Seven stocks that are not so magnificent

| Summary: The current global equity market rally could be the calm before the storm, unless the US Government can achieve a more stable debt outcome. Here are seven Australian stocks that are set to underperform based on their current high share prices, with all trading above their valuations. |

| Key take-out: When stock spruikers start tipping perennial poor performing companies as buys and ignore the high-quality end of the market, it is a sure sign that markets are overheating. |

| Key beneficiaries: General investors. Category: Growth. |

Recommendations: |

Picking markets is never easy. I liken it to what veterinarians must encounter when treating a sick animal. They observe the symptoms but the patient cannot describe the problem.

While acknowledging the difficulty in diagnosing market direction, I believe that the current worldwide equity market rally that has followed the partial resolution of the US Government debt ceiling limit could be a re-run of the 2006 to 2007 market rally that preceded the problems of 2008.

To my eye, markets are belying the poor or benign outlook for the world economy and are running hard on excess liquidity. This speculative activity is explainable by the monetary settings and it could, like 2007, spread like a disease across the world. Indeed it is the equity markets in the worst-performing economies that have recently hit new highs, with the fastest-growing economies (like Australia) now joining in without observable improvements in profitability.

An important observation for me is that the symptoms of this euphoric market seem similar to those witnessed in the lead-up to 2006-07 – except for one important aspect. Seven years ago the world was on a debt-fuelled consumption binge. Poor financial regulation and loose monetary settings by central banks resulted in the provision of credit to poor-quality households and businesses on terms that breached normal credit rules.

In particular, low-income earners were coerced to borrow by so-called “teaser” loans with low interest rates. Ultimately a subprime debt crisis eventuated as “teaser” loans, with low opening interest rates, were re-priced to market rates in 2008. This re-pricing was well known and actually documented before the event, but the general market ignored the risk of loan defaults.

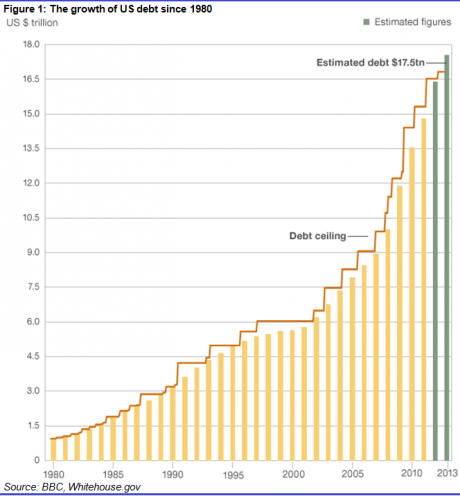

Today, in 2013, the mountain of debt resides with the governments of the world, and no more so than with the US Government. As the following figure shows, US Government gross debt has doubled since 2006 as it bailed out the highly indebted economy (Figure 1). The fiscal deficits since 2008 have added $US6 trillion to total debt, and the Federal Reserve (Fed) has been driven to introduce quantitative easing (QE) for two key reasons:

- The amount of debt to be raised by the US Government could not be funded in the bond market without an unacceptable massive drawdown from foreign investors that include China; and

- The debt servicing costs of the bonds issued. Should the debt servicing costs have moved to normal market rates, it would have blown the US fiscal position to obliteration. The US pays just 1.6% for its debt due to the intervention of the Fed.

The continuing explosion in US Government debt plus the maintenance of absurdly low cash rates and manipulated bond interest rates suggests to me that equity markets are being buoyed by support mechanisms that are not sustainable. Further, the risk of a market correction increases immensely as markets rise, QE continues, and time passes.

Recently, in May and June, we had a warning of what will happen when QE ends and interest rates normalise. The mere mentioning of QE tapering sent market interest rates sharply higher and equity markets into a correction.

My analogy to 2006-07 is drawn from the observation that interest rate settings are too low and not sustainable. QE has lasted too long to be useful and it is obvious that the natural rebalancing of monetary policy settings will significantly impact markets when they occur. That is just like 2008 all over again, when teaser mortgage rates were replaced by market rates. Defaults and the threat of default sent economies into recession. Imagine what will happen if the next default involves a major developed country?

