other differences too. While virtually all pay floating rate coupons (determined by applying a fixed credit margin to the bank bill rate) some pay quarterly and others only pay twice a year.

Among the key questions any investor should ask when assessing these notes would be:

Is the credit margin large or small?

The size of an issue, large or small, will affect secondary market liquidity and therefore its price. The same applies to the term to maturity/call – long or short, the credit quality of the issuer – strong or poor.

If a note is issued by a non-financial corporate, it could be valued more highly by the market for its rarity value. Then again, it might not be.

Each of these factors can impact on the value of a note and therefore its yield. Even among hybrids there are differences that can impact on market value.

Is the coupon deferrable? If it is, is it cumulative or not?

Can dividends still be paid to shareholders, while coupons are not paid to note holders?

(And in the case of hybrid notes issued by APRA-regulated financial institutions, are there common equity and/or non-viability triggers that could cause compulsory conversion of the notes into equity?)

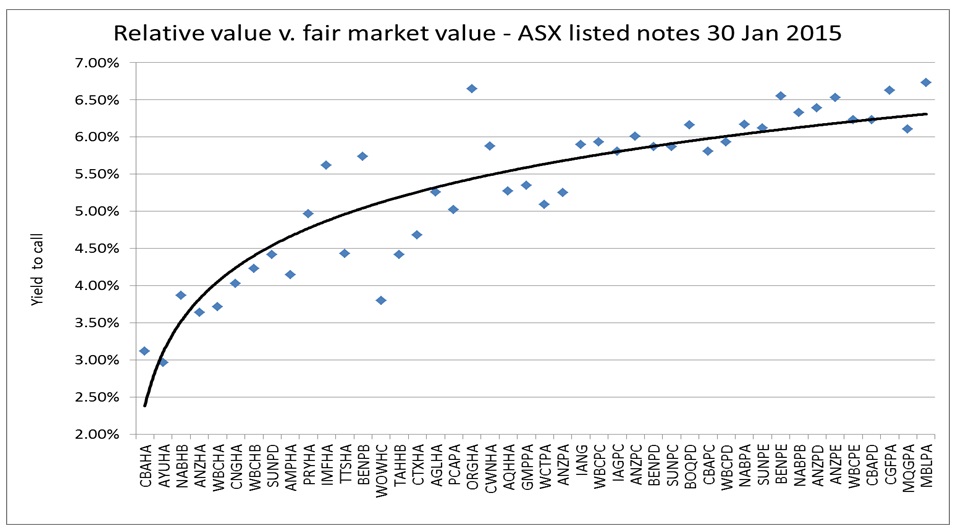

The chart below shows an empirical analysis of each of these features to determine relative value across the ASX listed note market as a whole. Relative value for each note on the X-axis is plotted against the calculated fair market curve (the black line).

Source: ADCM Services

Notes shown above the curve appear relatively cheap and those shown below appear relatively expensive. By measuring each of the quantifiable features of the notes, the analysis shows there are listed notes that are senior ranking or merely subordinated (but are not hybrids) that could offer better value – all things considered.

Remember however, that the empirical analysis is merely a tool for identifying relative value opportunities. Further research should be undertaken before any decision to buy or sell is made.

Philip Bayley is a former director of Standard & Poor's and now works as an independent consultant to debt capital market participants. He also writes on matters concerning debt capital markets and banking for various publications and is associated with Australia Ratings.