SMSF property investors: Rate cut winners

Summary: The real winners of falling interest rates are SMSFs with a variable rate LRBA and an offset account. Offset accounts are the most powerful savings accounts because they switch the equation from “earning” money at a low rate that is taxed to “saving” money at a higher rate that is untaxed. As interest rates fall, the benefit for SMSFs of an offset account attached to an LRBA is increasing. |

Key take-out: The after-tax returns gained from an offset account are on average more than twice as good as earning interest. |

Key beneficiaries: SMSF trustees and superannuation accountholders. Category: Superannuation. |

More than one million SMSF members will have winced a little when news of the recent rate cut came through.

SMSFs are huge holders of pure cash. Something north of $150 billion of the stuff is held by SMSFs. Based on interest rates being cut by 0.25 per cent, our collective income just fell by a before-tax amount of more than $375 million a year.

But it wasn't bad news for all SMSF members. There were some direct winners from the rate cut.

“Anyone with a SMSF property loan, of course!” I hear you cry.

Well, yes. If you have a SMSF variable rate home loan, then your interest bill will have reduced yesterday, sure.

But there is a smaller subset of those SMSFs with limited recourse borrowing arrangement (LRBA) loans, who have even more reason to smile.

The real winners of falling rates are: SMSFs, with a variable rate LRBA, and an offset account.

And there aren't many of them. If I had to guess (and it is a rough estimate), I would estimate that it would be fewer than 10,000-20,000 members.

The reason is that a very small number of super funds with LRBAs have one of only a very small number of products (I only know of two High St lender products) that offer a full offset account on their loans.

Offset accounts are the most powerful savings accounts on the planet. Usually by a factor of 100 per cent (see below table for proof) over regular interest-bearing accounts.

And, interestingly, the more interest rates fall, the better the relative return offered by offset accounts.

Why? Simply because they switch the equation from “earning” money at a low rate that is taxed, to “saving” money at a higher rate that is untaxed.

For those of you unfamiliar with offset accounts, here's how they work.

Let's say you have a property loan of $500,000 at 6 per cent. On top of that, you have $100,000 in savings.

If you have the savings in a separate account earning interest, you might earn 3 per cent. If you earn 3 per cent in a super fund, you will pay $450 in income tax (15 per cent), allowing you to keep $2550 in the hand.

However, if you have that $100,000 in an offset account, you will save yourself $6000 a year in interest. And when you “save” money, rather than “earn” it, you don't have to pay tax. You get to keep the whole $6000.

Save and keep $6000, or earn and keep $2550?

It's a no-brainer. And, as you'll see from the table below, the better earnings from offset accounts, even in super where tax rates are lower, get increasingly better the more interest rates fall.

(Note, offset accounts in personal names, where marginal tax rates are up to 49%, are even better, in an exponential fashion.)

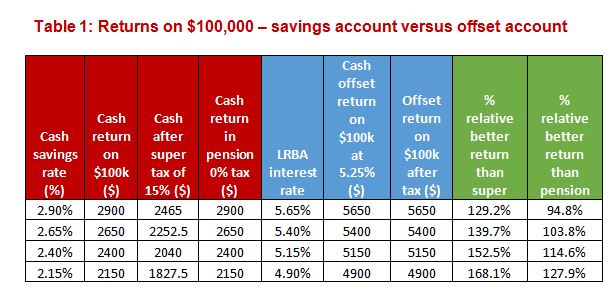

In the below table, I use interest rates that are a little closer to what SMSFs might be charged in interest on LRBAs and what they could, potentially, earn from cash and TDs.

In the above, the red section is the cash returns for interest rates earned on $100,000 in both super and pension.

The blue section is the effective return of your $100,000 cash sitting in an offset account. The green section is the comparison between the net super returns versus offset, and net pension returns versus offset. (Negatively geared property in pension has less value, but we'll assume, for the purposes of this example, a property that is roughly neutrally geared.)

I have tried to use interest rate figures that could be achieved prior to the recent interest rate cuts. That is, if you worked for it, you could get somewhere near 2.9 per cent on your savings. And if you had an LRBA with a major lender, 5.65 per cent as a variable rate, is about where interest rates are at.

What can you see from the above?

