Tanking motor sales hint at a stalling economy

It has been a turbulent period for the Australian motor vehicle industry, with domestic production set to cease by 2017. However, recent data suggests that it is not just domestic producers who are struggling to make a dime in Australia.

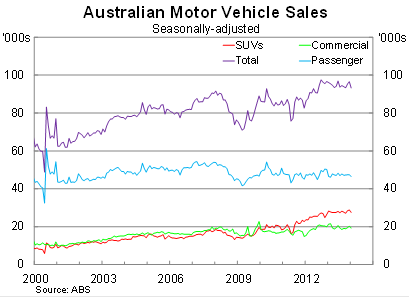

Motor vehicle sales fell by 3.5 per cent in January to be 3.0 per cent lower over the year. SUV and commercial vehicle sales fell sharply in January, while sales of passenger vehicles also fell significantly.

Sales growth has deteriorated over the past year, following a strong 2012. Is it really a surprise that domestic producers struggled, given they account for an increasingly smaller share of a largely stagnant pie?

At first glance, it seems that the depreciation in the Australian dollar may have contributed to the slowdown in sales, since around 90 per cent of new Australian motor vehicles are imported from abroad. But this proposition doesn’t stand up to scrutiny, with CPI data indicating that motor vehicles became more affordable over 2013.

Sales of passenger vehicles have been particularly weak and have yet to head back to their pre-crisis peak. Small passenger vehicles continue be the largest individual category for new motor vehicles.

Weakness in passenger vehicles has been offset by consumers moving towards SUVs. Evidently, when people are looking at buying a vehicle, they either go really small or massive – there’s little in-between.

Highlighting the plight of domestic manufacturers, Australian production was down 9 per cent over the year to January, with production levels declining by 35 per cent between 2008 and 2013.

At the state level, monthly sales declined most heavily in Victoria and Western Australia. Over the year, sales in Queensland and Western Australia were down by 12.3 and 14.7 per cent respectively.

Motor vehicle sales can often be a bit volatile and it is rarely wise to place too much emphasis on an individual month. However, it is clear that sales have, at best, been tracking sideways for the best part of a year. Sales levels have effectively stalled and that is a concern – certainly for Australian producers and importers, but potentially for the broader economy.

A motor vehicle is the biggest discretionary item that a household is likely to purchase. When times are tough, they are often the first items that household hold off on because typically they are not urgent purchases. Consequently, vehicle sales can sometimes be the proverbial canary in the coal mine – an initial sign of impending weakness.

Soft motor vehicle sales are likely a symptom of the broader weakness in Australian labour markets, which have left many households feeling more vulnerable than usual. The current environment is hardly conducive to large purchases, which is also why first home buyers are showing no interest in the property market.

Nevertheless we have yet to see any real weakness in retail spending, which has picked up while the labour market has deteriorated. Although many households have grown more pessimistic, high asset prices have produced some optimism, particularly among more affluent consumers.

Soft motor vehicle sales, deteriorating labour market conditions and strong retail sales: it is an unusual set of circumstances that is likely to prove unsustainable in the long term.

The outlook for motor vehicle sales is set to be fairly weak. Motor vehicle sales are likely to deteriorate further in early 2014 as a weaker Australian dollar flows through to consumers. This, combined with a labour market-led slowdown in retail spending, will weigh on broader consumer spending this year.