Spotting stock bubbles

| Summary: While much focus is on the prospect of a residential price bubble, there are better current bubble examples in the stock market. Here are four companies that are performing well, but which are trading above their intrinsic values based on various measures. |

| Key take-out: Investors responding to upward price movements need to be careful to determine they are not doing so on unsustainable business upswings or that are already reflected in the price movement. |

| Key beneficiaries: General investors. Category: Shares. |

| Performance: Ramsay Health Care: Underperform. Macquarie Group: Underperform. BT Investment Management: Underperform. Crown Ltd: Underperform. |

The raging debate concerning the potential for a price bubble in residential property, caused by a flood of investments by self-managed super funds, may well be unfair in its focus.

This is because the payment of excessive prices by investors and speculators is common across all asset classes. Further, I do disagree with those who claim that a price bubble is only clear after the event. I believe that the true value of an asset is derived away from the marketplace, and so it is possible to observe excessive prices at any time – but it requires a proper valuation process.

This week I propose to look at excessive pricing in the equity market. While I do not believe that the whole equity market is presently overvalued, I do perceive that some individual stocks are very excessively priced. This is an important observation, for our aim as investors is both to invest in good companies at an attractive price and to avoid those trading at an excessive price. As a side comment, I do commonly observe the propensity for many stock spruikers to recommend stocks that have already risen sharply. Clearly as the price of a company rises without a sustainable change in its outlook, then the potential returns from that stock will fall and its capital risk will increase. Therefore, those that respond to upward price movements need to be careful to determine that they are not doing so on unsustainable business upswings or that are already reflected in the price movement. Rarely do spruikers recommend when sentiment is poor, and yet this is the time that the best opportunity for investment rewards is presented.

In building my growth portfolio I have utilised the intrinsic valuations derived by “StocksInValue”. The intrinsic valuation is derived by determining an appropriate multiple of equity that should be paid by an investor for an individual stock. The equity multiple in turn is derived from inputs that include the sustainable normalised return on equity (NROE), individual company risk (required return or RR) and the dividend payout ratio.

Most of the above inputs can be derived from financial information presented in each company’s audited results. However, the intrinsic value analyst must make a calculated assessment on the outlook for each company (the sustainable profit). Further, the RR will vary dependent on the strength of the financials and the business case of each company.

So let’s have a look at four companies that I now regard as expensive and explain to you why this is the case. The valuations that I present will clearly state my financial assumptions and inputs. Without that information, then you would have no idea as to the basis or integrity of the valuations.

Ramsay Health Care Limited (ASX: RHC)

Ramsay Health Care Limited owns and operates private hospitals across Australia, the United Kingdom, France and Indonesia. The company’s facilities cater for a range of health care needs from day surgery procedures to psychiatric care and rehabilitation. In Australia, it has 66 hospitals and its day surgery units conduct over 450,000 procedures per annum.

It is easy to conclude that RHC has a superior longer-term business case. Supporting its business is the limited public health budgets of governments and the drive for a private sector solution. The aging population, the deterioration in general health through poor diet and the continuing expansion of medical solutions; suggest that this is a business that should have bright prospects. But is it value at present?

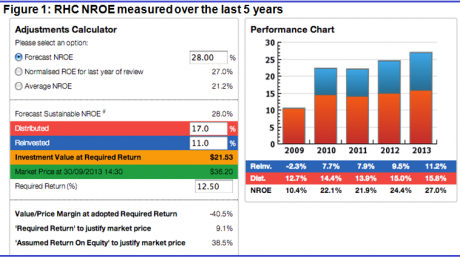

Source: StocksInValue.com.au

The above table (Figure 1) is instructive because it gives us a snapshot of the profitability of the company over the last five years as measured by NROE. Profitability is on an upward trajectory but has to lift substantially (to 38.5% from current 27%) to justify the current price. That is a massive lift and I note the current market consensus is forecasting 30% for 2014 and 2015. Given that 30% has never been achieved in the past I have held our forecast at 28%, maintained the payout ratio and derived a RR of 12.5% to derive a valuation of between $24 and $26 over the next year.

