The 7 who'll pay half the carbon tax bill

The total amount of CO2 equivalent emissions liable in the first year of the carbon price or tax (depending on your point of view) for the $23 per tonne fee is 284,562,865 tonnes.

Of course, a large proportion of these emissions will be covered by permits which the government has issued for free either as compensation, or to shield trade-exposed businesses from loss of competitiveness.

Not one single company so far has used international carbon credits to meet their carbon price obligations. However, a small number have used 1.7 million Australian Carbon Credits created under the Carbon Farming Initiative.

Only 0.01 per cent of Australian businesses are liable to pay the carbon price. While there are 351 firms registered under the emissions liability database, only 249 businesses exceeded the 25,000 tonnes of CO2 emissions threshold to become liable to pay a fee for their carbon pollution. By comparison, according to the Bureau of Statistics, Australia has 2,141,280 actively trading businesses in Australia at June 2012.

Of the 249 registered businesses a large proportion are actually subsidiaries of another company like BHP Billiton or Rio Tinto or Origin Energy, so in fact the number of businesses is indeed lower than this. For example, Origin Energy has at least seven subsidiaries and AGL Energy has 16 within the 249 businesses liable to pay the carbon price.

Without taking into account consolidated ownership, of the 284.6 million tonnes of CO2 liable for a carbon price, the top 10 emitters account for 47 per cent, the top 20 account for more than 60 per cent and the top 50 over 80 per cent of this total.

However, once we look at how many of these firms are owned by a single company or organisation we get an even more concentrated picture.

Australia’s biggest emitter is the NSW government, via the power stations it owns.

The three state governments of Queensland, NSW and WA alone account for more than a quarter of emissions liable under the carbon price, via the power assets they own. No wonder they have complained so bitterly about it.

If we then extend this to the big three energy gen-tailers of AGL, Origin and Energy Australia (plus GDF Suez, formerly International Power) we have covered more than half of the emissions liable to pay the $23 carbon price fee with just seven organisations.

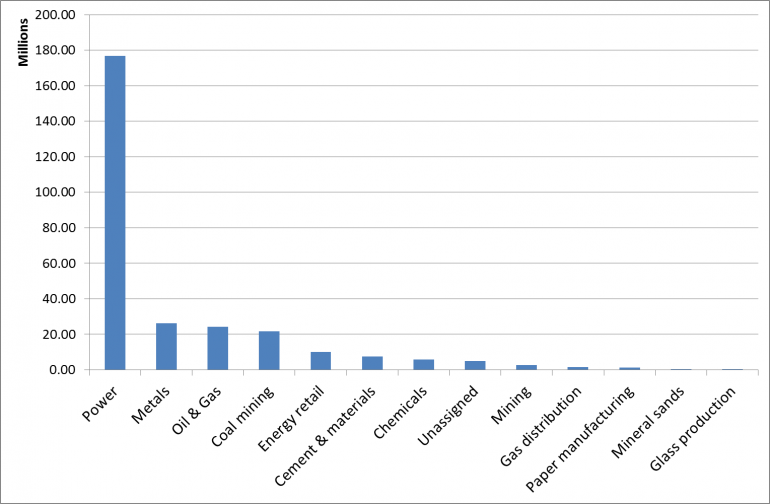

As the chart below illustrates, direct liability for the carbon price is highly concentrated in just a small number of industries. Just five industries account for 91 per cent of Australia’s emissions liable under the carbon price.

2012-13 emissions liable under carbon price by industry sector

Source: Clean Energy Regulator LEPID Database accessed November 18, 2013

EDIS: The 3 firms that didn't pay the carbon tax, November 18