Still time for some quality European shopping

| Summary: While the bargains might be harder to find, European and US equity markets still offer good value as the global economy accelerates over the next two years - Europe is out of recession, the US economy is finally gathering speed, as is Britain’s. Investing some of your portfolio in these markets should provide some insurance against the possibility of a Chinese hard landing. |

| Key take-out: The European and the US markets offer investors the chance to diversify while fears of a Chinese slow-down weigh on domestic markets. |

| Key beneficiaries: General investors. Category: Economics and Investment Strategy. |

I’ve been bullish on global equities for a while now and have argued previously that investors should be investing overseas. The strong Australian dollar was a key reason underpinning that bullishness. Global equities were cheap for Australian investors and pessimism was overdone.

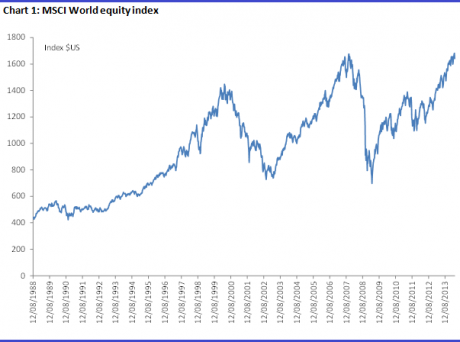

The landscape has obviously changed a lot since 2012. A lot of the pessimism has unwound, but then again we find that the currency is down 14% and global benchmarks have pushed markedly higher. The MSCI world index is back to record territory, rising 26% just over the last year alone.

So the question for the domestic investor is whether it’s still worth the effort to invest globally in that environment - with a weaker currency, global equities have pushed to new highs. Most of the talk in the market is that with many indices at new records, valuations are stretched. Where valuations are not stretched, mainly in the emerging markets, the argument is that this is due to economic underperformance and the real threat of a serious downturn. This again would argue against investing globally.

Either way we’re not hearing of any compelling case to diversify globally. Then again, I don’t think things are quite as unfavourable as a casual glance suggests.

- Firstly, the Australian dollar is still more likely to enhance global returns than not. Tactically, I’m bullish on the Australian dollar. That’s over the next 12 months, where I think 95 cents is very likely. Mainly I put this down to policy incompetence. That the AUD is rallying as the Fed tapers comes down to the poor performance of key policy institutions and the decision to target the AUD. Policy makers decided to enter a currency war they simply did not understand, and now we find our currency pushing higher even as the Fed tapers. If they’d left things alone the AUD would be lower - but they unwittingly laid the framework for the AUD to strengthen, as it became clear things weren’t as bad as they were making out. That being the case, I’m bearish medium-term. The RBA board and our politicians have wisely decided to tone down their rhetoric on the ‘high’ AUD. This is good because it means when the major central banks do finally get around to hiking rates, and assuming the RBA and our political/business leaders can close their mouths for a bit, then our dollar should do what comes natural - weaken. At the very least there is limited upside over the medium term even if the RBA hikes, as it will accompany more hawkish central banks around the globe.

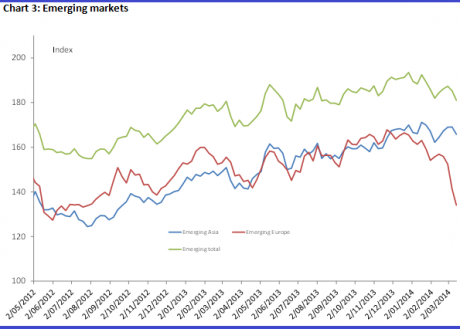

- Secondly, it’s not clear that major markets are actually all that expensive. The fact that many indices are at records doesn’t really mean that much if the earnings support is there. Take a look at chart 2. It shows the price-earnings ratio for the major advanced economies. Now I’ve only included the major markets because these get all the attention when it comes to value and relative richness etc. In each case, except for the Nikkei, current earnings multiples (trailing) are above the historical average.

A few things to note though. Firstly, these earnings multiples are only at or just above their pre-GFC averages. Not a sign they are particularly rich. Indeed multiples have been higher, substantially so in some cases, so there is nothing to suggest that the process of multiple expansion is over or can’t go higher.

When you get down to it, the assessment of value really comes down to a macro call. Is the global economy getting better or worse? If it’s getting worse, then markets are rich - if it’s getting better market don’t look so rich. Basically we’ve got the same problem globally that we find domestically. The view that the market is expensive is based on fairly weak growth assumptions. Or rather an expectation that the problems we’ve seen over the last few years will continue. Austerity, weak confidence, a recession in global construction etc.

