SMSF investors load up on mortgage debt

Summary: Concerns about SMSF borrowing for property purchases are being raised as Australian funds' property holdings are growing against a backdrop of falling share prices and market volatility. In the September quarter SMSF property holdings were worth $94.7 billion, up from $82.7 billion in September 2014. SMSFs had $18bn in limited recourse borrowing arrangements (LRBAs) at September 2015, or 3.1 per cent of all SMSF holdings. |

Key take out: The federal government has tasked the ATO and Council of Financial Regulators to monitor the levels at which SMSFs are leveraged. At this stage, lending for property is set to continue. |

Key beneficiaries: SMSF trustees and superannuation accountholders. Category: Superannuation. |

The clampdown on property lending to DIY funds has the potential to hamper not just SMSF activity, it may also undermine the wider success of the DIY sector. A close look at the ATO figures for DIY activity shows that SMSF property holdings is one of the few areas of growth against the backdrop of sliding share market valuations and low cash rates.

The amount of property held by SMSFs is on the increase, even as the overall value of assets in funds has been hit by this recent bout of share market volatility. While the value of assets held by Australian SMSFs decreased in the September 2015 quarter, the ATO estimates property was worth $94.7 billion, compared with $93.8bn in the June quarter and $82.7bn one year prior.

The total value of Australian and overseas assets, meanwhile, fell from $594bn in the June quarter to $576bn in September. Listed shares in SMSFs went from $183.2bn in June 2015 to $167bn in September.

There are a number of stakeholders involved in the discussion on property in SMSFs. On the account holders' side, investors want clarity around how they are allowed to buy property, and have often chosen the SMSF path because it allows them to invest in assets that have a strong appeal.

The banks and financial regulators are more cautious – as the amount that SMSFs borrow to buy property increases, so too do concerns about the amount of debt held in funds, the rise of property spruikers preying on those close to retirement, and the levels of risk involved in individuals pouring retirement savings into non liquid assets.

It's worth looking at both the amounts of property held in SMSFs over the last five years, and the overall levels at which the funds are leveraged, to consider the context in which concerns about borrowing are being raised.

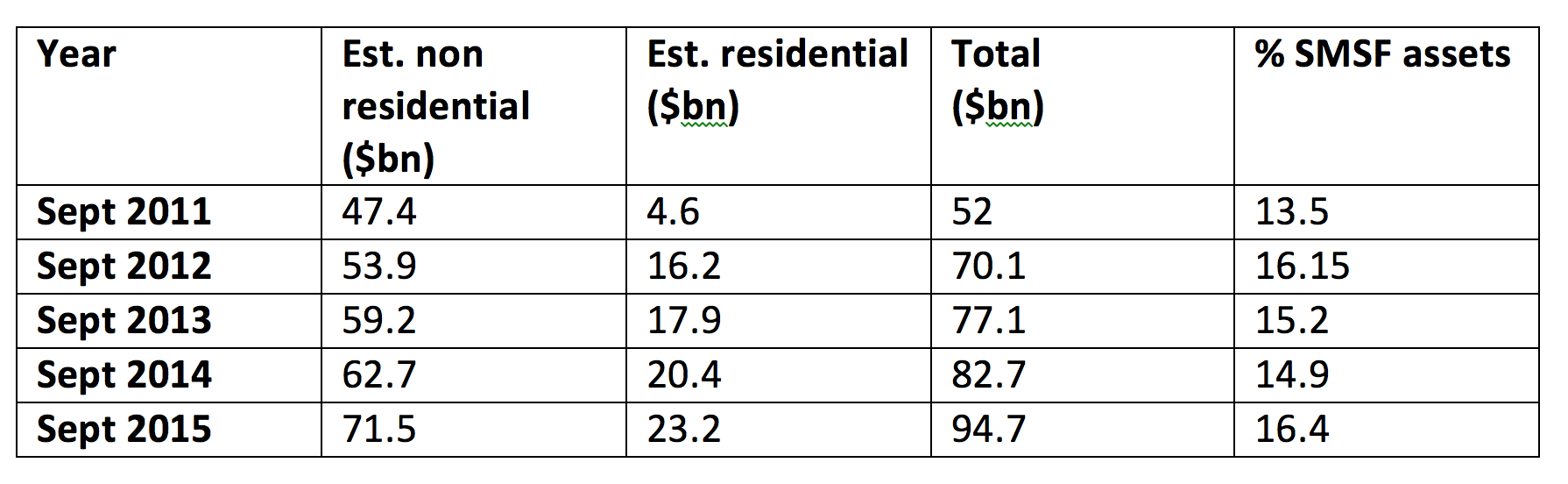

Here are ATO estimates for the amount held in property since 2011:

