Secrets of an income investor

Summary: Investors should be wary of buying stocks solely for the dividend yield, given so many factors contribute to a stock's ability to provide stable income. Some stocks currently delivering mouth-watering dividends, such as BHP, RIO and the big banks, look set to reduce these in the future as commodity prices slide and regulation affects the banking sector. There are some great potential opportunities in this market, but first consider whether the stocks on offer have strong profits and cash flow and pay attention to the company's payout ratio. |

Key take out: Keep in mind that past strong dividends are no indication of future income – consider where each investment fits in your portfolio and risk profile before committing. |

Key beneficiaries: General investors. Category: Shares. |

With markets tumbling, and dividend yield lifting as a result, it is more important than ever to understand that yield alone is not an appropriate measure for picking income stock investments.

It's also crucial to know that many of the top dividend yield stocks on the ASX could now be described as potential dividend traps – in other words they are stocks that that might be enticing to buy for dividend yield, but they are either unlikely to sustain that yield, or they are likely to see capital value deterioration.

When I'm looking for investment opportunities I Focus on forecast earnings, a company's ability to grow its dividend in absolute terms and the quality of the business's strategy: Putting these attributes together are the key to ensuring sound investment.

Sometimes this will mean letting seemingly higher yield pass you by in order to take less risk. At present, the dividend yield of the ASX on a 12 month forward basis is around 4.85 per cent, or 6.5 per cent on a gross basis (including the value of franking credits).

This forecast is based on broker and analyst estimates, and in my view it is probably optimistic. The reality is that those relatively high yields from the big end of town – companies such as the banks and the largest miners – are likely to see dividend stagnation and dividend cuts respectively.

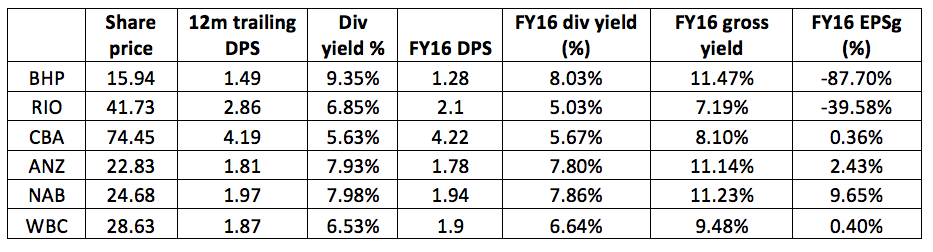

Even at significantly reduced prices, RIO, BHP and the big four banks account for more than 30 per cent of the market cap of the ASX, and are in my view the likely cause of an inflated dividend yield forecasts. Here are the vitals on those big six, which may serve as examples for caution, particularly when considering the miners in particular:

Clearly, the yields on all of these stocks are mouth-watering. However, it should be easy for investors to note that earnings declines such as those expected of BHP and RIO are not supportive of sustainable dividend payouts.

Much has been written on the risks of investing in mining stocks for dividend yield (including our take on it back in September – read Pitfalls of mining for income, August 18, 2015.

The banks are subtler, and I fear that many investors who have successfully built their portfolios with banks as the backbone may be in for further difficulties, even after bank share prices have underperformed this financial year. The fact is that the banks have enjoyed a period of significant underinvestment, high profit margins, and low debt provisions. With regulatory changes, cycle changes and the need to invest in technology (something often referred to by Robert Gottliebsen: read it in February 13's weekend briefing).

While the financials still suggest some stability in bank dividends, my view is that there is good reason to be reviewing your bank exposure, and ensuring that you aren't overly weighted, and introducing unnecessary risk to your investment portfolio. The Eureka Income First portfolio currently holds NAB and ANZ in small positions. These positions are significantly underwieght when compared to the broader market, reflective of our view on risk. However, in the near term, the dividend yield is strong, meaning that a risk controlled position can offer some benefit including diversification of a portfolio.

