Shorting: A secret weapon of winning LIC funds

Summary: It's important to note that LICs with exposure to large cap stocks have been battered around in this market, while those who hold cash or have shorting as an extra lever to pull have performed better throughout these volatile times. In the longer term we will see LICs taking using a variety of approaches to get returns, including shorting to hedge against the markets – but this is just one tool. |

Key take out: LICs with the ability to short may have performed better than others in the landscape, but this is not solely because of short selling, but rather an openness of investment mandate and a variety of methods at the managers' disposal. |

Key beneficiaries: General investors. Category: LICs. |

Unless you have been hiding out and waiting for Sean Penn to come and interview you, you would be aware the stock market has been a little turbulent these last 12 months. As a keen observer I have been watching the market and LIC model portfolio over the holiday period. When looking at the likes of Cadence Capital, I pondered, “Is it times like these the LICs that have the ability to short sell outperform their LIC peers and the market? Do they hold up better?”

At face value it would certainly seem to be a plus if a fund manager has the skill to short the market in volatile times...put simply, how else could a manager profit from falling markets?

For the purpose of this exercise I have taken a look at six LICs that use short selling as part of their strategy. Historically there has not been a lot of LICs that have employed this as part of their strategy as the older LICs tend to stick with a traditional long only approach, however this is starting to change. Recently we have seen the launch of a number of LICs that employ a number of strategies to get returns and this trend will only grow.

LIC | 6 Month TSR | 5 Year TSR | Strategy |

Australian Leaders Fund (ALF) | 16.07% | 15.99%pa | Long/short hedge fund including international equities |

Cadence Capital Limited (CDM) | 12.32% | 20.06%pa | Long/short fund including international equities |

NAOS Absolute Opportunities (NAC) | 10.61% | N/A | Long/short absolute return manager, ASX, International, commodities and currency |

NAOS Emerging Opportunities (NCC) | -1.808% | N/A | Long/short ex ASX 100 focus |

Perpetual Equity Investment Company (PIC) | -0.30% | N/A | Long/short ASX and international stocks |

Watermark Market Neutral (WMK) | 18.81% | N/A | Long/short market neutral fund |

*TSR includes the reinvestment of dividends

Source: Bloomberg

Is short selling all that has provided them with outperformance?

It is important to highlight the above LICs have open mandates when it comes to investing. They do not have to stick to ASX100 stocks or remain fully invested at any time. A natural hedge to the market is also cash. This ability is one that divides people in the managed investment realm.

The LICs that do remain fully invested or very close to have not faired as poorly as the market over the last six months, but certainly have not faired as well as those who have the extra levers to pull and those who can hold cash. I have included Mirrabooka and Contango Microcap below to show it is not just the large cap focused funds that have been battered around in these markets.

LIC | 6 month TSR | 5 Year TSR |

Australian Foundation Investment Company (AFI) | -5.91% | 8.73%pa |

Argo Investments (ARG) | -3.11% | 9.62%pa |

BKI Investment Company (BKI) | -0.01% | 13.18%pa |

Milton Corporation (MLT) | -3.32% | 12.69%pa |

Mirrabooka Investments (MIR) | 0.13% | 15.57%pa |

Contango Microcap (CTN) | -6.65% | 2.07%pa |

It is interesting to compare the above small cap managers to their counterparts who do hold cash. The Wilson Asset Management funds should be no secret to those who follow our LIC coverage. These funds tend to hold between 30 per cent to 40 per cent cash no matter the economic conditions. Over the last six months the flagship fund WAM Capital (WAM) has returned 13.67 per cent while LIC model portfolio holding WAM Research (WAX) has returned 13.03 per cent.

Consequently we can say that LICs that short have done better in the recent volatile markets. We can also say that some funds which do not short but hold high levels of cash at the right time can also outperform.

The different ways shorting is used

Over the last six months the ASX200 Accumulation Index has declined by 9.86 per cent. All of the above listed LICs outperformed the market by varying degrees. CDM, NAOS funds and PIC these LICs do not use shorting as a hedge against the market. They use their ability to short when they see a fundamentally weak company and can generate performance from it.

Readers may remember an article last year where we spoke with the team at Cadence about their use of short selling in their portfolio - you can review this here: Cadence Capital's winning approach, July 20 2015.

