Taking Scotland out of the sterling

Surveys leading into this week’s Scottish referendum have caught the markets by surprise, sending the pound sterling lower. With the result seemingly too close to call at the moment the lobbyists on both sides of the political landscape have been very vocal. The fact the Queen herself has been forced to weigh in on the debate indicates there is a real possibility that Scotland could leave the UK, which would have very serious ramifications across the continent. There is a fear other nations may follow, meaning they would have to move away from the Great British pound as their currency.

While there is still a chance the vote will not get through, contingency planning is well and truly underway just in case the Yes vote triumphs. Such a scenario doesn’t mean there would be a new currency in Scotland this week, as there will need to be a transition period, but businesses and individuals with cross-border money transfer requirements will be impacted in a number of ways. And more than likely they are not prepared for such a change. So let’s just assume for a moment that the Bank of England gets its way and there will need to be a new currency. It might be the euro, or perhaps something else.

Taking the pound out of sterling

Perhaps Scotland will claim the pound back, as it was once the name of its currency after all. It was in the early 18th century that the sterling was combined with the pound to get what we know today as the pound sterling. Perhaps to avoid confusion they will go for something different, though. For the purpose of this article, and to avoid confusion, let’s call the new currency 'the scot and the old the sterling.

If the Yes vote succeeds, a standard conversion rate for sterling to scot will need to be applied, similar to what happened when the euro currency was formed, but in reverse. One would imagine that one pound will be worth more than one scot. Let’s say one pound sterling in the new world is worth three scot. Shop owners and the broader economy would have to convert consumer prices into scot (GBPx3), as too wages, and basically everything money can buy will need to be converted.

Those Scottish individuals and businesses with pound sterling denominated bank accounts will see their balances change to accommodate the new exchange rate. Eventually life will go on as normal for most folk, with stories told for generations to come about how life used to be under the old monetary system.

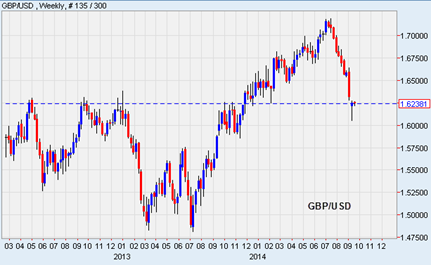

In the background, to make this happen, there would need to be a very large amount of pound sterling sold in order to transfer to the scot. So this is likely to have a rather large negative impact on the GBP exchange rate against its major counterparties like the US dollar, the euro, and of course the Aussie dollar. To estimate how low the GBP can fall is very difficult, but one thing’s for sure -- speculators will sell the GBP lower by the end of the week and it will stay depressed for some time, with trade below 1.6 in quick time very likely.

New risk for many

For those who do business between Scotland and the rest of the world, or England and what’s left of the UK, there will be a new currency to manage. This opens up new risks that many would not have had to encounter previously.

Businesses based in Scotland will have to manage foreign income from the rest of the UK for the first time. What was once a same-currency transfer will become a foreign currency transfer, so they will have to manage this in order to avoid the possibility of reducing their income streams. For some Scottish importers, supplier payments will also be subject to change, making it more difficult to manage their cost base. And of course individuals holding bank accounts in England would also face currency risk.

Perhaps this is an over-reaction. Come Thursday the No vote may prevail, sending the GBP higher. But many are not taking the chance. At OzForex we have already seen a flurry of activity, with many British expats moving their pound sterling to Australia or other parts of the world in order to protect against the possibility of their savings being diminished.

Jim Vrondas is chief currency strategist, Asia-Pacific at OzForex, a global supplier of online international payment services and a key provider of Forex news. OzForex Group Limited is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".