Sizing up the threat of China's debt pile

I have deliberately refrained from commenting on whether China's economy faces a debt crisis for two somewhat opposed reasons. Firstly, I don't trust China's data. Secondly, I do -- in a sense -- trust China's leadership.

Chinese data has no doubt improved dramatically from the days when it was a pure centrally planned economy. But the impact of those days still lingers in a country where the Communist Party is the only legitimate power structure, and it tends towards producing data that tells leaders what they want to hear, rather than what is really the case. I expect Chinese data to understate its problems and overstate its achievements.

On the other hand, I expect that the leadership of the Chinese Communist Party would win hands down an intelligence contest with those of any other country -- or at least an education contest. There are many more engineers than lawyers, and when it comes to understanding a complex system, engineers are way ahead of litigators. My expectation has always been that China will face a crisis, but its reaction will be markedly different to -- and better than -- what the West has done with its similar crises. But at the same time, I expect the scale of the problem they confront to be more extreme than would be implied by official data. So I held off from commenting in one direction or the other.

I'm still not willing to make a call on China, but with the caveats outlined above, it's still worth trying to quantify how big a crisis China is likely to face.

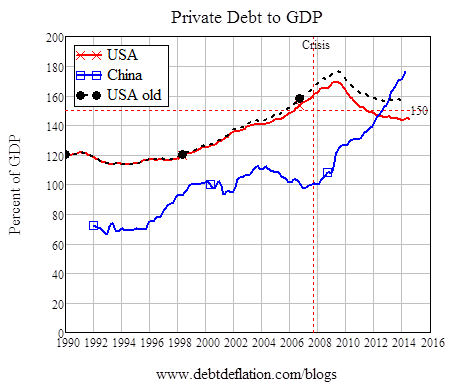

If we look at the official statistics -- which surely understate the problem --it's going to be bigger than the crisis the USA entered in 2007. The statistics here come from the Bank of International Settlements and the OECD, and they exclude the shadow banking system in China, so they surely understate the problem. But even when understated, it's still very big.

Firstly, on the figures that the Federal Reserve was using until its most recent release -- which reduces the recorded level of business debt by up to 14 per cent -- China's debt level is now equal to the peak level reached by the USA of 176 per cent of GDP. When compared to the recently revised figures, it is 7 per cent higher than the US peak of 169 per cent of GDP. And Chinese debt levels continue to rise.

Secondly, the growth of debt in China has been much faster than in the USA. It's increased by 80 per cent of GDP in just six years. This compares to rising by about 60 per cent over ten years during the sub-prime frenzy in the USA. So it's a bigger bubble, and it's faster-growing.

Figure 1: Private debt to GDP

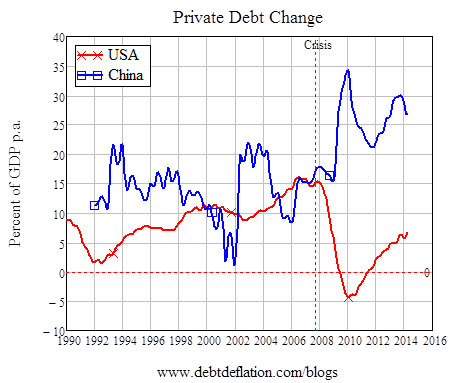

The China bubble was also clearly engineered by the Chinese authorities in response to the US crisis. In stark contrast to the USA, where the banks tell the government what to do, in China the government tells the banks what to do -- and the banks listen. Back in 2009, that instruction was “lend like crazy”, and that's precisely what China's banks did. They lent so crazily that at the peak in 2010, the increase in China's private debt in one year was equivalent to 35 per cent of China's GDP. This dwarfs the biggest rate of increase of 15 per cent in one year in the US.

Figure 2: Change in debt in the USA and China

The American private sector has returned to leveraging, as Figure 2 illustrates. Just as America's deleveraging and the economic crisis that led firstly to a downturn in China and then its “borrow to the max” policy response, a return to leveraging by America might give China a buffer as its leveraging slows down, via an increase in exports to the USA.