If you're a SMSF who wants/needs to hold cash, then the relative benefit you are getting, as interest rates are falling, from having an offset account attached to your LRBA loan is actually increasing.

The after-tax returns gained from an offset account are, as above, on average, well more than twice as good as actually earning interest (then paying tax on it). Currently, versus super cash returns, an offset account is 129 per cent better.

All super funds need to hold cash. And if you do, and you intend to hold a geared property, then the value of having an offset account is, on average, at least twice as good as not having an offset account and earning interest on your savings.

What I have ignored in this example – hey, I can't use too many variables to make a point – is that many people would have, and have had, the opinion that why would you hold any money in cash, if your rate of return is going to be below 4 per cent or 3 per cent?

Returns in the share market, even given the risk of negative returns, had to have been worth taking, didn't they? The answer there was, in hindsight, a clear yes. That has been a very, very worthwhile risk to take in the last three years. But if you weren't sold on equity returns, the great thing about cash is that the returns are far more predictable. And so are the after-tax returns.

And property returns?

Direct residential property has been on a canter for the last 2-3 years. And anyone aboard that train has done well, enjoying double digit returns, if invested in quality property in the right cities. (And if you haven't been sucked into property spruiker seminars selling rubbish development property.)

So, those SMSFs who have been geared into quality property assets in recent years have done well, with returns well into the double digits.

But those who have had great property and have also had an offset account attached to their mortgage … well, they'll continue to laugh if interest rates continue to fall.

Looking at minimum pension rates

In other news…

“Rock bottom interest rates are decimating super pensioners' income and the government must slash minimum pension rates to stop them starving to death in the next few years.”

I've paraphrased a bit. But this is essentially what the SMSF Owners' Alliance (usually such a sensible group of people) are claiming the drop in income from interest rates will do. They want to see drastic measures introduced to save super pensioners having to dig into their super.

They have likened the gentle reduction in interest rates – granted, to record lows – to what happened during the GFC.

“At the time of the GFC, recognising the effects of low interest rates on the income of retired people, the Government halved the minimum pension that must be withdrawn each year from 4 per cent to 2 per cent of the value of assets in their account,” the SMSFOA release actually said.

“It is now time for the Government to again consider reducing the minimum pension rate.”

Oh, puh-lease! Seriously? That's one of the worst arguments ever!

Yes, the pension rates were halved, for a period, after the GFC hit. It had nothing to do with official interest rates being cut from 7.25 per cent in September 2008 to 3 per cent in April 2009.

The income on your $100 dropped from $7.25 a year to $3. But your $100 was still worth $100.

It actually had everything to do with the global stockmarket and property market collapse. The Australian share market dropped 55 per cent. Listed property markets dropped 75 per cent.

Your $100 in Australian shares slumped to $45. If you had $100 in listed property trusts (now known as A-REITs), it was now worth $25.

It was terrifying. For everyone. Emergency action from Governments was justified. That is why there was a cut to the minimum pension requirements.

But saying that a drop in interest rates to an official rate of 2 per cent requires the same treatment …

… when stock markets have stacked on about 65 per cent, including dividends, in the last three years?

No, sorry, that's just being silly. It's not the same as the GFC. It's not even close. Pull your heads in.

The information contained in this column should be treated as general advice only. It has not taken anyone's specific circumstances into account. If you are considering a strategy such as those mentioned here, you are strongly advised to consult your adviser/s, as some of the strategies used in these columns are extremely complex and require high-level technical compliance.

Bruce Brammall is a licensed financial adviser and mortgage broker, and is managing director of Bruce Brammall Financial. E: bruce@brucebrammallfinancial.com.au. Bruce's new book, Mortgages Made Easy, is available now.

- Several industry players have welcomed the Federal Budget's lack of changes to superannuation.

The SMSF Association said that the lack of tinkering with the superannuation system increased stability for SMSF members.

The Financial Services Council said the government had made a “prudent” decision in keeping changes to super out of the Budget cycle and placing them in the broader policy agenda.

But Pitcher Partners director Brad Twentyman warned that after the government's tax review is completed, the government was likely to announce changes to super tax concessions.

“There were no significant changes announced in the budget, which does provide people with some short term certainty. There are changes on the horizon but in our view we're unlikely to see any changes prior to the next federal election,” Twentyman said.