“CDM's shorts are only put on when they believe the position can provide performance. They are not put on to reduce exposure or as pair trades.”

The team at Watermark Funds Management, who operate ALF and WMK, do use their ability to short sell as a hedge against the market and try to generate returns no matter what the market conditions. WMK is a market neutral fund, meaning for every dollar they have long they have a dollar short, so it is fully insured against the market movements. ALF is a directional fund, meaning they can be as long or short as they like with the portfolio – 100 per cent long or 100 per cent hedged depending on the team's outlook. In the video below Watermark Chief Investment Officer, Justin Braitling explains:

Listen to the full interview with Justin Braitling here: Eureka Interactive Watermark Funds Management, September 22, 2015.

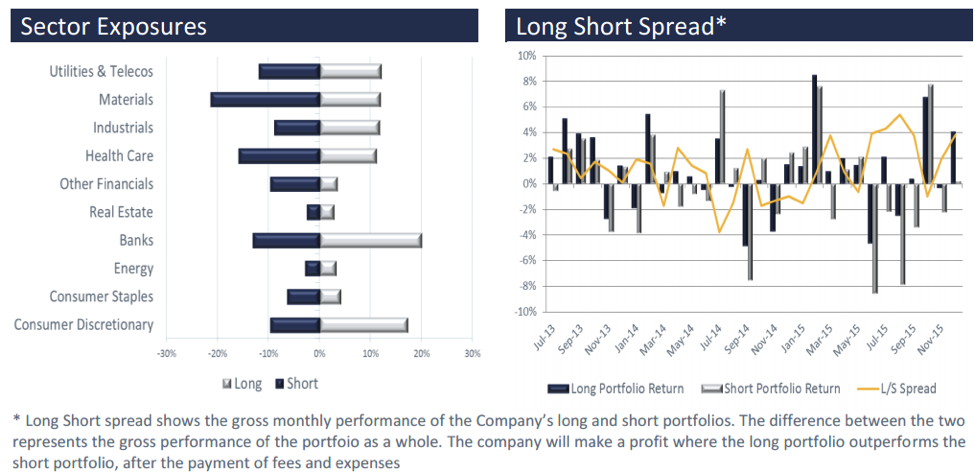

On Thursday (January 14) ALF and WMK released their monthly update which shows you how both portfolios are positioned.

WMKs exposure taken from NTA announcement:

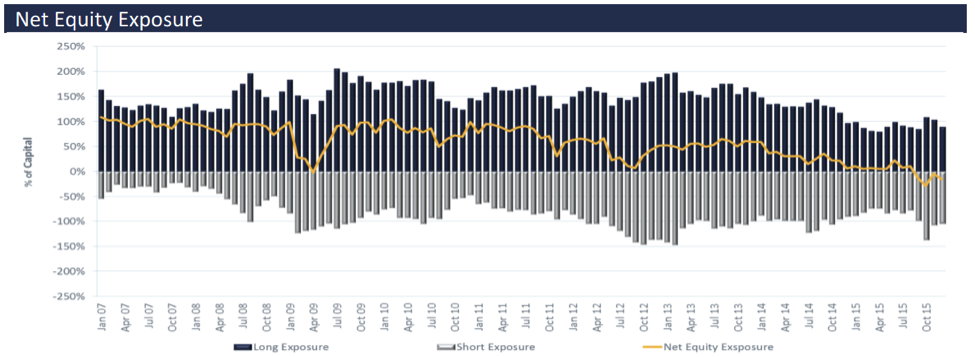

Net equity exposure for ALF

It is important to note bearish conditions are perfect for the market neutral fund. It is in a bull market where the fund will lag behind. As you can see from the chart below, when there was an uplift in the market earlier in 2015, WMK was flat. When the market declined significantly the market neutral strategy proved quite favourable. The question for investors interested in this is whether or not they believe the downturn has further to go.

What can be drawn from all of this?

Do managers with the ability to short outperform those who don't during times of market turmoil? Yes and no. Yes, they have outperformed the heavily invested large cap managers, but is it specifically due to the ability to short sell? No. It is due to openness of the investment mandate. They hold more cash, invest in smaller companies, invest in international companies and short sell. There are many tools to use, but without a competent manager behind them, they are useless.