Markets 2006 to 2008

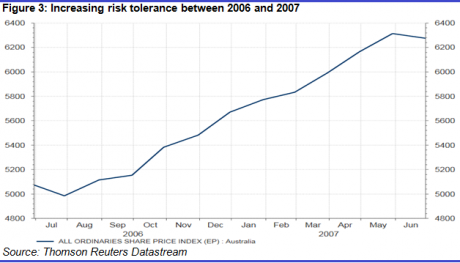

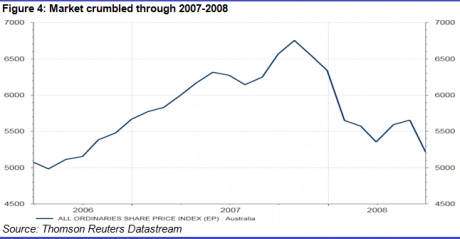

The following charts (Figure 3 and 4) are indicative of what may lie ahead as markets speculate their way upwards. In mid-2006 the All Ordinaries Index was sitting in the low 5,000 region and then spiralled upwards through to mid-2007 by over 20%.

Readers may recall that in mid-2007 many value-focused equity managers claimed there was limited value in the market. In particular, intrinsic valuations based on return on equity (ROE) modelling, as undertaken by StocksInValue, suggested the Australian equity market was grossly overpriced.

As you can see from Figure 4, the market started correcting from late 2007, back to its 2006 level, and then fell a further 20% until February 2009.

Pinpointing overvaluation in markets

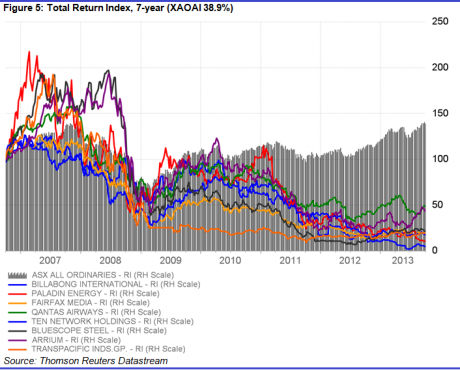

The following chart (Figure 5) helps investors identify the warning signs as to when the Australian equity market is moving to an excessive level. A feature of such an event is strong outperformance by companies with poor or sub-market ROE.

