Shale gas miracle mythology

In reading some of the rhetoric coming out of the business press you’d think that shale gas is the cure to all of the United State’s ills. We hear that shale gas will spell the revival of US world dominance; that it will mean the US will regain its position as a manufacturing powerhouse; and that the carbon emissions problem has been solved.

Of course that’s not to say the shale gas boom hasn’t made a very big impact on US carbon emissions and energy supply. But as our charts of the week illustrate some of the more extravagant shale gas promoters might be well served to take a Bex and have a lie down.

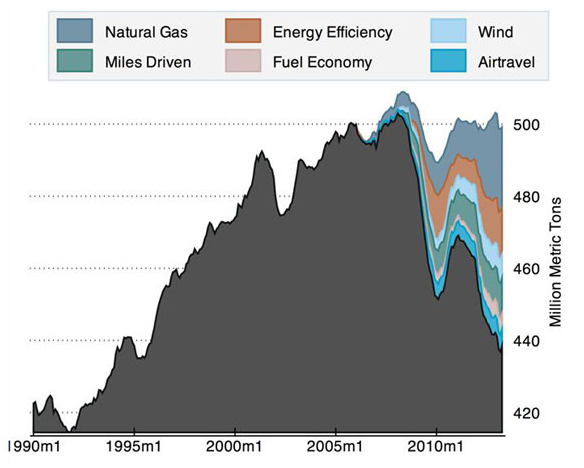

Firstly on carbon emissions, the chart below taken from an article by Zeke Hausfather published on the Yale Forum on Climate Change and the Media provides a break down on the various individual components that have contributed to reductions in US CO2 emissions from energy use. Increased use of gas in electricity generation has made the greatest contribution to the recent significant reduction is US energy CO2 emissions (ignoring disputes over leaking methane), reducing them from 500m tonnes to 480m or about 4%.

But you could hardly say it’s showing any real sign of solving the carbon emissions problem in the US. In addition there are wide array of other changes including simply driving less, that have also played an important role.

US energy CO2 emissions and the contributions of different abatement sources

Source: Hausfather (2013) using US EIA data

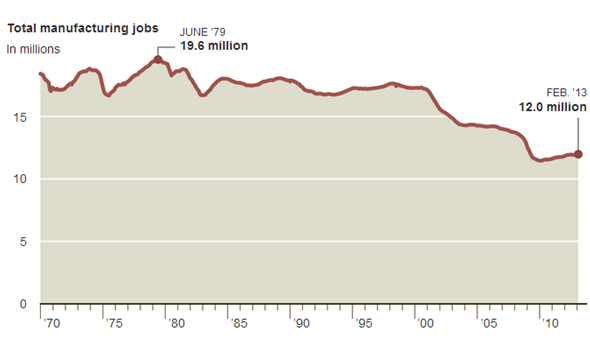

In addition it is true that gas is a very important cost component for a handful of industrial sectors, particularly basic materials like chemicals and cement. But these tend to be very capital intensive and so don’t employ many people. They form a small component of overall manufacturing employment and economic value-add in America. As the chart below from the New York Times illustrates, total US manufacturing jobs aren’t exactly on a radical upward trajectory since the shale gas boom took off. If anything the slight recovery is a function of the US slowly emerging out of the GFC.

Source: Bureau of Economic Analysis; Aliance Bernstein, cited by New York Times