I have outlined consistently to readers why this view on global growth is wrong - as a very brief summary:

- Corporate balance sheets are generally strong

- The process of household deleveraging is over

- Unemployment rates are falling

- Household and business confidence is recovering

- The global construction cycle is turning

- Many of the major economies - the US and UK especially, have gone a long way to repair public balance sheets

- Notwithstanding these improvements - monetary policy remains extremely accommodative

These are not conditions where I think it’s reasonable to expect earnings growth to remain sluggish. Prospect remain very positive. Indeed forward estimates, provided by Bloomberg, show a completely different picture of value for the major market indices. In each case, earnings multiples are all back into value territory on a 1-2 year view. So the view that global markets are rich, overlooks the fact that the global economy expected to accelerate over the next two years - Europe is out of recession, the US economy is accelerating, as is Britain’s. The ‘crisis’ is over and earnings growth will lift as a result.

Ok but isn’t the Australian economy doing fine? Why not just stay fully invested here?

It is, and on a three to five year view I think the Australian economy - and share market - will outperform. There is one very large problem, or obstacle to this outperformance though: China. The fact is, global benchmarks have consistently outperformed Australian stocks over recent years. One of the key reasons for that are the persistent and unshakeable concerns of a slowdown in Chinese growth - banking crisis what have you. I think these concerns are misplaced, as I have outlined elsewhere, but the fact is they weigh. If you’re a global institutional investor and markets are constantly concerned over China, and everything you hear out of Australian business leaders, economists and policy makers is all about the end of the mining boom and weak growth etc. Well that’s hardly a buy message is it.

I think all of that will change over time. It is changing, but we may be waiting a while. In the meantime - it pays to diversify. I actually think that’s the one key lessons learned for domestic investors - especially since the GFC. In a world full of uncertainty, driven by fickleness and fear we must diversify our investments globally. Markets are ruled by emotion and rumour - and as the old saying goes, they can remain irrational longer than we can remain solvent - John Maynard Keynes I think.

With that in mind the question is where to invest?

For now, I still think that the place to be is in Europe and the US. Especially Europe - and for all the reason I listed above. Growth momentum is building and the US and Europe are leading it. As far as your global portfolio goes, I would remain overweight those two regions - there is still a long way to go in this growth rebound and little in in the way of partial data or policy settings that point to a slowing.

Japan I wouldn’t touch and I would have a zero allocation there. True, the market is up about 25% over the year. Yet most of that market gain occurred in the five months to April 2013. Since then it’s done nothing. More generally I just think Japan is too risky. The Japanese economy has huge structural problems which simply aren’t being addressed. All they can do is print money. That isn’t a solution, keep clear. Japan is a speculative play only.

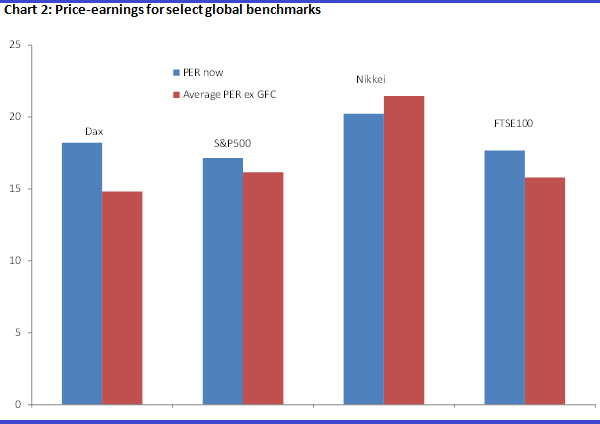

The emerging markets are a tougher call. I’m actually quite bullish on many of the emerging markets over the medium term.

Yet having said that, there is always something that occurs to weigh on these markets. A China hard landing, capital outflows from a taper. You can see from the chart above that stocks in emerging Europe were hammered as a result of the Crimean Crisis. The truth is though if the developed economies are recovering then the emerging economies and their markets will do well.

Weighing it all up, I would have the bulk of any ex-Australai portfolio in the US and Europe over the next 12 months- something like 60-70% invested. Of the remainder, Emerging Asia has the growth story and is probably more political stable than other emerging markets. That is my preferred emerging play over the medium term. Having said that, the recent 20% drop in emerging European stocks makes them attractive as a speculative play at these levels for those with the risk appetite.