Surprising news from the international investing experts

Summary: For those interested in international investing, the US appears to be a dream position. American value is increasingly concentrated around technology companies. But don't overlook China, where there is an opportunity to find stocks that represent value after a large market fall. In Europe, some individual companies can perform well in tough times. |

Key take out: If you have the time and expertise, it's interesting to pick your own stocks. It is also possible to gain exposure to offshore markets through ETFs. Don't hesitate to use more than one manager. |

Key beneficiaries: General Investors. Category: International investing. |

Let me share the unexpected with you. I left yesterday's Eureka Report “Around the World of Investing” seminar in Sydney clearly surprised at what I had discovered. I went to the seminar with fairly fixed ideas about overseas investment and came away with some very different thoughts.

And of course the seminar is repeated on Thursday, November 27 (tomorrow) in Melbourne.

Over many years Australia has been a wonderful place to invest and indeed apart from the last 12 months we have been outperforming the rest of the world. Nevertheless, as you will know, for some time, I have been edgy and have been suggesting Eureka Report readers look more closely at increasing the overseas content of their portfolios. And I met a great many Eureka Report readers at the seminar who face the problem of not really wanting to sell down their high yielding bank stocks plus Telstra because of the income they provide and the capital gains embedded in the portfolios. Nevertheless some find they have a greater exposure to our four big banks than is wise.

This particularly applies to older readers. Younger people are in the process of building their savings rate and often are much more adventurous. There is no simple answer to that asset allocation problem and each person needs to look at their own situation and preparedness to change the portfolio weightings.

So let's put that aside for a moment and assume that you are interested in lifting your overseas content. And that was certainly the attitude of the majority of the packed Sheraton meeting room. For some years I have been advocating that people wanting an overseas exposure should look first at the US. It is a dream position. The US economy is recovering on the back of a unique combination – high technology, low cost and flexible labour, cheap energy and an infrastructure that, while it might be imperfect, is better than most countries.

I more or less expected to have my view reinforced but instead Platinum who was sponsoring the conference announced that they had cut the portion of US stocks in their base international fund from 42% to 27% in the 15 months to September 30. That is an enormous change in a relatively short time and it surprised me. And they had done this, not because they think the US is falling apart, but because the US stocks have had a great run and they see better value elsewhere in the world.

When you step back there is no doubt that while two or three years ago the US was deeply unpopular, now most people are American bulls except those who believe that there is havoc ahead when America starts to increase interest rates. However the “havoc” view loses popularity because the US Federal Reserve is being very tentative in its higher interest rate agenda and is not likely to lift interest rates until well into next year and then only slowly. My biggest fear in the US is that longer term the increase in income inequality will trigger a hard swing to the left in American politics.

The great strength of the US is that it is leading the world in the revolution which has seen a complete change in manufacturing, finance, energy conservation and many other areas with the new disruptive technologies. But as always it is a question of stock values.

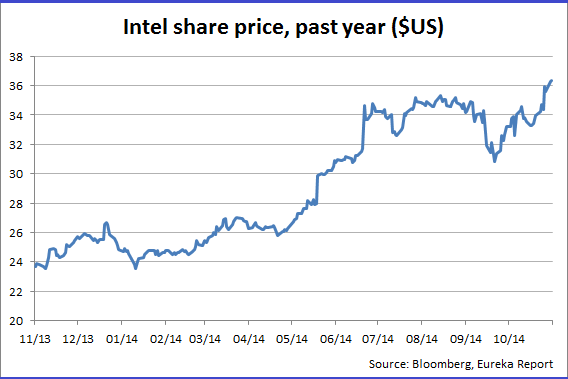

Increasingly American value is being concentrated around emerging technology companies or more importantly well-established technology companies that are being overlooked in the market. One mentioned at the seminar was Intel. And so for Australian investors one of the share market areas where we are weakest is technology and that is a source of great value in the US. So that is an area of special attraction to Australians. But what Platinum are saying is that in other sectors they can obtain much better value in China than the US and even European companies are looking increasingly attractive in relation to American share prices.

When it comes to China we tend to forget that the Chinese share market has experienced one of the biggest falls we have seen in the last 100 years. Markets rarely fall by 50% yet that is what happened in China. There has been a small recovery but they are way below their peak.

After a fall like that you get the opportunity to find stocks that represent rarely seen value given the fact that we are dealing with an enormous market and a rapidly rising middle class. As we know from the commodities market China is moving from a standard manufacturing export country to a much more service-oriented country. Changes like that are hazardous but companies that can ride the change have enormous potential.

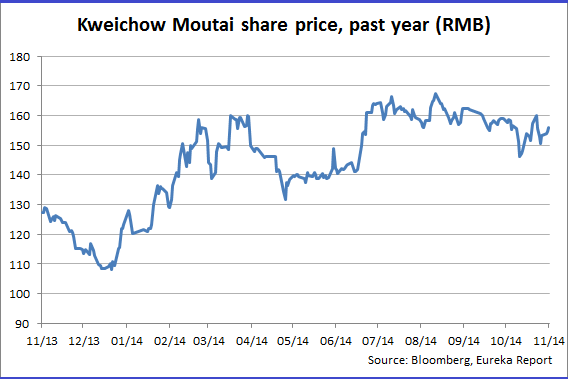

I am certainly not in the business of recommending individual Chinese stocks because I don't have the knowledge but I was fascinated to learn that Google is excluded from China and the Chinese version of Google – Baidu – is growing dramatically and Platinum believes it offers better value than Google. And China has a spirits company called Kweichow Moutai that is priced at a fraction of similar companies in other parts of the world. (This spirits company is the sixth-largest position in AMP's China-focused listed investment company – see LIC spotlight: AMP Capital China Growth Fund.) And it is these sorts of stocks that are attracting Platinum. If China gets through its transformation then we are going to look back at 2014 as an incredible opportunity because we are buying after a 50% fall in the market.

And Europe? Those investing in Europe say firstly that there have been considerable underlining improvements in countries like Spain, Italy and Ireland. Spain has tackled its work practices and Italy's prime minister is vowing that he will resign unless they are changed. The theory behind European share investment is that individual companies can perform well in tough economic times. Even though a country or a region may not be growing there can still be very profitable companies that are often priced cheaply because conventional investing ignores the region. And so in Europe there can be bargains that may stay bargains for a while but eventually will be recognised.

One question was raised many times – if you are going to increase your overseas exposure how do you do it? If you have the time and expertise it can be really interesting to pick your own stocks. And the amount of information now obtainable on the internet makes this possible and in Eureka Report we provide many suggestions (click here for Clay Carter's recommendations). It is certainly more interesting to follow your own stocks but at the same time you can gain exposure to all these markets through ETFs which are basically indexed securities. In this period of great change when it comes to funds I like to have someone trying to pick the better companies, albeit that costs money. Obviously our sponsors Platinum at these events are one such group but there are many others as well. If you do make a decision to increase your overseas exposure then don't hesitate to use more than one manager.