Trailing yield can be misleading

In all of the above six stocks, except WBC and CBA, the forecast dividend is expected to be lower than that paid in the last 12 months. This is a common occurrence when markets are turning down, and is the key thing I am looking at to identify when seeking to avoid a dividend trap. Unfortunately, an investor can't buy past dividend, only future ones, and while past yield can be a good starting point, it can also be a dangerous basis for investment.

Thankfully, with the market falling to levels not seen since mid 2013, there is an abundance of stocks that are trading on dividends yields that appear appealing. The key is to find the companies that are likely to grow their dividends and earnings in tow, and avoid the dividend traps.

Key metrics to consider for dividend stocks

There are two outstanding factors to examine when assessing a company's ability to pay future dividends

* The first is profit. For a company to have a sustainable dividend, there must be sufficient profits to pay the dividend into the future, and breathing room on this point is very important. In assessing this, investors should look at the payout ratio (dividends per share / earnings per share). As a rough guide, caution should be taken where a company is lifting its payout ratio to maintain dividends. This implies that dividends are growing faster than profits – an unsustainable situation, and one that we have witnessed playing out in the big four banks in recent years.

• Second, cash flow is a huge consideration when looking for dividend paying companies, and assessing the ability of a business to pay. Investors should look for operating cash flow that is also supportive of dividends. This can be harder, and sometimes requires deeper analysis. However, for simplicty's sake, operating cash flow that is growing in line with dividends and earnings before interest, tax, depreciation and amortisation (EBITDA) is supportive of dividends. Negative operating cash flow should raise a red flag, and needs more analysis.

For the most part, the key is to not ignore forecasts. Attention to the expectation for dividends in the future, and the company's earnings growth profile is key to understanding whether a good income investment will prove a trap for the uninitiated.

Market yield has risen – but that is a function of lower prices

The forecast dividend yield of the broader ASX is now close to 6.5 per cent when we include the value of franking credits (gross dividend yield). This is a fantastic return, unmatched by other assets classes. However, my view is that for income investors the tide has turned, and investing for dividends is significantly more difficult than it has been in the last five years.

Take a portfolio approach

Income investors, probably more so than growth investors, need to actively manage risk. Often there is a higher need for income focused investors to preserve capital, usually due to their stage in life, and as such risks need to be carefully considered.

Key to managing risk is the attitude of taking a portfolio approach to equity allocations within investment portfolios. By this I mean considering diversification, liquidity and volatility when selecting stocks, and asking the question “how does this fit into my portfolio?”

Each stock should be considered from a returns perspective and a risk perspective. While adding BHP and RIO might add the potential for some near term dividends, and some near term capital appreciation, it would also add commodity price risk, two correlated stocks, and the potential for capital volatility. Sometimes, taking a lower yield with a higher level of certainty that dividends and earnings are growing is a far better course.

