Solar's 100GW king-hit

A few days ago one of the leading global market analysts for solar photovoltaic, NPD Solarbuzz released its 2014 outlook for the global solar PV market. It projected the market could hit a major milestone in 2018 – 100 gigawatts of annual sales and 500 GW of accumulative installed capacity.

If this were to come true it would mean solar PV would be by far the largest source of newly installed power generating capacity across the globe, above gas and coal.

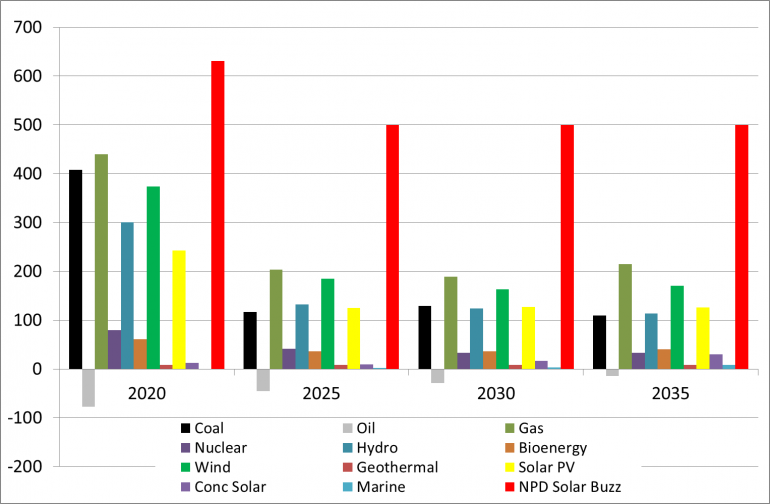

To appreciate just how significant it would be if this forecast were to come to pass, below is a chart illustrating additions of new power generation capacity by fuel from 2011-2020 and then each subsequent five-year period, according to the International Energy Agency. This is then compared to NPD Solarbuzz’s forecast for solar PV in the red bar. However, I’ve assumed in the red bar that solar PV hits 500 GW cumulative capacity by 2018 relative to 69 GW in 2011 (as per the Solarbuzz forecast) and then growth in sales abruptly stops and remains at 100 GW per annum.

Additions of new power generating capacity by fuel – NPD SolarBuzz solar PV forecast (in red) vs IEA

Sources: International Energy Agency (2013) World Energy Outlook - New Policies Scenario; modified version of NPD Solarbuzz (2014) Marketbuzz 2014 forecast.

As you can see, the red bar representing solar PV installations towers above all other fuel types. Also, note how much higher it is relative to the yellow bar, which is the IEA’s forecast of solar PV uptake.

So who’s right – the International Energy Agency or some outfit called NPD Solarbuzz?

In the end there’s a good chance they both could be wrong, because energy forecasting has a track record that makes astrologers look good.

Still, we already know that the IEA’s forecast released just a few months ago for solar PV additions to 2020 has a good chance of being an underestimate. Most solar PV analysts, not just NPD Solarbuzz, expect that around 45 GW of solar will be installed just this year. Even if solar simply flatlined at this level (yet year-on-year growth of 20 per cent-plus has been the norm) we’d achieve the IEA’s forecast for solar PV three years early.

In addition, the IEA’s track record of forecasting solar PV uptake has been far worse than NPD Solarbuzz. That’s not to say NPD Solarbuzz are perfect, for example they are quite poor at understanding what’s happening in the Australian market. But they go through a far more thorough assessment of what each major solar PV manufacturer is planning, as well as interviewing a range of major solar retailers.

The IEA takes a more abstract approach detached from what the market participants are doing, which means their pricing data is often out of date. This leads to forecasts which tend to be tied to the past and systemically and grossly underestimate growth of solar PV.

Nonetheless, solar PV’s growth is highly vulnerable to government policy change, at least in the short term. This creates risks that solar PV sales fall well short of 100 GW in 2018. Japan and China came to the rescue in 2013 and also this year, while Europe has slumped. Yet the Japanese market’s sudden rise was the product of generous policy support from a progressive government responding to a nuclear meltdown. That government has now been replaced by a highly conservative one that is keen on restarting nuclear power stations.

Still, the cost reductions being achieved by solar manufacturers mean the technology’s sales are less sensitive to government policy support. NPD Solarbuzz expects average solar module prices of $US510 per kilowatt. While you can then add a lot more cost for a fully-installed system, it is approaching the ballpark of conventional power plants. For example, the cost of a gas-fired turbine is about $US700 to $US900 per kilowatt, fully-installed.

I wouldn’t be betting my house just yet on solar PV taking over the power sector. But I’d be getting pretty worried if my life savings were heavily invested in the thermal coal business.