Shining a light on your property's worth

Australia’s housing market is estimated to be worth around $5.1 trillion and housing accounts for a majority of household net worth. Yet despite regular and timely updates on house price valuations at the city or national level, most households have little idea about what their individual home or investment property is worth.

Recent research by Reserve Bank of Australia economists Callan Windsor, Gianni La Cava and James Hansen, in a paper called Home Price Beliefs in Australia, explores the economic impact of beliefs about housing on the economy.

Belief formation on housing is fairly important; in fact many of us already do it. Although there is a range of timely measures of dwelling prices, each house is a unique asset and changes in its valuation cannot be fully captured by any dwelling price measure that assesses the entire housing stock. Postcode level data is available but costly and unlikely to be used by the average person.

Making the task more difficult is the fact that Australians sell or buy a home fairly infrequently. Over the past decade, around 6 per cent of homes in Australia are sold each year -- suggesting that the average stay is around 16 years. Over that period there have been a number of house price booms and downturns.

Despite the difficulty, it is worth noting that homeowners’ beliefs about house prices are largely unbiased, on average, across postcodes. Basically, there is no systematic bias that leads to homeowners being either irrationally optimistic or pessimistic about the value of their home.

Nevertheless, house price beliefs differ significantly from transaction prices. For example, a relatively large share of postcodes believe that their homes are undervalued or overvalued. But on net these valuations offset one another.

Older home owners tend to be the most optimistic and have a greater tendency to overvalue their homes. Controlling for other factors, an increase by one year in the average age of homeowners within a postcode shifts the difference between beliefs and transaction valuations higher by around 0.25 percentage points.

By comparison, homeowners tend to undervalue their homes if they have lived there a long time or in postcodes with high levels of unemployment. An additional year of tenure is estimated to lower the difference between beliefs and valuation by around 0.4 percentage points. In practice the ageing and tenure effects are likely to offset one another.

The effect of higher unemployment is much larger, with a 1 percentage point rise in the average rate of unemployment within a region resulting in an 8 percentage point decline in the difference between beliefs and valuations.

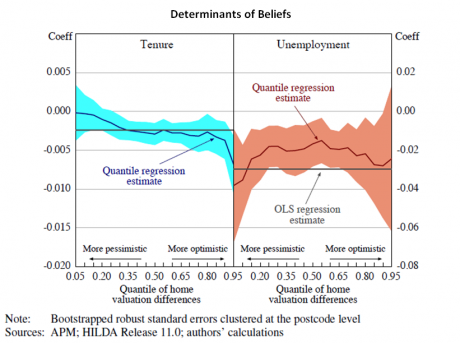

The effects of tenure and unemployment can be seen in the graph below, which separates the effects of those two factors based on how optimistic or pessimistic the home owner is. Tenure has a greater downward effect in postcodes where homeowners are more optimistic on average, while unemployment appears to have the greatest effect in postcodes where homeowners are either very pessimistic or very optimistic.

Perhaps the most important finding is that home valuation differences are associated with households’ consumption and financial decisions. They find evidence that “valuation differences are positively associated with spending, leverage and the allocation of wealth to ‘risky’ assets, such as equities.”

After controlling for other factors, households that appear to overvalue their properties the most will typically spend more and take on more leverage than unbiased or more pessimistic households. This response is similar to what we would expect to see from more observable assets such as equities.

The researchers find that a 1 per cent rise in the difference between beliefs and valuations results in a 0.34 per cent rise in household spending -- an effect that seems quite large.

The most optimistic households tend to have higher levels of debt. They are also the households that have the highest shares of financial assets, suggesting that they derive their beliefs on housing from the performance of other assets.

Housing is a unique asset and also the most important asset that most Australians will ever own. The research by the RBA suggests that beliefs about house prices can have a significant effect on decision-making by households.

That revelation is perhaps no surprise -- after all, financial markets are often driven by irrational exuberance or pessimism and the housing market is no exception. But unlike financial markets, or most markets for that matter, house prices are not directly observable and there is considerable uncertainty surrounding the value of a person’s home.

In aggregate, house price data can be used to track beliefs on housing but at the state or local level beliefs can often differ significantly from valuations. It suggests that analysing the effect of dwelling price growth on consumption or debt in, say, New South Wales or Victoria can be more difficult than simply looking at changes in house prices.