Suddenly sunnier days for balancing Europe's trade

The large current-account imbalances that had emerged within the eurozone in the years leading up to 2008 reflected heterogeneous developments in unit labour costs and spending patterns across the currency union.

The heterogeneity of the single economies has made the area as a whole vulnerable to external shocks such as the 2007-2009 financial crisis. The ensuing European debt crisis has also been worsened by the large scale of current-account imbalances, which have “contributed to the severity of the economic contraction and damaged banking systems and sovereign creditworthiness, ” according to one IIS discussion paper.

Because current-account imbalances are indicative of underlying differences in macroeconomic fundamentals across the currency union, restoring uniform competiveness across the eurozone has become a policy objective for many European policymakers. For example, in 2012 Mario Draghi stated that “Europe’s future prosperity requires member countries to be competitive individually in order to be competitive jointly and thrive in an open, global economy”. However, the heterogeneous developments in wage setting and public and private spending patterns that caused the current-account imbalances had taken a decade to develop, thus giving rise to concerns that closing current-account imbalances also might take a prolonged period. Indeed, given the lack of the possibility of exchange-rate depreciation, external adjustment within currency unions is generally thought to be a slow and costly process.

Current-account balances in the southern eurozone are rapidly improving

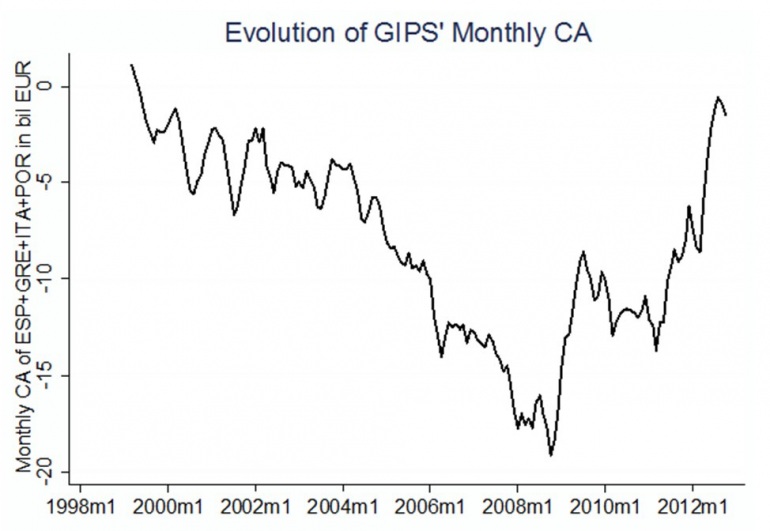

Against the backdrop of these considerations, it is worthwhile to point out that rapid current-account rebalancing is actually well underway at the current juncture. Figure 1 from my paper documents the joint monthly current-account balance of Greece, Italy, Portugal, and Spain. Figure 1 documents that in the last years, these four nations have nearly rebalanced their joint current account. The monthly current-account deficit had increased steadily from 1998 to late 2008, peaking at a monthly rate of well over €17 billion per month (i.e. at an annualised rate of €204 billion). Since then, it has sharply reversed. In the third quarter of 2012, the average seasonally adjusted monthly current-account deficit of these four nations together stood at less than €2 billion (€24 billion at an annualised rate).

These developments suggest that the GIPS nations have undergone an expenditure switching in excess of €180 billion per year, which constitutes a sizeable fraction of their overall consumption.

Figure 1: Evidence of GIPS' monthly current account balance

The current-account rebalancing took place at a rapid pace and the speed of adjustment has even increased substantially over the course of the last six months (see figure 1).

