Spin-offs: The secrets of success

Summary: The share prices of spun-off businesses have performed better on average than the benchmark and their parent companies, UBS research found. A split can help each division to focus more and to be more accountable to shareholders, and staff can find it more motivating to control their own destiny. Analysts are mixed on BHP Billiton's plans to spin off South32, with some pointing out BHP's strong history of demergers, and others questioning the timing, given weak commodity prices. |

Key take-out: One study found that on average, spin-offs beat the ASX200 index by 40.1% after two years. |

Key beneficiaries: General investors. Category: Shares. |

Demergers have performed strongly in Australia in the past, and another large spin-off is just around the corner. Mining giant BHP Billiton is preparing to separate its manganese, aluminium, silver, nickel and coal assets into a new vehicle, South32, which analysts are valuing at around $15 billion. BHP shareholders are set to receive one share in South32 for every share they hold in BHP.

As BHP shareholders wait for a listing date for South32 (some time after May), it's timely to consider the pattern of other demergers. Over the past two decades, not every case has been successful, but on average, investing in spun-off entities has been a significantly better choice than investing in their parent companies.

Past performance

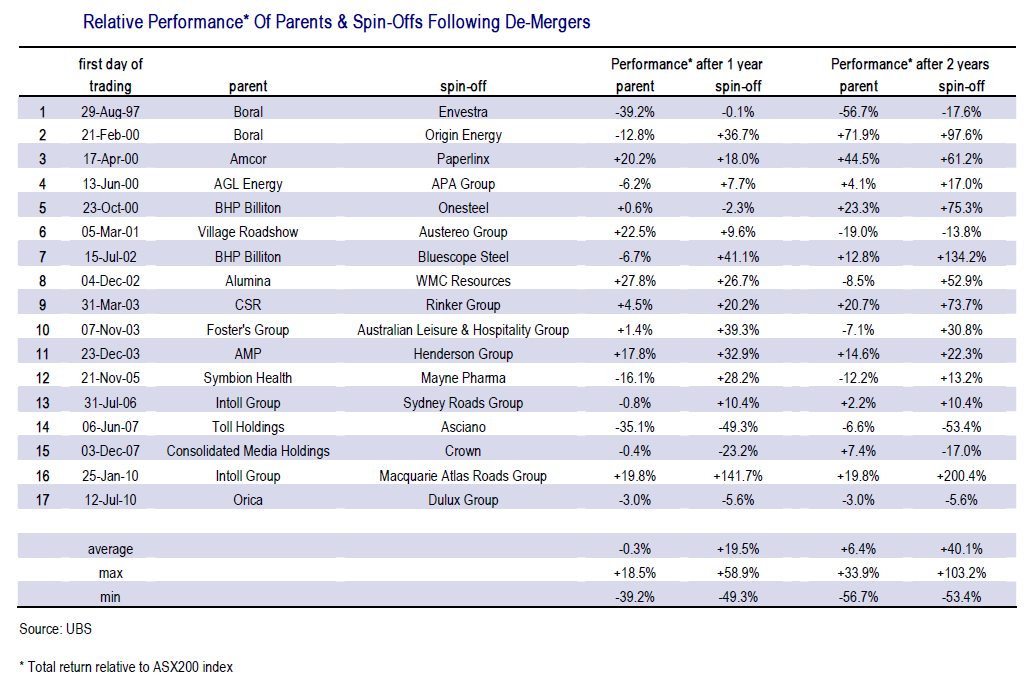

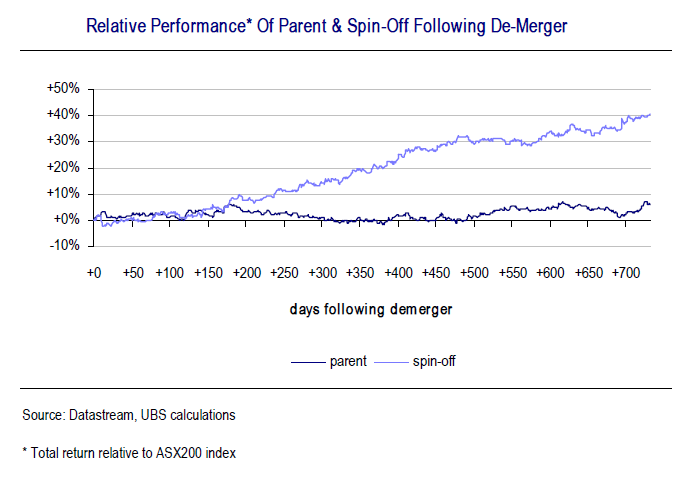

A study by UBS strategist David Cassidy in 2011 found that among the 17 significant demergers between 1997 and 2010, the demerged company or spin-off performed significantly better than the market over the following two years. The parent entity's performance didn't significantly differ from the market during the two years after the demerger, UBS found.

Among the 17 spin-offs, the average total return relative to the ASX200 index was 19.5% after one year and 40.1% after two years, the research found. But individual performance varied widely. Two years after being spun off from Toll Holdings, Asciano had underperformed the ASX200 index by 53.4%, worse than Toll's underperformance of 6.6% over the same period. At the other end of the spectrum, Macquarie Atlas Roads Group had beaten the market by 141.7% one year after being spun off from Intoll Group.

A further study headed by UBS analyst Vyas Balasubramanian in 2013 considered 26 demergers since 1997 and found slightly softer, but still impressive, results.

The average outperformance for this group of spun-off entities was 10.7% above the market return after one year.