Volatile price creating potential entry points in reporting season

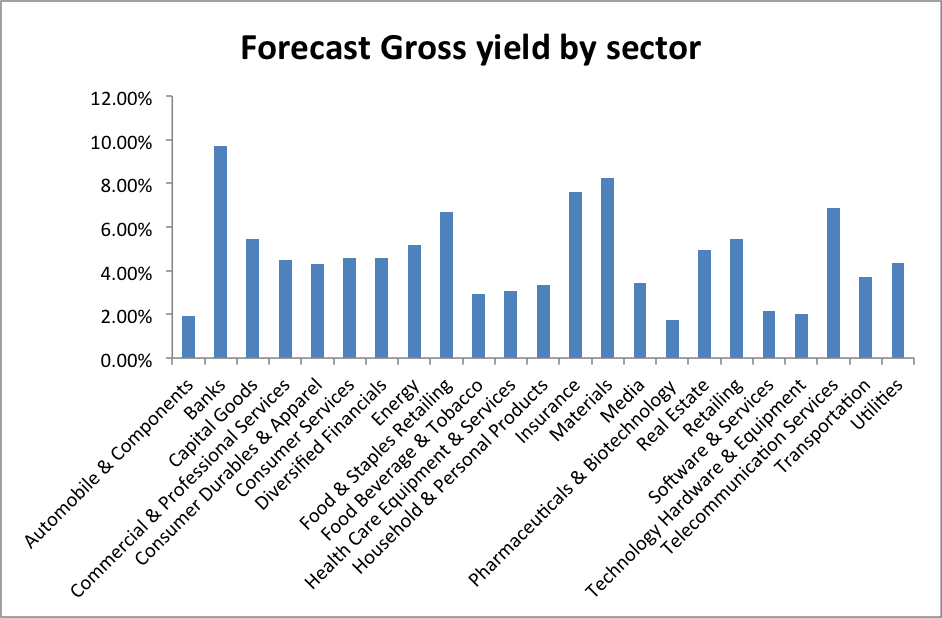

Although it may seem easy to pick the sectors that are currently offering strong dividends, it does pay to check our assumptions. Below is a chart of the sector forecast gross dividend yields, weighted by market capitalisation. Of course, some sectors will contain one big stock that skews the result, such as CSL making up 87 per cent of the pharmaceutical and biotech subsector. Nonetheless, trends exist and it shows that the market is being propped up in terms of yield by banks, and materials – both areas where caution is advised. Realistically, if we exclude these sectors a gross dividend yield of 5 per cent would appear to be a healthy benchmark to strive for. Here is the sector breakdown:

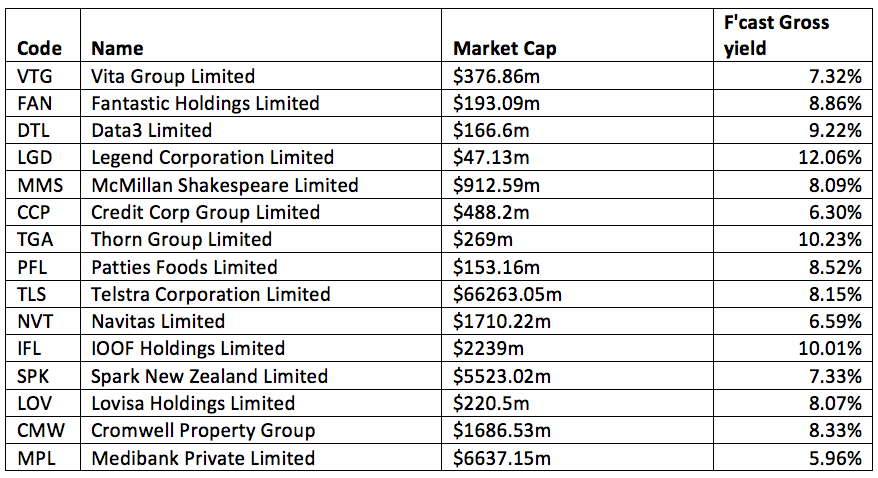

While my tone may seem cautionary, I do think that the current downturn will provide some very attractive opportunities for savvy investors to pick up growing businesses with strong cash flows and sustainable dividend payouts at low prices. Outside of our income first model portfolio (read more here: Income First model portfolio), I have created a shortlist of stocks that I am watching, and potentially looking to further research as reporting season unfolds further. These are not recommendations, just businesses that might form a good shortlist for further research:

These stocks are in no particular order, and definitely require a significant amount of research. But from a cursory look, there's no shortage of good companies that are providing a gross dividend yield upwards of six per cent over the next 12 months. The key for investors is ensuring that these companies are well placed for the mid to long term, and risks are appropriate to the individual investor's portfolio.

Here are the main questions to consider when doing further research for income opportunities on the ASX. Ask the following questions:

1. Is the yield reflective of the company's profit performance and outlook?

2. Does operating cash flow and cash balance support the dividend payments?

3. What is the dividend forecast, and is it supported by similar expectations for earnings?

4. Is the high yield a function of low prices, and is there a reason for lower prices?

5. Am I comfortable with the risk of capital and volatility involved?

6. Is the company's strategy and market position sound?

7. Are there any external risks or industry issues to consider?