Solar sceptics proved wrong by revival

For the past year and a half we’ve been talking about the red ink spilling from solar PV module manufacturers. The industry has suffered from a huge overhang of excess supply with solar module prices plummeting to levels where just about every producer was losing money. None other than market leaders Q Cells and Suntech even fell into financial troubles.

It now appears the industry is starting to turn the corner back to profitability.

And the recovery is proving the solar sceptics wrong.

Over 2012 solar module prices reached such incredibly low levels that even the sceptics couldn’t ignore its potential. But the sceptics reassured themselves that these prices were a temporary phenomenon. Manufacturers were losing money at these prices, so there would have to be a closure of plants which would then lead to a sharp rise back up in module prices. We’d then see solar PV put back in its box as an expensive green trinket.

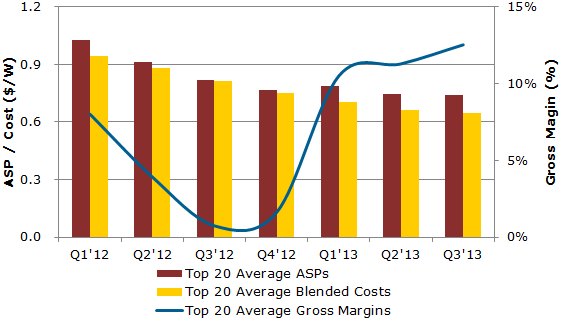

NPD Solarbuzz have been one of the leading solar industry analysts, closely tracking producers' performance for many years now. Every quarter they put out the results of a module tracker survey which assesses solar producers’ costs and average selling prices. The chart below illustrates their results over the 2012 and 2013 quarters to date.

The red bar illustrates the average of the prices the top 20 producers have sold their modules for per watt, while the yellow represents their average costs, with the blue line illustrating gross margins. As you can see margins became razor thin in the last two quarters of 2012. While they were recovering cash costs, manufacturers wouldn’t have been recovering anything to cover the cost of all their investment in capital equipment. In the first quarter of 2013 prices did rise. But then the next quarter they dropped down to record low levels of $US0.75 per watt and then $US0.74 this quarter.

Average selling prices, blended costs, and gross margins of top 20 solar PV module suppliers ($US)

Source: NPD Solarbuzz Module Tracker Quarterly

What appears to have driven the recovery in margins is not a rapid rise in module prices, but in fact continued reductions in production costs, contrary to solar sceptics' predictions.

For the leading tier 1 Chinese producers production costs are actually markedly lower at an average of 63 cents per watt, with Jinko Solar the cost-leader at $US0.50/watt. Yingli Green has also recently reported that its total production cost sits at $US0.55/W. There is now an expectation that 20 per cent gross margins will be achieved soon for Chinese producers, which should ensure a sustainable industry.

In addition US company First Solar announced it achieved its largest quarterly decline in its module cost per-watt since 2007, reducing it from $US0.67c last quarter to $US0.59 in the third quarter. What’s more they point out that their best production line is achieving costs close to $US0.49/watt.

It looks like after stalling last year, the industry is already back on track to rapid growth in sales. Bloomberg expect the global solar PV market to expand by 40 per cent this year. NPD Solarbuzz expects that nine of the top 10 solar PV module suppliers will achieve quarterly shipment growth, with six set to claim all-time shipment records.

SunPower is reported to be running all of its current manufacturing plants at full capacity and has announced it will build a new 350MW factory in the Philippines, boosting its production capacity by a further 25 per cent by 2015.

So as we emerge out of the solar producers' red ink bloodbath of 2012, it appears the global solar PV juggernaut of dropping costs and rising sales still has some way to run.