UBS' research included two previous spin-offs from BHP Billiton, both of which performed strongly. Bluescope Steel returned 134.2% above the index over the two years from its 2002 listing, while Onesteel (now known as Arrium) beat the market by 75.3% over the two years since it listed in 2000. Investors will be hoping these previous results bode well for South32 – and will be mindful that Arrium's share price has slumped 87% over the past year in response to a falling iron ore price.

As for the parent companies, the average performance one year after the demerger was negative 0.3% compared to the benchmark, with an average return of 6.4% above the index after two years, Cassidy found. In Balasubramanian's sample, the parent companies outperformed the market by 2.2% after one year and 9.5% after two years.

Making spin-offs successful

Abi Cleland, a director of Orora, which was spun off from Amcor, and managing director of advisory firm Absolute Partners, says it can be more motivating for staff inside a spun-off business to control their own destiny.

Demergers work particularly well for smaller divisions that aren't seen as key to the future growth of the parent company, she says. “When that business is spun out, management is more visible, more motivated and more accountable. They've got direct reporting lines through to shareholders and the company gets a lot more attention – that can help you with recruitment as well.”

UBS' Cassidy explains that spinning off one part of a business can help both divisions – the new and the remaining – to enhance their focus, boosting efficiency and performance. A split can also mean that each division's performance can be more closely aligned to executive pay and shareholder return.

Michael Heffernan, senior private wealth adviser and economist at Phillip Capital, warns of the need to allocate skilled staff to the new entity before demerging. “You've got to do it properly,” he says. He agrees that allowing the different businesses to focus is key. “The entities can concentrate on their knitting, rather than trying to spread themselves over a wide range of activities.”

Packing up and leaving

The demerger of packaging businesses Amcor and Orora is a case in point. The split was announced in August 2013, too late for inclusion in either UBS study, but serves as an example of the revaluation that can occur after one business is spun off. Although both entities produce packaging, they use different technology to make different types of packaging with different uses.

Since listing on December 20, 2013, Orora's share price has soared more than 70% to trade at $2.07. The company is trading on a FY15 price-earnings ratio of 19.8 times, which some investors might view as expensive.

Orora's Cleland emphasises the importance of an appropriate balance sheet for the spun-off entity. Management should avoid apportioning too much debt to a spin-off, so that it has the opportunity to invest and grow in the future, says Cleland.

It's also key to ensure that the parent company invests appropriately in the spin-off before making the separation so that the new standalone company is not suffering from a lag in investment, she says. “There had been a lot of investment in the Orora business in the three to five years prior to demerging, so when it was split out, it had the investment and ability to take the growth opportunities that were there.” For example, Amcor had invested $500 million in a new recycled paper mill for the Orora business before the split.

Cleland also notes that the spin-off must be set up to succeed as a standalone organisation, with its own IT systems, HR systems and a capable management team.

“That's something investors can look for – has that company been invested in in an appropriate way in the last three years, does it have an appropriate balance sheet, and is the management team strong and capable?”

South32: Will history repeat?

South32, the much-anticipated $15 billion spin-off of BHP's non-core assets, had mixed beginnings. An initial decision to list only on the Australian and South African share markets was later amended to include a London listing and satisfy UK-based institutional investors. The separation is now expected to be complete by June, subject to a shareholder vote of approval set for May.

Although each demerger is different, BBY resources director Mike Harrowell points out that BHP has a compelling history of spin-offs. “There was Onesteel, now Arrium, and Bluescope. Both appeared to work well.” He says it's hard to know what the return on those assets would have been if they had remained in BHP. “But if you look at the share price performance of Bluescope, it performed really well outside of BHP due to strong steel prices. It's arguable that if it had stayed inside BHP, it would not have had the same recognition.

“Arrium is not doing so well now but it created value for shareholders by starting an export iron ore business which it never would have done under BHP.”

On the question of timing, Harrowell says that if a spun-out business is strong enough to withstand the down cycle, so it can be around to benefit in the up cycle, it will likely be successful.

But as the oil and iron ore prices continued to tumble, Royal Bank of Canada said in December that the South32 spin-off “could be a case of ‘good idea, bad timing'”.

“We like South32, so much so that we think BHP should hold those assets, or at least consider other options such as letting South32 shoulder the debt burden,” analysts headed by Chris Drew wrote. BHP should reassess whether the demerger should be delayed and whether some of the South32 assets could support BHP's earnings in the near term, according to Drew.

RBC said BHP could have handled the split as late as three to six months before their December publication. “In better times, this South32 spinoff seemed a good corporate clean-up or refocusing strategy. In more recent times, however, we have thought more along the lines of ‘How does this help BHP?'”

At Deutsche Bank, analysts headed by Paul Young do believe the separation will help BHP. The split will improve the parent company's returns and margins by around 5% and will improve production growth in percentage terms of its core portfolio, they say.

But for South32, they see limited opportunities for organic growth. “[We] believe South32 will need to go on the hunt for acquisitions, both operating assets and greenfield projects,” they wrote. “The two areas of upside appear to be cost out and mine life extensions.”

In response, incoming South32 chief executive Graham Kerr publicly downplayed suggestions the new company would be looking for acquisitions.

Some commentators are now pointing to signs that commodities are close to the bottom of their price cycle (see Power play, February 11, 2015). South32's prospectus is scheduled to be released in March, and shareholders will be keen to see more details as they appear. But if the history of demergers is any guide, resources investors could be in for some welcome good news.