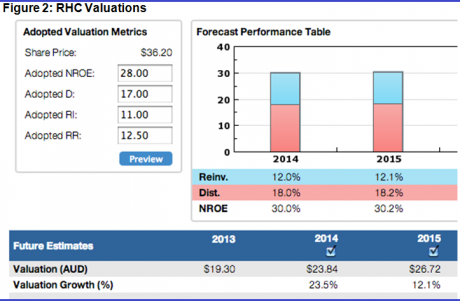

Source: StocksInValue.com.au

The above valuation (Figure 2) may be regarded as conservative but that suits my investment strategy. Better to be conservatively wrong than optimistically wrong! In any case, StocksInValue.com.au is an interactive site for investors. That means that a user can adjust the inputs of NROE and RR to derive their own valuation. For instance, if you believe the market consensus forecasts of NROE of 30% and are happy with a lower RR of 12%, then a forward value of $28.18 is derived.

Either way RHC is very expensive at present following a massive re-rating in the market.

Macquarie Group Limited (ASX code: MQG)

MQG is well known to readers as Australia’s largest investment bank. However, what is not well understood is that MQG is currently achieving a NROE (below 7%) that is inferior to the big four commercial banks (average 18%). This is significant because the business model of MQG does involve more business risk and therefore should generate a higher return on equity.

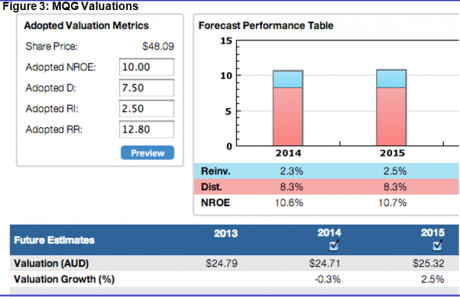

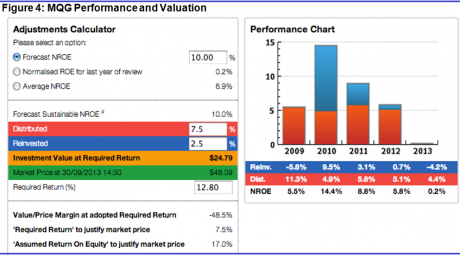

Source: StocksInValue.com.au

The current share price has rocketed as the market anticipates a return to a higher plateau of profitability. Indeed, to justify the current price, which is 1.6 times NTA, MQG must achieve a NROE of over 15% in 2014. That would involve a doubling of the profit recorded over the last 12 months, and I suspect that this is way beyond the reach of this bank in the next few years. I have assumed 10% as the most likely outcome.

Therefore, until MQG returns to a profitability level that is above the RR, I find it difficult to get excited with the company at any price that is above NTA of $30. (Also see Karl Siegling's recent article, Working Macquarie's human capital harder).

Source: StocksInValue.com.au

BT Investment Management Limited (ASX:BTT)

BTT provides investment solutions through multiple channels to its clients. It provides investment management services to retail and institutional clients through managed funds and investment mandates. The company also manages retail funds and superannuation trusts for Westpac Banking Corporation/ BT Financial Group (Westpac/BTFG) and provides model portfolios and research to Westpac’s private clients business.

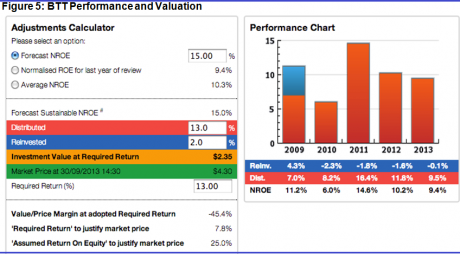

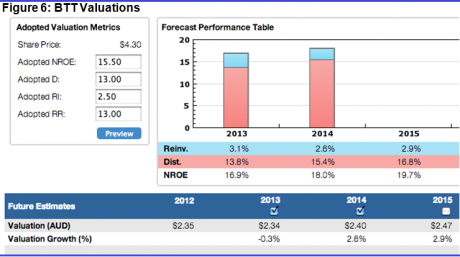

Source: StocksInValue.com.au

The above business description presents as highly attractive with significant tailwinds at present from burgeoning superannuation flows and rising equity markets. This is why the stock has caught the attention of some commentators who talk concepts rather than value. So with the share price up by over 100% in 12 months, what is its intrinsic value now?

