Soft income growth will squeeze the housing market

House prices continued to rise during the September quarter but the pace of growth has slowed considerably in each capital besides Sydney. The unusual combination of elevated housing multiples and poor income growth leave the property market on an unsustainable footing. In the long term, income growth must rise or property prices will inevitably ease.

According to the ABS, nominal house prices rose by 1.5 per cent in the September quarter, moderating somewhat over the past nine months, to be 9.1 per cent higher over the year. Low interest rates continue to support activity in the housing market -- encouraging existing home owners and investors to bring forward their purchases -- although there is mounting concerns that the market has become imbalanced.

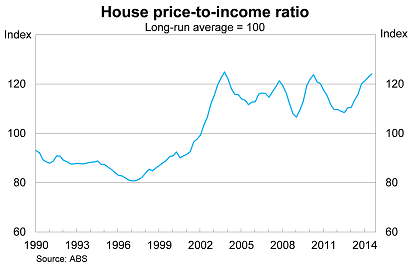

Housing multiples, which are a reasonable proxy measure for affordability, show that housing is expensive by historical standards. The house price-to-income ratio is slightly below its peak and at a level that has, during previous episodes, resulted in prices falling sharply.

With the unemployment rate rising to its highest level in twelve years and wage growth subdued, it seems unlikely that the housing market can maintain its momentum for much longer.

Furthermore, it remains somewhat surprising (even with historically low rates) that households are willing to tolerate housing multiples that first occurred during the midst of a once-in-a-lifetime terms-of-trade boom.

The truth is that in most cities, home owners and investors are not willing to tolerate those multiples. Growth has been highly concentrated in Sydney and to a lesser extent Melbourne, although at this stage conditions appear to be easing in Melbourne.

Prices in Sydney rose by 2.7 per cent in the September quarter -- the sixth consecutive quarter with over 2 per cent growth -- to be 14.6 per cent higher over the year. By comparison, prices in Melbourne, Brisbane and Adelaide rose by 1 per cent and the pace of growth has clearly eased over the past nine months.

Annual growth is now under 7 per cent in Melbourne and Brisbane and below 4 per cent in Perth. The market has subtly shifted from being merely Sydney-centric to being almost entirely dominated by speculation in the harbour city.

Residential construction is starting to pick up, which should ease the supply glut to some extent. But in the medium to long term, house prices will be determined by income growth.

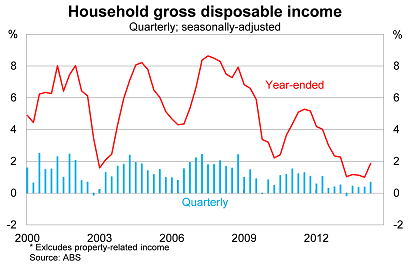

There's good reason to be pessimistic in that regard. Nominal household gross disposable income, As measured by the national accounts, rose by just 1.8 per cent over the year to the June quarter. Growth has slowed considerably over the past five years, albeit with pockets of strength.

With the terms of trade falling sharply, household income will remain subdued for the foreseeable future. As the dollar eases, the purchasing power of Australian incomes will decline and more resources will be directed towards maintaining a specific standard of living rather than investing and bidding up property prices.

That process has already begun and can be more easily recognised through real house price measures. After adjusting for inflation, property prices in several cities remain below their prior peak and have experienced several years of poor growth. That's not true of Sydney of course, where prices are above their peak, although Sydney had a particularly poor run after their 2004 boom ended.

The past decade shows that housing downturns are now a fairly frequent event. We have had three such episodes over the past decade, which compares unfavourably with the property-owning experience during the 1990s and early 2000s.

Homeowners and property investors should be aware of softer income growth and more volatile property prices. Buying a house is often the biggest investment any household will make and it shouldn't be made lightly. High levels of existing debt make such purchases increasingly risky, particularly if you get the timing wrong.

Those buying in Sydney right now have almost certainly missed the boat. Even if prices continue to rise rapidly, our financial regulators are likely to intervene before you have the opportunity to reap a rich capital return.

The tax benefits of housing investment remain in place and are obviously appealing to many Australians. But are such investments worthwhile if medium-term capital gains are in doubt and rental yields so poor?