Spotting key sharemarket health signals

Summary: Despite the US Federal Reserve’s unprecedented flood of liquidity, price inflation has remained subdued. As more money was printed, less was used. But when interest rates rise, the circulation of money could accelerate and push up prices. An increase in inflation would reduce the real returns of shares and bonds – potentially causing the darkest investment decade in modern history. |

Key take-out: In the case of a substantial US correction, investor safeguards can include keeping bond maturity durations short and using a market timing system for shares. |

Key beneficiaries: General investors. Category: Economics and investment strategy. |

Critics of loose monetary policy as practised by the US Federal Reserve (and most central banks outside Europe) have argued for years that it will result in hyperinflation. Yet to date the main problem has been deflation as households, companies and governments have tightened their belts to pay off a debt hangover following the global financial crisis.

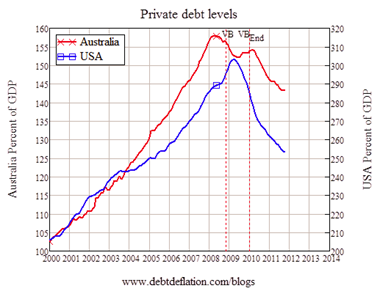

In both Australia and the US, for instance, private debt expressed as a ratio of GDP has been scaled back, but deleveraging has a lot further go before borrowing levels are sustainable. Note that private debt in the following chart covers both household and business debt.

Chart 1: Private debt levels in Australia and the US

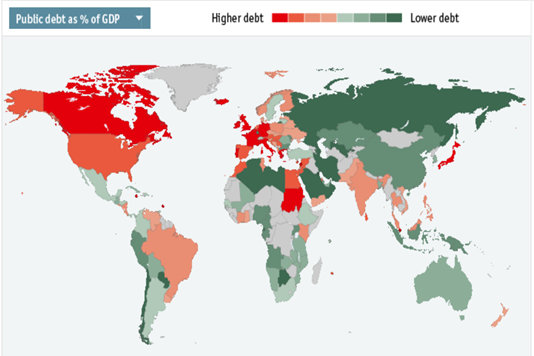

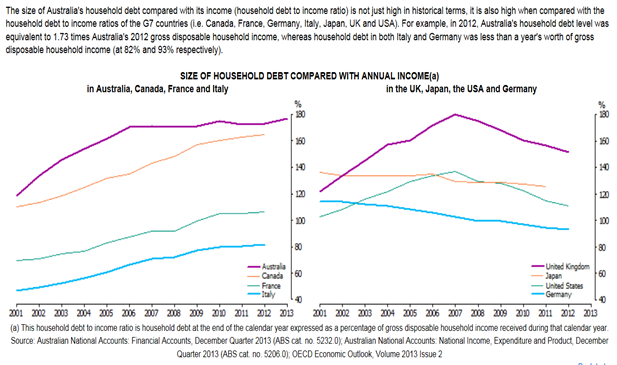

The next illustrations show that while government debt as a ratio of GDP is low in Australia compared with other developed countries, household debt as a proportion of annual income is higher here than in other countries and has resumed rising again due to a real estate boom in Sydney and Melbourne.

Chart 2: Government debt as a proportion of GDP

Source: The Economist

Chart 3: Household debt as a proportion of annual income

The reason the Australian government must fix its $50 billion annual deficit is that if there were another external financial shock it would need its triple-A credit rating to backstop Australia’s banks, which are exposed to the most indebted households in the world. Standard & Poor's has already warned that unless the federal budget is repaired, Australia’s high credit standing is imperilled.

We only escaped the last GFC because our home prices and jobs market held up. But with Australian homes now the most expensive in the world and the mining sector going into reverse gear, Australia, as Ross Garnaut said in a recent book, is facing its dog days.

But what of the global picture?

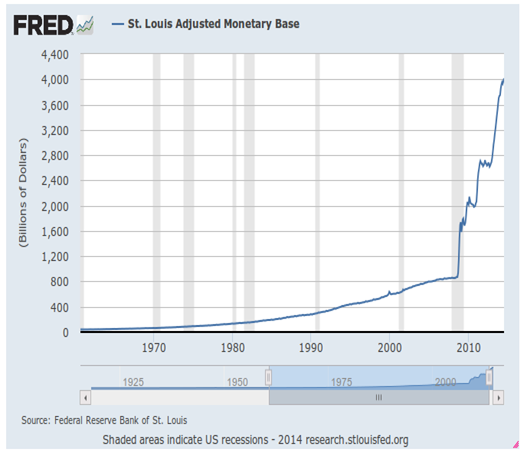

For the past five years the US Federal Reserve has expanded the monetary base on an unprecedented scale using “quantitative easing”, that is, creating money to buy government and bank bonds. Flooding a broke banking system and public sector with liquidity staved off a repeat of the 1930s Great Depression.