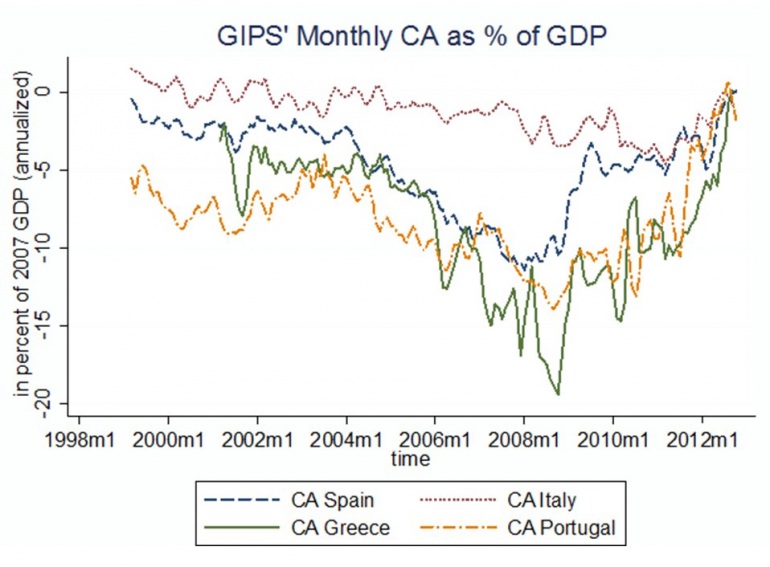

Figure 2 documents that all four countries have achieved substantial external adjustment. It plots the evolution of the current-account balances of Greece, Italy, Portugal, and Spain as a percentage of GDP.

Current-account deficits have been the smallest in Italy (red dotted line), where the deficit was in the range of -2 to -4 per cent of current GDP during 2008 to 2011. Reflecting the low need for adjustment, the country’s CA deficit has only improved somewhat during the second half of 2012, nearly reaching 0 during July 2012.

The monthly current-account deficit of Spain (blue dashed line) peaked at over -10 per cent of GDP in 2008 and substantially improved to -5 per cent in the course of 2009. During the third quarter of 2012, the magnitude of the deficit has been lower than 1 per cent of GDP, on a seasonally adjusted basis even reaching positive territory in October.

The monthly current-account deficit of Portugal (represented by the orange dash-dotted line) had exceeded -10 per cent of GDP for large parts of 2008 and 2009. It has substantially improved thereafter and, during the third quarter of 2012, it was less than -2 per cent of GDP on a seasonally adjusted basis.

In 2007 and 2008, the monthly current-account deficit of Greece (represented by the green solid line) had at times exceeded -15 per cent of GDP. The country’s current account improved to the -10 per cent region during 2010 and then rapidly improved to a deficit of around 1 per cent of GDP during the third quarter of 2012 (when adjusted seasonally).

The size, the speed, and the uniformity of the current-account improvement in these four nations could indicate an improvement of macroeconomic fundamentals or of the deep recession in these nations. If the recent speed of adjustment prevails, it is not impossible that the near future holds substantial current-account surpluses for these nations.

Figure 2: GIPS' monthly current accounts as a percentage of GDP

In fact, the speed of current-account rebalancing in the southern eurozone is actually much faster than the typical rate of current-account rebalancing following large imbalances.

In fact, for the monthly sample in the post crisis-period in Greece, Italy, Spain, and Portugal, the coefficient on the one-year lagged monthly current account is equal to 0.576. This rate of current-account persistence in the southern eurozone is below any of the average rates estimated in previous samples of over one hundred rebalancing episodes from 1970 onwards – including for fixed-exchange-rate regimes (0.63), for flexible-exchange-rate regimes (0.73), or for the average rate of current-account adjustment in industrialised countries (0.867).

Of course, these recent developments also have to be interpreted with care as it is not yet clear whether the reduction of current-account deficits reflects only temporary cuts in private and public spending or a permanent improvement in the competiveness of these countries.

A key requirement for the eurozone to achieve long-term success is that corrective forces are at work which limit external imbalances. This column documents that Greece, Italy, Portugal, and Spain are close to achieving a balanced current account.

These patterns indicate that one of the key requirements for the end of the European debt crisis is on its way. As such, there is no evidence that the institutional setup of the European Monetary Union will lead to ever-increasing imbalances akin to the ones in the Bretton-Woods system. In fact, the speed of current-account rebalancing in these four nations is actually faster than the typical rate of adjustment found after other episodes of large current-account imbalances.

This rebalancing also has to be seen in the light of the current discussion on the origins and implications of the large Target2 imbalances within the eurozone. In a panel analysis, I analyse the role that the provision of central-bank liquidity (visible in Target2 balances) played in smoothing the ‘sudden stop’ and the partial reversion of private capital flows that had financed current-account imbalances before the onset of the financial crisis in 2007.

Given that current-account imbalances are rapidly diminishing, Target2 balances will be reduced once private capital flows return to the southern eurozone. And given the current signs that private investors are rediscovering these troubled financial markets, this may happen in the not-too-distant future.

This is an edited version of an article originally published on www.VoxEU.org. Reproduced with permission.

The views expressed here are those of the authors and do not necessarily represent those of the institutions with which they are affiliated.