Seriously Ten, get with the ratings

It could be said that Ten won the free-to-air TV world’s version of the pre-season cup for 2014.

Ten has experienced ratings success beyond what most thought was probable with the third season of the Big Bash League, and started February with strong optimism around its bargain purchase of the Sochi Winter Olympics and its ability to connect with Australian viewers. But since the Games opened on Australian screens on February 7, the story has not been a positive one.

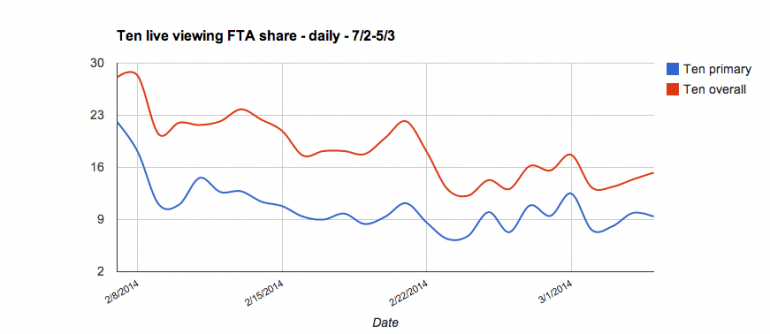

The first two days of Winter Olympics coverage gave Ten an overall share (inclusive of One and Eleven) of 28.1 per cent. The next day it increased to 28.3 per cent. But as the above table suggests, since those heights there has been a dramatic downward trend, with Ten last Sunday receiving an overall share of 13.3 per cent for all channels, and just 7.6 per cent for its primary channel.

And yet Ten’s share price appears immune from the company’s ratings performance. This year it is up 22 per cent and for the past five weeks has remained consistently around 33-34 cents. What are investors seeing that the ratings don’t show?

One theory is Ten is a solid takeover target for a business looking to get into the free-to-air TV space, a space that is still the biggest advertising game in the country and has barriers to entry that other mediums do not have. Another theory is Ten has bottomed out performance and can’t really go any lower. Both theories have their merits, but none represent a long-term strategy.

Remember that with free-to-air TV, the money directly follows the ratings.

Sunday and Mondays, traditionally the strongest TV viewing days, have been especially problematic in the past two weeks. On Monday February 24, Ten received viewer shares of 6.8 per cent for the primary channel and 12.2 per cent for all channels, and the following Monday (March 3) it achieved 8.1 per cent for the primary channel and 13.4 per cent for all. To illustrate the gap between Ten and its commercial competitors, you just need to look at Monday’s overall share: Seven 31.3 per cent, Nine 34.1 per cent, Ten 13.4 per cent.

The most troubling part of this equation for Ten is that it hasn’t sat on its hands in terms of trying to win back viewers. Sochi and Big Bash were strategic plays designed to primarily bring in new viewers by using marquee events to expose them to the rest of Ten’s programming suite. This hasn’t worked so far. Key Ten programming such as So You Think You Can Dance, Wake Up, The Biggest Loser, Modern Family, Secrets and Lies and The Project are delivering metro audiences far under expectations. The performance of all new Modern Family episodes -- a franchise so adored by Australia Qantas felt compelled to fund their local episodes -- is concerning, with Monday’s premiere failing to crack 500,000 metro viewers. On Seven or Nine, Modern Family would most likely generate double the ratings Ten is managing.

From this week, sport will begin to dominate the viewing landscape. Nine will enjoy the bounce of the NRL regular season from this weekend until the beginning of October, with the AFL giving Seven the same bounce from next week. At the moment, Saturdays are a rare positive for Ten -- the past four Saturdays have given the network a share of between 17.5 per cent and 20.9 per cent -- but when the AFL and NRL are thrown in the mix, this advantage will be quickly eroded.

Come March 18, chief executive officer Hamish McLennan will have been in the big chair for a year. All eyes are on what he can do over the next twelve months to turnaround a network that seems as troubled as it was when he commenced.

Ben Shepherd is a media and technology consultant. He can be found on LinkedIn and on Twitter.