The alternative options for North Queensland baseload

Following on from Friday's article looking at the market and the call made for a new coal-fired power station by local MP Ewen Jones in the Townsville Bulletin here, today I explore what the options might be for this new industrial load given the likely progress of renewable energy technology between now and when it comes online.

The assumptions used to explore what these options might be are based on the year 2020, which would be the earliest that this capacity would come online along with a price point for this electricity which is between a half and a third of the price that a retail customer would pay. This was confirmed in an interview with Ergon CEO Ian McLeod on renewables radio, where he discussed this along with some of the challenges associated with supporting industrial loads in the least dense grid in the Western world, representing only four customers per kilometre of grid.

It is very important to acknowledge that the National Electricity Market at the moment in Queensland is dealing with an oversupply of electricity [ed's note; see today's article detailing AEMO downgrading demand yet again] that is likely to be significantly worse in 2020, so any of these options would need to be as part of a direct action-type strategy to clean up the electricity sector by bringing on additional capacity knowing that you are shutting down dirtier generators in Central Queensland and effectively writing them off.

The first factor to consider in what is becoming an increasingly decentralised grid is the need to as closely as possible match supply to demand. Then tuck that supply up right next to this industrial zone so as to minimise any of the grid-related transmission and distribution costs which, at present, make up about half Queenslanders' bills.

We can use the case of Sun Metals for the purposes of investigating the various options as highlighted by Jones, but it is important to note that there are other large industrial users, such as Clive Palmer's Queensland Nickel, that would need to have a similar calculation done.

If you take a look at Sun Metals sustainability report available here for the year 2012-13 and assume that it will be roughly the same going forward, the company uses per year, as the report indicates, 3,041,240 GJ which, as confirmed by Ergon, gives them a maximum capacity of 120 MW.

Looking at the Levelized Cost of Energy (LCOE) or price point for the demand while all these contracts get negotiated independently, if we were to assume that prices for residential customers by 2020 were 33 cents per kWh - and I do believe that will turn out to be a very conservative estimate - then industrial users can expect to pay about 10-12c per kWh if they get a good deal but I have used 10c per kWh to be conservative.

(Attempts were made to contact Townsville Enterprise, the authors of the yet to be released feasibility study, to gain exact figures but they were not able to supply them prior to the printing of the article.)

Which brings us to the options.

PV and off peak grid – Option 1

The first cab off the rank for the comparison must be PV in the day and cheap dirty coal from central Queensland at night, possibly with some sort of industrial scale storage system as it becomes economically viable just to get them over the residential peak at 6pm. It is important to acknowledge that this is not in line with the science on what we need to do in terms of reducing emissions but does represent probably the cheapest option for the capacity as it stands for the moment.

The luxury you have with PV systems like this is that they are modular and you can put them up to mirror your day time demand and one of the advantages that you get in a place like Townsville is that the output from such a system would be almost uniform throughout the year given its more even days in both summer and winter.

There would need to be some consideration of back-up supply for the few cooler rainy and overcast days (when air conditioner loads would also be minimal) in the wet season, but given the transmission assets are a sunk cost they would unfortunately have to stump up the costs for the 16 per cent losses above Tarong and 12 per cent above Gladstone, just like they would with their off-peak night rate and like they do all day, every day, at the moment.

PV costs will continue to fall by 2020 as we discovered when interviewing Muriel Watt from the Australian PV Institute (full podcast of the interview is available here and well worth a listen for those interested in why this is happening). In the interview she described how in 2008 a 5kW system would have cost you $60,000 and the same system at the time of the interview (December last year) would have cost you about $8500. At the moment PV is a LCOE of between 12-18 cents per kWh which is great for Queensland residents looking to reduce their power bills but is not quite at the price point for an industrial load just yet, but certainly not far off.

The other factor to bear in mind is that large-scale solar PV systems are much quicker to assemble compared with baseload coal power stations which can take five to seven years to get through planning and assemble. Despite some short-term pessimism, if PV companies like Sunpower and Trina continue to innovate and achieve their goal of 6 cents per kWh in the next five to seven years then even if you started putting up your PV panels at the beginning of 2019 it would mean that for daytime electricity demand, even without a carbon price, this new fossil fuel generator is likely to be a stranded before the paint dries.

Concentrated solar thermal with storage – Option 2

The other option is concentrated solar thermal with storage which uses molten salts to store energy in the day to be dispatched at night, which at present is the most expensive technology at a LCOE of 20.8 c per kWh - but it is also a very immature technology as far as deployment and innovation. The other not insurmountable issues that would need to be addressed are its resilience to category 5 cyclones and the fact that, like a coal plant, it would take you five or more years to build so we can’t wait like we could with the PV option and just start throwing it up in 2019. That is the bad news.

The good news is once you start to deploy the technology it will start to come down the cost curve rapidly just like PV which has collapsed 90 per cent in price over the last five years, and like wind has been doing incrementally as it’s scale has increased. But someone needs to back themselves to innovate.

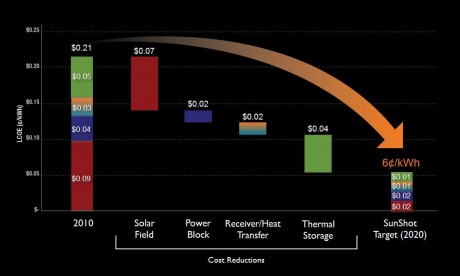

Other nations in the world are deploying this technology now like oil-rich Saudi Arabia, the US, South Africa and Chile. And if the CSIRO’s projections are correct, by 2020 - which is the year that this new capacity would be due to come online - the LCOE will drop to 12c per kWh or, if the US Department of Energy manages to achieve its aggressive SunShot initiative targets, it will be down to 6c kWh. As this graph below shows.

Source: US Department of Energy

Even if we split the difference between our CSIRO and the US Department of Energy and call it 9 cents per kWh then choose to sit on the sidelines while everybody else does the innovating and gets the economic benefits that come with it, then this proposed coal plant still has a problem.

There may be a tiny window between, say, 2021 and 2025 depending on when they would be intending to start building the new hypothetical cheap concentrated solar thermal plant, but what this means is that as far as electricity productivity in a carbon constrained world is concerned, it is going to get stranded some time between before the paint has dried to some time after the paint has dried - but before trainees who helped paint it have finished their apprenticeships. Either way, the bankers that financed it won’t be happy.

In part three, I will look at all three proposals for new baseload: coal with algae carbon capture, PV with off-peak grid and concentrated solar thermal with storage, all from the point of view of their long term cost competitive advantage.

Matt Grantham is a radio presenter, political comedian and renewable energy advocate.

*I would like to add that while at present wind is now is in some places cost competitive with new capacity coal unfortunately due to its intermittent nature and the “budgetary constraints left to me by previous Climate Spectator contributors”, I was unable put up a wind monitor to assess whether the resource was adequate.