Taper waits for the American consumer

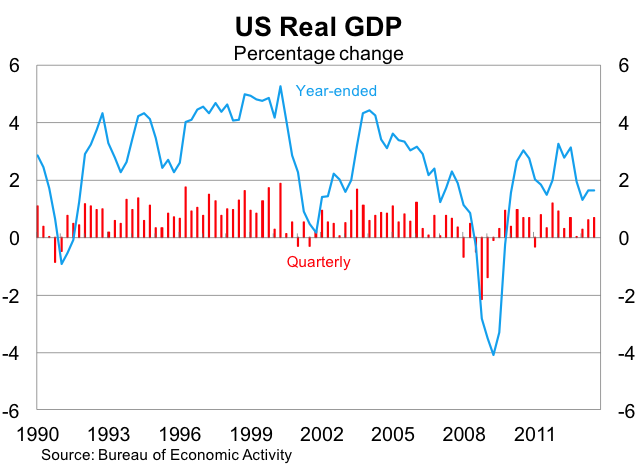

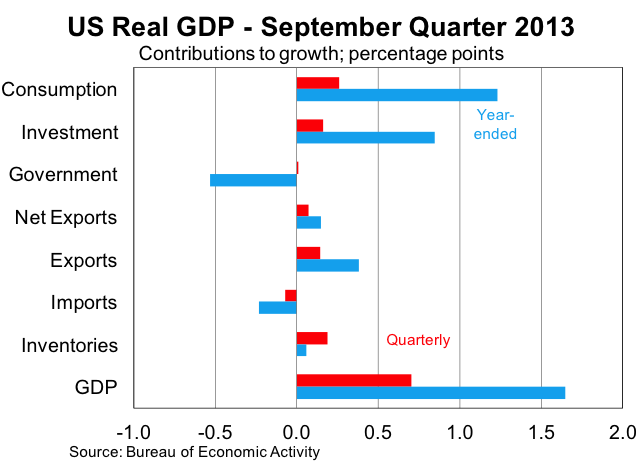

United States real GDP rose by more than expected in the September quarter, but the result points more toward soft domestic demand rather than a sign of recovery. Growth is expected to slow next quarter and the Federal Reserve is unlikely to taper until 2014. In the United States, real GDP rose by 0.7 per cent in the September quarter, to be 1.6 per cent higher over the year. The result was above expectations, but this was mostly due to a stockpiling of private inventories, which is typically a sign of insufficient demand. The big concern for the December quarter is that businesses will cut back on production and run down their inventories, while at the same time government expenditure declines following the federal government shutdown. Excluding inventories, real GDP growth was in line with market expectations. Real GDP continues to grow at a fairly moderate pace but at this point of the recovery growth could and should be higher.

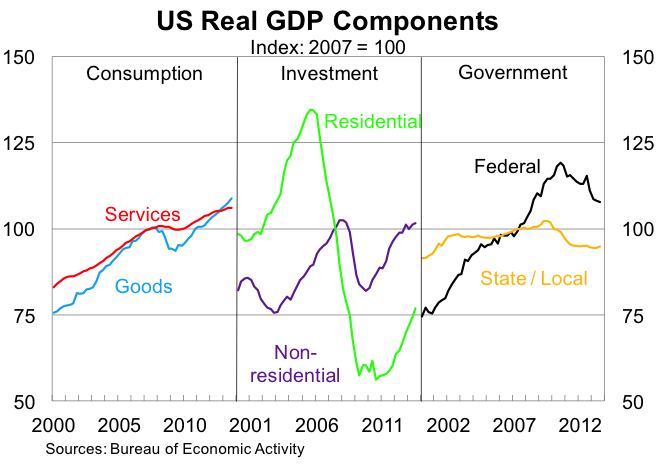

Emphasising the soft domestic demand, consumption expanded at its slowest pace in over two years, rising by just 0.4 per cent in the quarter to be 1.8 per cent higher over the year. At 68 per cent of real GDP, consumption has to be a driving force in any sustainable economic recovery for the United States. Goods accounted for all the growth in consumption, with services unchanged in the quarter. This was a little bit of a surprise given that services growth is typically quite stable (see graph 3), and in this regard might provide some upside for the December quarter. But with the labour market remaining soft, it is unlikely that we will see a significant pick-up in consumption in the near-term.

Investment continues to be a shining light for the US economy. Fixed investment rose by 1.0 per cent in the September quarter; led by residential investment which increased by 3.5 per cent, to be around 15 per cent higher over the year. Below we can see the sharp rise in residential investment over the past two years, but it remains well below the giddy days before the global financial crisis. Residential investment is one of the best indicators of future growth due to its cyclicality. As a result, the US economy is unlikely to slow too much in the near-term, excluding the effects of the government shutdown next quarter. I expect the recovery in residential property to continue, supporting growth over the next few years. By comparison, non-residential investment is back towards its pre-crisis peak, although growth has slowed significantly over the past couple of quarters.

Government spending rose modestly in September but is down 2.8 per cent over the year. The graph above highlights the fiscal drag at all levels of government over the past few years, which has slowed the recovery. Although there are some obvious budgetary concerns for the US in the long-run, it would have been preferable for the federal government to spend a little more stimulating the economy now and then consolidate at a faster pace once the recovery is on solid ground. But with further budget negotiations set for January, it is likely that the federal government will remain a drag on the broader economy.

Net exports made a modest contribution to growth, on the back of exports rising by 1.1 per cent in the September quarter. This was led by goods exports, which were up by 1.6 per cent. By comparison, imports rose by 0.5 per cent.

Overall, the result paints the picture of a moderate economic recovery featuring soft domestic demand. Prior to the release of the September quarter data, markets were expecting growth of around 0.5 per cent in the December quarter, but the run up of inventories over the past three quarters instead point to a softer outcome for December. Offsetting this to some extent, I anticipate growth in services consumption (45 per cent of real GDP) to head back towards its level of the past year-and-a-half. Based on currently available data, real GDP growth is likely to be around 0.3 – 0.4 per cent in the December quarter.

The data today should remove any likelihood that the Federal Reserve decides to taper at their December meeting. Quite simply they will not have sufficient new data, or at least sufficient untainted data, to make a firm decision on the pace of recovery. Expect them to remain cautious and wait until 2014.