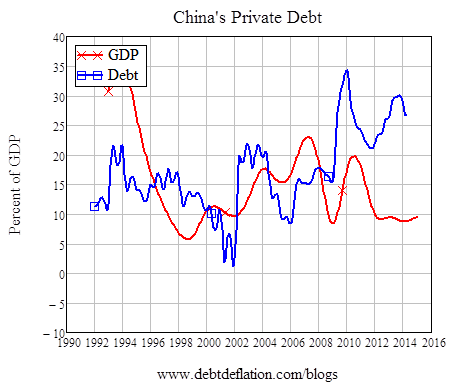

But it would need to be a pretty huge increase in exports to counter even a stabilization of China's private debt to GDP ratio -- which is still skyrocketing, as Figure 1 shows. Even with a recent slowdown, private debt in China is growing at over 25 per cent of GDP per annum, while nominal GDP is increasing at less than 10 per cent per year (see Figure 3). The best case scenario for stabilizing the ratio and not subtracting from the rate of nominal GDP growth would involve both export growth and an increase in government spending to make up for a hole in aggregate demand (and income) that would be equivalent to about 15 per cent of China's GDP.

Figure 3: China's private debt is still growing 15 per cent faster than GDP itself

I just don't think that's going to happen, so when credit growth decelerates in China, economic activity is likely to decline and unemployment rise -- even if the credit mechanism alone were the only factor.

But in China there's another factor. A lot of the growth in nominal GDP comes from businesses started by local governments -- not something you see in the West. These local governments finance the establishment of these businesses (whose output, rather than sales, are measured as part of GDP --or so I have been told) by selling land to developers, who themselves profit by selling new properties into a rising housing market.

If the deceleration of credit ends the property market bubble in China, then it also ends the easy route to financing new businesses that these local governments have been using -- and thus directly reduces recorded growth in GDP.

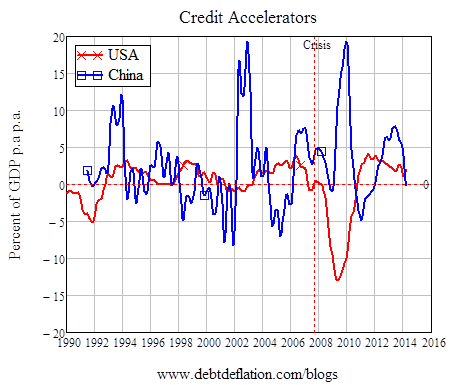

Figure 4 indicates that credit is already decelerating in China -- and that its acceleration in the past has dwarfed the credit bubbles in the USA. So China may well be approaching its first home-grown financial crisis.

Figure 4: Credit acceleration in China has been much larger than the USA

How will it respond? That's where it gets interesting. There was a crisis in an ex-command economy beforehand -- the Russian crisis of 1998. But there hasn't been one as home-grown as this, with a housing bubble playing such a key role. Nor was the Russian government as strong in either financial or domestic power terms as the Chinese government is. So, this will be a unique crisis in human history.

So will be the response of the policy makers. The “politico-financial complex” that distorted the US response to the financial crisis so that it focused on rescuing the financial sector rather than the real economy is nowhere near as powerful in China. The central government in Beijing is far stronger than that in Washington. They may well take the actions that the West should have taken in this crisis: put failed institutions into receivership, sack their managers (and worse), and bolster the real economy via government money injections that will make the “cash for clunkers” programs and the other Obama initiatives look like the actions of a wimp (which they were).

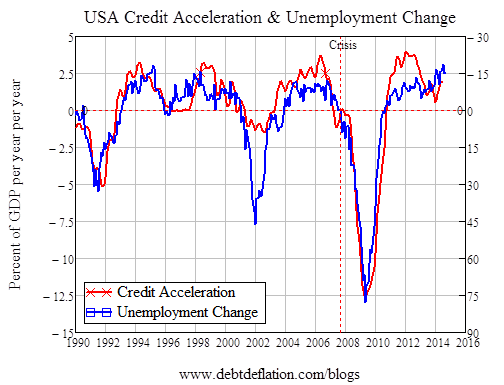

That said, the Chinese leaders will have their hands full. The rescue they engineered to avoid a serious downturn during the 2007-08 crisis worked, but at the expense of making China as ‘financialised' an economy now as the USA was back then. The impact of the credit slowdown in America was extreme, as Figure 5 shows. The credit deceleration in China, when it finally comes, could be even more severe than the one America experienced.

Figure 5: The correlation of credit acceleration and unemployment change in America (Coefficient -0.88)

We do indeed live in interesting times.