Special report: Australia's electricity demand collapse

This is part 1 of a 2 part series. The 2nd part can be found here.

Electricity demand has been sinking for the better part of four years. Bitter cold or relentless heat, weather extremes appear unable to spur demand – peak or overall – back to where it was pre-GFC, or perhaps more aptly, pre-solar boom.

Yet we plough on accepting throwaway lines from executives and journalists that peak demand is a costly problem. It was.

And from forecasters we hear that all of a sudden overall demand is going to burst back to life. It won’t.

Analysing the six reasons why demand has gone down – according to industry players and the Australian Energy Market Operator – it’s clear those factors are only likely to further constrain demand, contrary to forecasts:

-- High power prices. This relates to the basic economic law of demand: as prices rise, demand will fall. Electricity isn’t perfectly elastic, as there is an element of necessity about much of its use. It does, however, have a discretionary element to it, which means demand can fall in response to prices.

While it is right to say high prices have helped bring demand down, this is unlikely to change as prices are heading higher in the next few years; although rises should at least moderate.

-- Solar PV. Rooftop solar has curbed demand and this will continue as more solar panels are installed across the country. The extent of the growth, however, isn’t close to being fully factored in.

Take last year’s release of AEMO’s Rooftop PV Information Paper as proof.

The forecaster predicted that through 2012-2018 there would be an average of 320 MW of solar installed annually across the NEM. In 2012 we had around 1 GW Australia-wide and 2013 is expected to see around 750 MW.

These figures admittedly take into account the Northern Territory and Western Australia, which the AEMO forecasts do not (as they are not part of the NEM). But after taking out Western Australia and the Northern Territory, installed solar for 2012-13 combined will be in the realm of 1.5 GW.

Given an average of 320 MW a year through 2018, AEMO expected 1.92 GW to be installed within the NEM in the six-year period. In the first two years around three-quarters of this figure will have already been installed.

For the forecast to prove accurate, solar demand will have to fall off an Everest-like cliff. Such a circumstance is improbable – despite state governments trying their utmost – leaving solar to exert more of a downward influence than currently anticipated.

-- Manufacturing weakness. It’s no secret that the Australian manufacturing sector has been struggling with several significant factory shutdowns in recent years. Right now, with strong global competition, high Australian wages and a robust currency, this is set to continue.

Indeed, there are a number of significant electricity users that are clinging to life – the energy guzzling aluminium smelters in particular. The dollar may collapse and manufacturing might spring back to life, but it would be a brave soul who would predict the latter. More likely that several key users will collapse rather than new entrants rise up or old players expand.

-- Cooler summers. Australians have just sweltered through our hottest summer on record, yet there was no peak demand record in the NEM. Crucially, in light of the extended hot spell, overall demand for summer in the NEM fell compared to last year.

In other words, the myth of cooler summers being the reason for weak demand – and particularly, softer peak demand – has been busted.

-- Energy efficiency. Energy efficiency is now a key part of the planning process for manufacturers and technology is improving all the time. Appliances are consequently becoming more energy efficient, while businesses and consumers are increasingly conscious of their electricity usage.

Such factors will serve to further reduce demand in the lead up to 2020, as will the build of new houses that have better insulation and more energy efficient features (solar hot water, insulation etc) than the old houses they replace.

-- Weakness in the economy. This is one of the key reasons forecasters expect electricity demand to hit new highs in a couple of years. Yet, by any measure, the Australian economy has been performing well – not boom times, but far from depressed.

We reaped 3.1 per cent growth in 2012 on the back of 2.3 per cent in 2011 and 2.7 per cent in 2010 and 2009. Even in 2008 we grew (0.3 per cent), and in 2007 it was an impressive 3.9 per cent.

Indeed, since electricity demand started falling, the economy has grown significantly.

If we are blaming economic growth for milder demand then what are we waiting for? Four per cent GDP? Five? Six? If so, we are chasing an unsustainable dream.

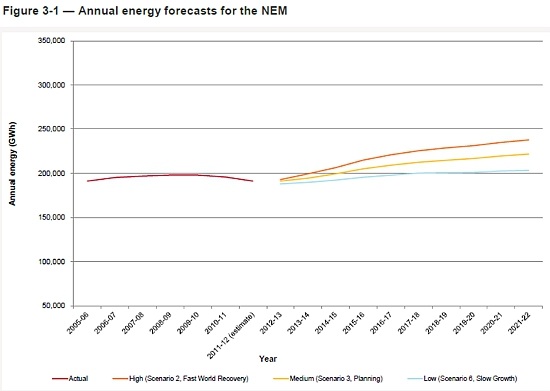

Incidentally, AEMO’s ‘medium growth – planning’ scenario (see: below) is based on 3 per cent annual GDP, which is very close to what we’ve experienced every year that demand has declined.

Everyone was behind in realising there was a trend and now we’re all behind in understanding that this trend isn’t going anywhere.

This is part one of an electricity demand special. Part two can be found here.