Source: StocksInValue.com.au

Noteworthy from its recent performance is that BTT has struggled to generate a superior NROE. Whilst the business is highly leveraged to FUM growth, its recent profitability has been decidedly disappointing. Further, whilst equity is stated at $2 per share, it is totally made up of intangibles and goodwill.

To justify the current share price NROE would have to lift to 25% from the current 10%. Current market forecasts maybe conservative at 18%, but that is way below what is required for me to buy this stock.

Crown Limited (ASX: CWN)

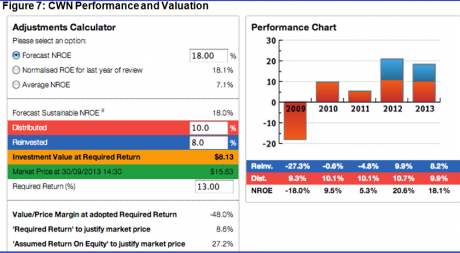

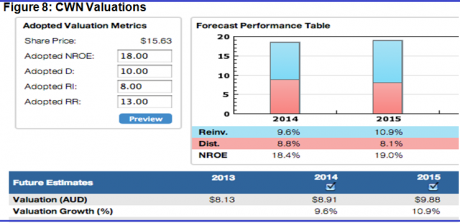

The business and recent success of CWN is well understood by the market. Indeed, what has been most impressive is the solid lift in financial performance as measured by NROE. This is particularly impressive because casinos are capital intensive businesses which require significant capital reinvestment to maintain their performance.

Source: StocksInValue.com.au

It is remarkable to note that in recent months CWN has lifted its market capitalisation to over $11 billion or some three times stated NTA. The problem with this is that market forecast NROE of 18% to 20% does not justify this price. Indeed, even with a lower RR of 12%, which may be justified given the quality of the business, I cannot see much value above $10. So I suspect that CWN will raise equity to fund its Bangaroo project in the coming year. At the current price it would be very cheap equity for the company to issue and very expensive for an investor to support.

(Earlier this year there had been more enthusiasm for Crown – It was reported as an ‘overweight’ in our Collected Wisdom column on July 10.)

Source: StocksInValue.com.au

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Growth Portfolio Statistics

Return since June 30, 2013: 11.00%

Returns since Inception (April 19, 2012): 30.55%

Average Yield: 6.21%

Start Value: $141,128.64

Current Value: $156,654.21

Dividends accrued since June 30, 2013: $2,375.74

Clime Growth Portfolio - Prices as at close on 1st October 2013 | ||||||

| Company | Code | Purchase Price | Market Price | FY14 (f) GU Yield | FY14 Value | Safety Margin |

| BHP Billiton | BHP | $31.37 | $35.49 | 4.91% | $38.82 | 9.38% |

| Commonwealth Bank | CBA | $69.18 | $71.35 | 7.59% | $68.69 | -3.73% |

| Westpac | WBC | $28.88 | $32.54 | 7.99% | $30.99 | -4.76% |

| Woolworths | WOW | $32.81 | $34.91 | 5.73% | $35.87 | 2.75% |

| The Reject Shop | TRS | $17.19 | $17.48 | 3.92% | $16.98 | -2.86% |

| Brickworks | BKW | $12.70 | $13.86 | 4.23% | $12.74 | -8.08% |

| McMillan Shakespeare | MMS | $16.18 | $11.51 | 6.08% | $12.47 | 8.34% |

| Mineral Resources | MIN | $8.25 | $11.04 | 8.54% | $13.41 | 21.47% |

| SMS Management & Technology Limited | SMX | $4.55 | $4.55 | 6.91% | $5.31 | 16.70% |