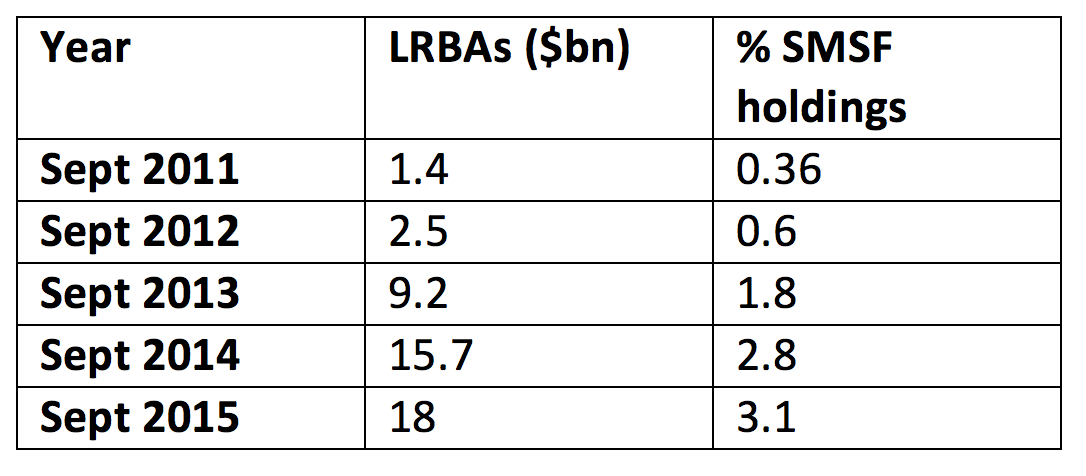

This is the amount in limited recourse borrowing arrangements (LRBAs):

LRBAs in SMSF accounts since 2011 (ATO estimates)

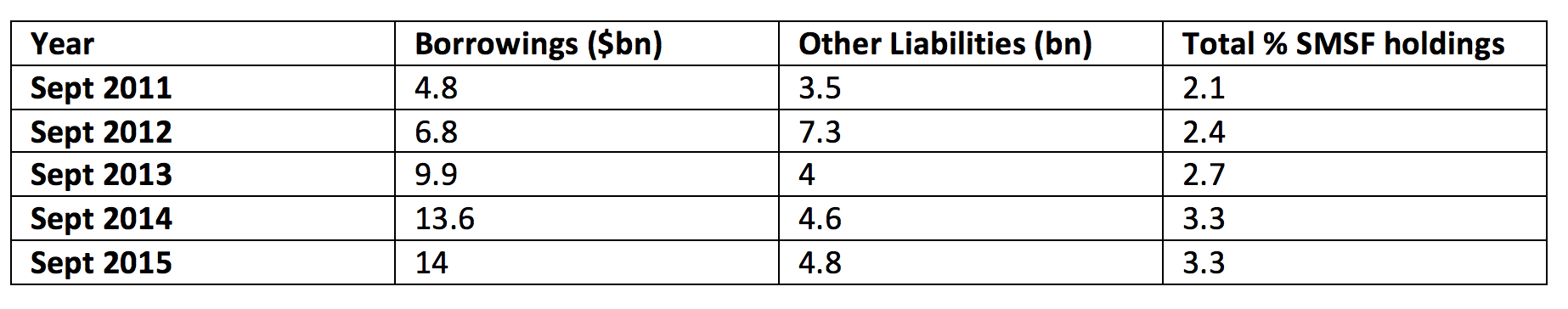

Liabilities – since 2011 (ATO estimates)

SMSF Owners' Alliance Executive Director Duncan Fairweather says that it's difficult to know why any individual decides to structure their SMSF investments in a particular way, but that property has always been attractive no matter broader share market conditions.

“It's possible SMSF holders simply continue to see property as a stable investment in the long run, one that allows you to build the assets in your fund – in particular for the reliable yields from commercial property,” he said.

The future of LRBAs

The use of limited recourse borrowing arrangements, in which trustees take out loans from a third party to buy an asset, were the subject of much debate in 2015 when David Murray's Financial System Inquiry recommended this lending be prohibited.

As Bruce Brammall explains elsewhere (see DIY fund property investing gets a body blow), this was the only FSI recommendation rejected by the government. They responded that there was not sufficient data at the time to warrant intervention in these lending arrangements.

The Council of Financial Regulators and the ATO are now tasked with "monitoring" the levels at which SMSFs are leveraged, with the goal of reporting back to government in three years (October 2018).