Sophisticated investing: Worth the plunge?

Summary: Sophisticated investor status gives individuals access to investments that retail investors are locked out of - and this involves forgoing access to the usual product disclosure statements. |

Key take out: It's difficult to know exactly what protections you are giving up if a sophisticated investment goes wrong, because the regulations are complex - so consider the risks before diving in. |

Key beneficiaries: General investors. Category: Investment strategy. |

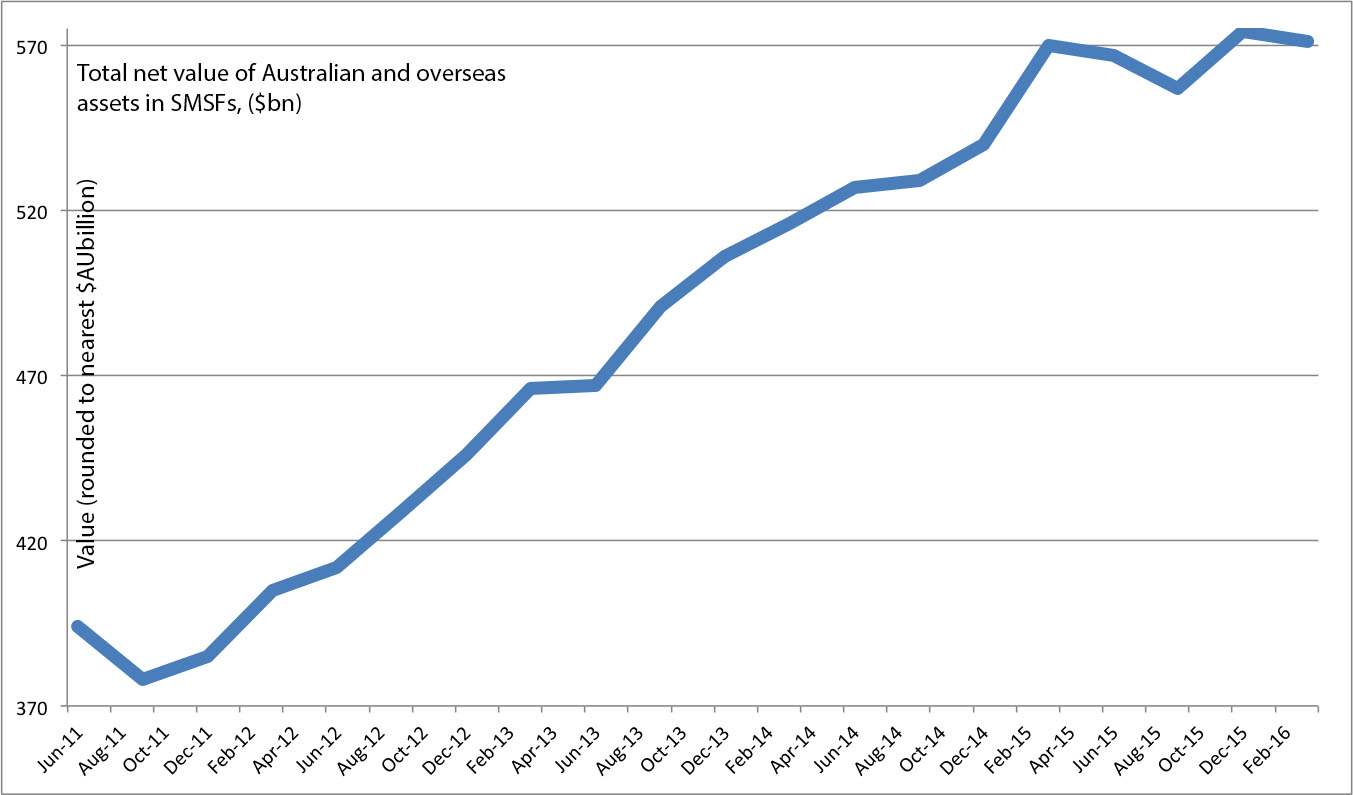

It's a new financial year and everyone is getting used to the idea that major gains are harder to come by. The ASX200 finished FY16 down 4 per cent, and the value of SMSF assets is also bouncing around. Even as the total number of SMSF holders increases, the performance of our local market over the past 12 months has seen the value of DIY fund holdings go up and down quarter to quarter, and the growth is slowing.

Net value of Australian and overseas SMSF assets, $billion

Source: ATO, Eureka Report

So is now the time to start chasing investments that others are locked out of? There are wins to be had, but if your accountant or broker has contacted you suggesting you are eligible to act as a “sophisticated investor”, you'd better have the risks in mind.

What are the requirements for becoming a sophisticated investor

In order to qualify, individuals require a certificate issued by a qualified accountant stating the following:

- They have a gross income of $250,000 or more in the previous two years, or

- Net assets exceeding $2.5 million.

The certificate is valid for two years from the date of issue.

The idea behind the framework is that those with this level of income are more likely to be able to evaluate securities and other assets on offer without the assistance of the relevant prospectus or product disclosure statement (you can read more on this through ASIC, click here).

How these above rules apply to SMSFs was a grey area until August 2014, when ASIC clarified that, provided an accountant creates a certificate, an SMSF with assets in excess of $2.5m can act with “sophisticated” status.

Potential wins

The benefits, obviously, are that wholesale investors have access to opportunities retail investors do not, including pre-IPO offers, share placements, seed capital raisings and other types of unlisted companies. These are assets usually only available to professional investors, so a wholesale certificate is your ticket to play.

The risks

That ticket means you are electing to invest without the scaffolding of product disclosure statements. It's not even a given that investments in this class will outperform, or match, those available to retail investors. For example, there were 3000-odd sophisticated investors who bought in to music streaming platform Guvera in preparation for listing on our local exchange. Many of these investors were DIY fund trustees. The ASX later blocked the company from listing at all.

Then there's the following assumption that is built into the regulatory framework:

“The rationale is that people meeting one of these criteria are more likely to be able to evaluate offers of securities and some financial products (such as interests in managed investment schemes) without needing the protections of a regulated disclosure document,” the ASIC framework says.

For a certificate to be issued, nobody has to check if the above is true. It's only required that individuals meet the asset and income tests – not that they necessarily have any more expertise than other investors. There's no test for the level of investing experience.

“Dispute resolution processes [for sophisticated investments are] not needed to be provided as would the case be for a retail client,” says Chloe Ward, SMSF manager at Superfund Partners. “We are finding clients that would easily fall into the sophisticated category still value the need to for external professional advice and are not shying away from that aspect."

What happens if an investment made with sophisticated status goes seriously wrong?

It's a tricky one to answer – experts, financial planners and advisors we asked were reluctant to talk in any solid terms about what rights you are really trading off, because it's such a legally complex area, and one that is reviewed on a case-by-case basis.

In the most simple terms, if you are using a certificate to invest, there is a good chance you'll have little recourse if things go awry – after all, you have agreed to forgo the disclosure paperwork in the first place.

Consensus from the experts we have spoke to is that it's very difficult to know exactly what you might lose.

Given the murky regulatory waters, consider how a potential 'sophisticated' investment would likely benefit your portfolio in the long term. Ask these questions:

Can you afford to lose the capital you are putting up – all of it?

Is a broker, property developer or investment spruiker strongly encouraging you to get involved in an investment with 'sophisticated' status? Be wary of anyone trying to pressure you into getting a certificate.

Do you have experience with the asset class on offer? Is it something that you would choose if available to retail-only clients?

Do you have a financial advisor to run a second set of eyes over the opportunity?