Save our super

Summary: Treasury has admitted that its $32 billion estimate of the annual cost of superannuation was fiction. Readers should be prepared to correct inaccurate reporting that relies on this figure. I fear super is losing the battle for public opinion and that the next parliament will make nasty changes to the system. Meanwhile, bank term deposit rates are falling, hurting retirees. |

Key take-out: I fear dividend imputation will only be applied to, say, 75 per cent of profits, and that lump sums from super will be more difficult to get. |

Key beneficiaries: SMSF trustees and superannuation accountholders. Category: Superannuation. |

I fear that the Australian superannuation movement is losing the battle for public opinion. Whenever any portion of a society finds itself on the outer and becomes the subject of humour then that group is in a dangerous position. That's what is happening to superannuation. In addition, as I explain below, dividend imputation is also under threat.

Our problem in superannuation is that many of the journalists that write about it are young and have very little understanding of the needs of those saving for retirement. The self-managed funds that dominate the retirement industry are diverse, although great work is done by Andrea Slattery of the SMSF Association and by the SMSF Owners' Alliance. The big institutions are next to useless because they have their backs to the wall as too many of them have been engaged in bad practices and fee gouging which puts them on the wrong foot to enter the debate.

But while this situation is serious there is good news and if Eureka Report readers understand the debate they will be in a position to at least begin the process of getting the truth out into the community.

One way to determine whether a journalist has any idea of what they are talking about in superannuation is to watch to see if they use Treasury's $30 billion to $32 billion estimate of the annual cost of superannuation. Lazy journalists from all forms of media use this figure as gospel when anybody who has done the smallest amount of work knows that $30 billion or $32 billion as a cost is absolute rubbish. There has been no proper assessment of the cost and benefits of superannuation by Treasury.

Rob Heferen who is executive director of Treasury's revenue group has at last admitted that the $32 billion figure was absolute fiction as a measure of the cash cost of superannuation. It was achieved by adding together two theoretical calculations that mathematically could not be added together and it forgot to calculate the reductions in government pensions caused by superannuation and used rates of return that were vastly inflated to arrive at a silly sum.

I can't recall a Treasury document being so deliberately inaccurate and misleading. It was simply Treasury playing politics and doing itself incredible harm. The new head of Treasury John Fraser has complained about the cost of superannuation. He should stop talking about the subject until Treasury does its sums again. Frankly I don't think they have the ability to look independently at the cost of the superannuation concessions so it should be outsourced by the government.

You will remember when the ALP was in power myself in the Eureka Report and Business Spectator aided by the SMSF Owners' Alliance managed to convince the then assistant treasurer Bill Shorten of the absurdity of the Treasury sums. He came up with a solution which taxed at a 15 per cent rate the income of individual stakes in superannuation funds above a minimum figure. The scheme had a lot of problems but there was underlying merit. The ALP lost power before they had a chance to fix those problems. Then with a new government, Arthur Sinodinos became assistant treasurer and his mates in the banking industry convinced him that it was all too hard so he abandoned the scheme.

People with worthwhile amounts in superannuation like me were the beneficiaries so thank you Arthur. But in fact in the self-managed funds the Shorten plan was an easy calculation and the danger now is that a government will put a 15 per cent tax on all retirement pension income. Given the fall in interest rates this would be a disastrous step for a lot of people.

I don't think that the current government will do it because they have promised they will not make major changes to superannuation in this term. But the pressure of the anti-superannuation movement is building up and in the next parliament no matter who gets to power there will be nasties. But there is some interesting news coming.

I was in the company of Financial System Inquiry chairman David Murray at an SMSF Association breakfast and he explained in simple terms that superannuation was there to provide income for people in retirement and the way superannuation benefits were structured would need to be examined.

Interestingly the only benefit he isolated was he was dividend imputation. And of course dividend imputation extends to all Australian residents not just superannuation funds. My guess is that in most industries and superannuation some way, somehow, a different version of the original Shorten scheme will emerge.

I fear that dividend imputation will only be applied to say 75 per cent of profits to encourage companies to invest. And that percentage may fall over time. If there is any fiddling with dividend imputation there will be a big fall in the share market.

If Murray's view that superannuation is about retirement income is adopted then I think that lump sums will be more difficult to get. It will also be more difficult for people on higher incomes to invest large sums in superannuation.

I must emphasise that I am not agreeing with these measures merely reading the signs as best as I can. My fear is that something far worse may happen if the current momentum is not addressed. I also think there may be major restrictions on the use of superannuation funds to leverage and buy houses. It is going to be a long fight but we should start by having Eureka Report readers write to newspapers or any other media outlet whenever any young journalist uses the figure of $32 billion as the cost of superannuation.

Meanwhile any attack on superannuation will be made more vicious by the falling incomes from bank term deposits.

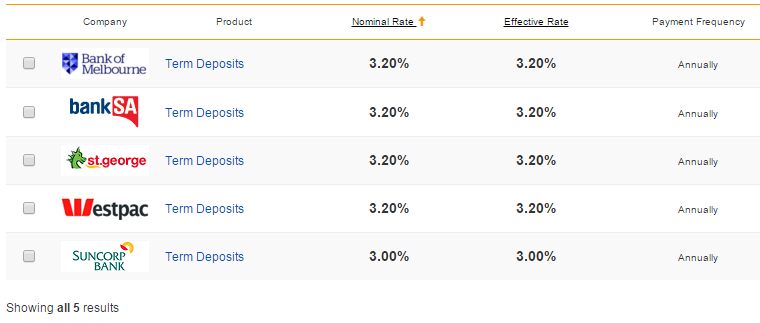

Term deposit rates on offer for $10,000 invested for five years with interest paid annually. Source: RateCity.

Those people with superannuation funds that are dominated with bank deposits have received another sickening blow. The Westpac five-year bank deposit rate is now down to 3.2 per cent whereas in December it was 4.1 per cent. Many banks had a six month rate of 3.6 per cent and that is now down to 2.8 per cent.

Obviously the banks vary a little but this is a dramatic fall in interest rates in a short period of time. In effect Australian banks are herding people into bank shares and bank hybrids plus Telstra. The danger is that these stocks are going higher and higher but not achieving great growth. Many people are panicked and seriously bidding up dwelling prices in Sydney and many other states. None of this is going to change until interest rates begin to rise and this is not on the immediate horizon. Clearly the banks don't think interest rates are going to rise anytime in the next twelve months and could fall further.

The combination of the Reserve Bank and the big banks' policies is increasing the risk profile of Australian retirees.