Slashing the RET to ... improve policy certainty?

The government authority who writes the rules for Australia’s energy markets has told the government that the current Renewable Energy Target can not be met and should be watered down.

The submission from the Australian Energy Market Commission recommends that the government either:

1. Change the large-scale Renewable Energy Target from a fixed amount of gigawatt-hours of electricity (currently 41,000 GWh) to a substantially reduced target based on a meeting 20 per cent of electricity demand; or

2. Transition the RET into a type of carbon trading scheme similar to the NSW Greenhouse Gas Abatement Scheme, where generators below an emissions intensity benchmark earn credits which generators above the benchmark have to acquire to make good their emissions exceedance.

According to the AEMC, option two would be worthwhile because it believes it would achieve an emissions reduction target at lower cost (because of a broader range of technology options). This is most likely true.

Although, wasn’t this why we had put in place a carbon price that was not just covering the electricity sector but a range of other major sources of emissions? (I wonder why the AEMC didn’t make a submission to the government on this particular issue when they put forward the legislation for repeal of the carbon price?)

Let’s chop and change policy to 'contribute to policy certainty'

However, what is perhaps most interesting is that the AEMC believe that abruptly ending the RET (on top of the emissions cap and trade scheme) and replacing it with its emissions intensity scheme will “contribute to the policy certainty that is necessary to provide industry with confidence to continue to invest in the energy sector”.

OK, so let me get this straight.

The government has just axed the already operational carbon emissions cap and trade scheme that was developed via an extensive process of consultation since 2005, and which everyone had geared up to manage and incorporate into their investment decision making.

Then you proceed to also abruptly change another major emissions reduction policy, in the RET, involving billions of dollars in investment that was official government policy since 2007.

Then you’ll commence designing a completely different mechanism which is acknowledged to be second-best to a broad based emissions cap and trade scheme with international linkages. At the same time such a scheme is, in reality, another type of emissions trading scheme and so is likely to be vehemently opposed by the guys in the Liberal-National Party who put Tony Abbott into the leadership.

Yep, I’m guessing such a move would be great for policy certainty and improving confidence in investing in the energy sector.

And it will also be great for keeping the cost of abatement low, too, because it’s not like this will scare off investors from ever risking a brass razoo on an emissions reduction credit market.

AEMC modelling projects major shortfalls, even if target is dramatically cut

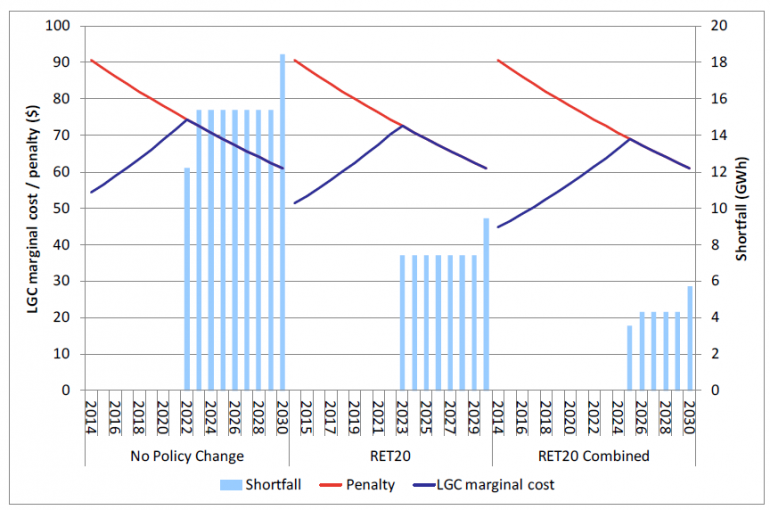

Still, there is the issue of whether the current level of the RET can be practically met. The AEMC suggests it can’t, based on modelling it commissioned by Frontier Economics. This looks at several scenarios:

– No policy change so LRET maintained at 41,000 gigawatt hours;

– RET20: a revised LRET of around 30,000 GWh which it figures would be 20 per cent of demand in 2020, no change to SRES;

– RET combined: reduce the LRET to 23,000GWh after taking into account the contribution from the SRES.

The chart below illustrates rather strangely that under all scenarios, even the one where the LRET target is almost cut in half, that we’d end up falling short of the target and the price required for a renewable energy certificate, or LGC, in order to make a wind farm viable would exceed the inflation adjusted price cap (this is about $93 nominal).

Projected price of LGCs and expected shortfall in renewable energy supply to meet target scenario

Source: Australian Energy Market Commission (2014)

Unfortunately, when Climate Spectator requested a copy of the underlying modelling report to better understand the basis for its findings, the government authority refused to provide it.

So in its absence we’re left with some major unanswered questions.

Now, it is not all that unusual that the AEMC modelling found that renewable certificate, or LGC, supply would fall short for the existing target, but the size of the shortfall is highly unusual. And it defies explanation to believe that there would still be a shortfall if the target was slashed in half to 23,000GWh.

Recent modelling by ROAM Consulting (who are also regularly used by the AEMC) found that the existing 41,000GWh target could be met without any adjustment to the certificate penalty price, but they did acknowledge it was a close shave. Modelling by SKM-MMA for the Climate Change Authority found that if the carbon price was abolished then the current target would not be met unless the price cap was lifted by $3. But its estimate of the shortfall per year was 3500GWh, or less than a quarter what the AEMC are suggesting.

But what makes this modelling extremely difficult to understand is that they still foresee shortfalls under the dramatically reduced targets.

Based on already operating projects and projects already under construction, the production of LGCs is already at 18,000GWh per annum leaving a gap of 5000GWh to the AEMC’s lowest target scenario.

Just eight wind farms which became operational or commenced construction in Australia over the last three years will produce that amount of electricity (listed below). This was done without anyone reporting major stress on industry supply chains. This totals just under 1600 megawatts of capacity, meanwhile the Bureau of Resource and Energy Economics lists 12,000MW of wind farms under active development.

Given this, and the results of other modelling exercises from credible energy market analysts, one has to seriously question the credibility of the projected shortfalls in supply the AEMC is projecting from modelling it refuses to release.

Wind farms built or under construction in last three years with annual production equal to 5000GWh output gap

Wind Farm | Annual Output | Megawatts |

Mt Mercer | 395 | 131 |

Collgar | 792 | 206 |

Snowtown 2 | 989 | 270 |

Macarthur | 1290 | 420 |

Musselroe | 500 | 168 |

Teralga | 271 | 106 |

Boco rock | 350 | 113 |

Gullen range | 500 | 165.5 |

TOTAL | 5087 | 1579.5 |