Chart 4: Adjusted monetary base, Federal Reserve Bank of St. Louis

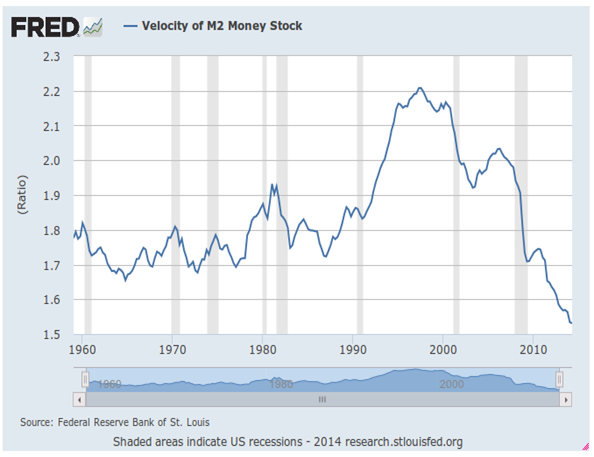

Contrary to the expectations of monetarists, price inflation has remained subdued, even in the absence of a depression. The next chart explains why – it shows the increased money supply was offset by a drop in the “velocity of circulation of money”. In other words as more money got printed, less was used.

Chart 5: Velocity of money stock

The Federal Reserve Bank of St. Louis has published a paper that explains why money has been stashed rather than circulated:

“And why then would people suddenly decide to hoard money instead of spend it? A possible answer lies in the combination of two issues:

- A glooming economy after the financial crisis

- The dramatic decrease in interest rates that has forced investors to readjust their portfolios toward liquid money and away from interest-bearing assets such as government bonds

“In this regard, the unconventional monetary policy has reinforced the recession by stimulating the private sector’s money demand through pursuing an excessively low interest rate policy (i.e., the zero-interest rate policy).”

If the paper is right then once interest rates begin increasing the circulation of money will accelerate and push up prices. That would see Main Street replace Wall Street as the main hub of activity.

If the Federal Reserve then tried to mop up the excess liquidity created since 2009 it could snuff out the economy. Yet the alternative would be to tolerate a spurt of inflation that could get out of control as idle cash became hot money.

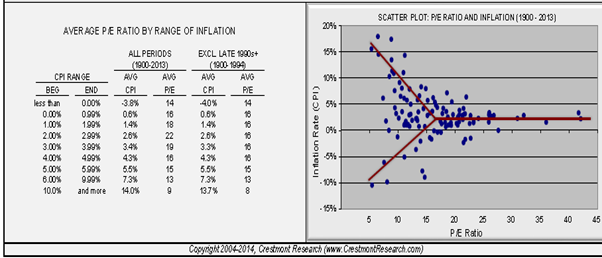

If the result was hyperinflation, gold and property prices would surge, but bonds and shares could crash. According to Cresmont Research, some inflation is good for shares, but excessive inflation has been associated with low price/earnings ratios, as the next charts illustrate.

Chart 6: Relationship between inflation and p/e ratio

Just as hyperinflation expunged Germany’s war debts after World War I, an inflationary outbreak would make it easier to pay off the massive private and public debt obligations holding back economic activity. But as with Germany, it would impoverish private pension funds loaded with fixed income securities.

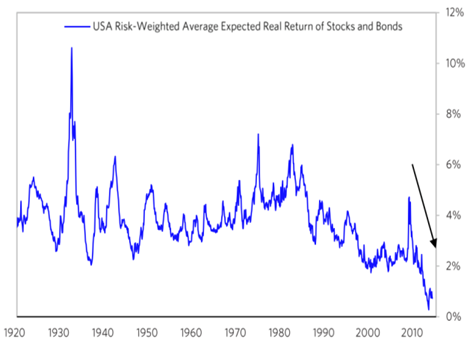

As long as central banks suppress interest rates by boosting money supply, the goldilocks environment for both shares and bonds should continue. But according to Bridgewater Associates, the largest hedge fund manager in the world, once the low interest cycle goes into reverse we will enter the darkest investment decade in modern history, with shares and bonds set to earn less than 1% a year in real terms (i.e. after inflation). See the next chart.

Chart 7: Expected real return of stocks and bonds

Source: Bridgewater Associates

Fortunately this prognosis is for the US (where share and bond markets have both been over-extended), not the rest of the world (where long-dated bonds are over-stretched but shares are not).

Nevertheless, if the US at some point undergoes the mother of all corrections, having a good market timing system for shares and keeping bond maturity durations short (or using CPI linked or floating rate bonds) is in my view the best safeguard against a Bridgewater scenario. That’s especially true in Australia, where economic prospects are dimming rather than brightening.

I have previously written about how to use a slow trend-trading system to provide a stop-loss for a share portfolio (see Not overstretched, but overshadowed). This is a conservative market timing strategy to help investors predict when the next market downturn may occur. That advice stands.

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.