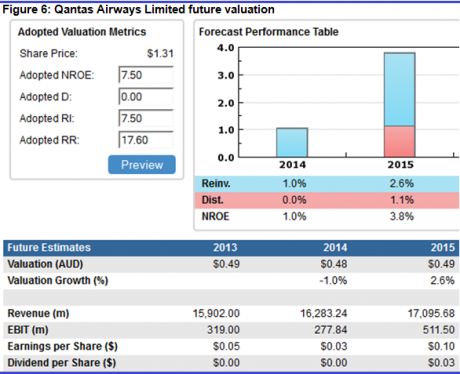

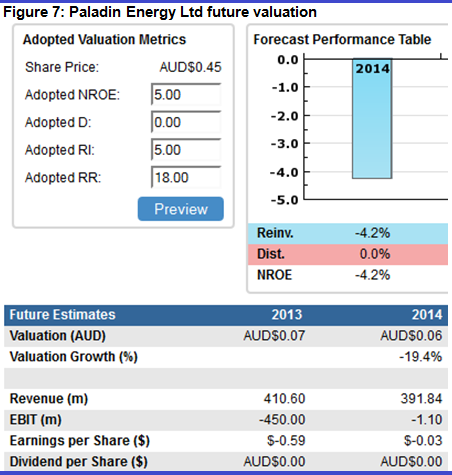

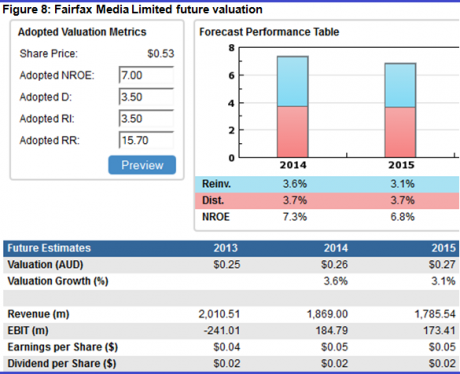

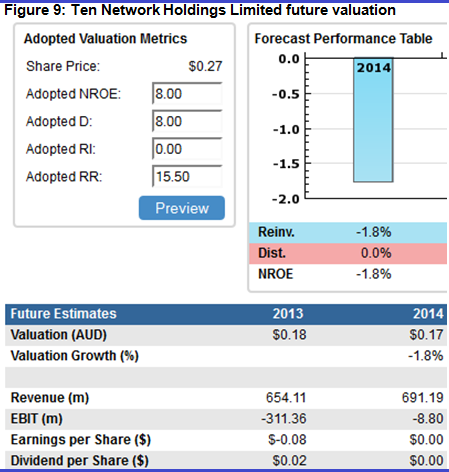

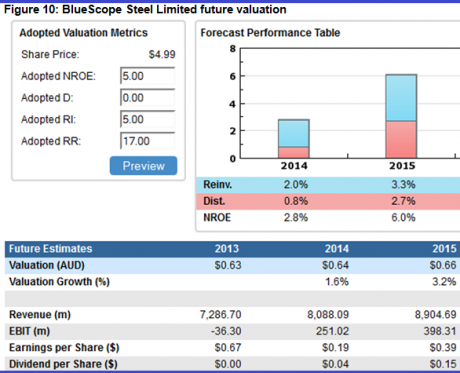

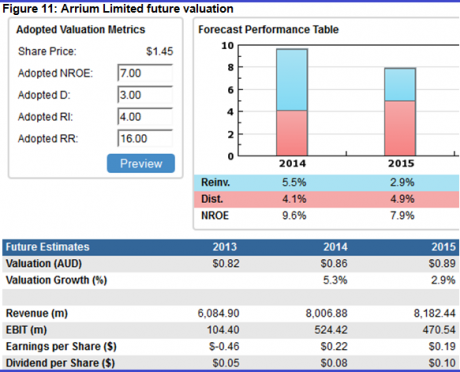

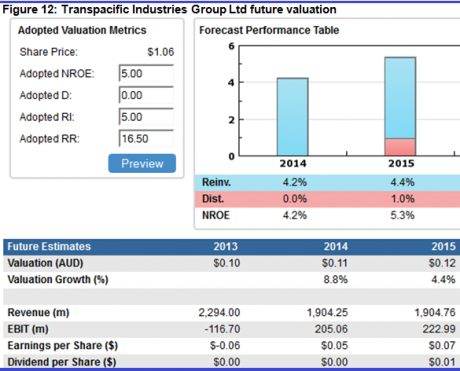

In the 12 months prior to the GFC, stocks such as Qantas, Paladin Energy, Fairfax, Ten Network, BlueScope Steel, OneSteel (now Arrium) and Transpacific Industries substantially outperformed a rising market. When speculation is rampant, it is the companies that are perennial underperformers that have their day in the sun!

So when stock spruikers start tipping perennial poor performing companies as buys and ignore the high-quality end of the market, it is a sure sign that markets are overheating.

As for how far this market can rally given the tailwinds of imprudent economic management, I don’t know. However, history suggests this time will be no different to previous speculative rallies. It will end, and arguably it won’t be a happy ending if the US does not get its debt under control.

For interest, I have included the StocksInValue forecast valuations for the above mentioned stocks so readers can see how far above reality the price of these shares moves as this market drives higher. Take note of the share price compared to the valuation.

Source: StocksInValue.com.au

Source: StocksInValue.com.au

Source: StocksInValue.com.au

Source: StocksInValue.com.au

Source: StocksInValue.com.au

Source: StocksInValue.com.au

Source: StocksInValue.com.au

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Growth Portfolio Statistics

Return since June 30, 2013: 14.37%

Returns since Inception (April 19, 2012): 34.51%

Average Yield: 5.95%

Start Value: $141,128.64

Current Value: $161,413.38

Dividends accrued since June 30, 2013: $2,375.74

Clime Growth Portfolio - Prices as at close on 22nd October 2013 | ||||||

| Company | Code | Purchase Price | Market Price | FY14 (f) GU Yield | FY14 Value | Safety Margin |

| BHP Billiton Limited | BHP | $31.37 | $37.05 | 4.70% | $37.46 | 1.11% |

| Commonwealth Bank of Australia | CBA | $69.18 | $74.76 | 7.24% | $69.17 | -7.48% |

| Westpac Banking Corporation | WBC | $28.88 | $34.11 | 7.62% | $30.61 | -10.26% |

| Woolworths Limited | WOW | $32.81 | $34.85 | 5.74% | $35.87 | 2.93% |

| The Reject Shop Limited | TRS | $17.19 | $18.22 | 3.76% | $16.98 | -6.81% |

| Brickworks Limited | BKW | $12.70 | $13.97 | 4.19% | $12.75 | -8.73% |

| McMillan Shakespeare Limited | MMS | $16.18 | $12.81 | 5.46% | $12.47 | -2.65% |

| Mineral Resources Limited | MIN | $8.25 | $11.65 | 8.09% | $13.41 | 15.11% |

| SMS Management & Technology Limited | SMX | $4.55 | $4.64 | 6.77% | $5.29 | 14.01% |