Rivers of gold

PORTFOLIO POINT: Australians wanting a taste of water in their portfolio can buy physical water from the Murray-Darling or dive into US exchange-traded funds. There’s an abundant supply of choices.

Several years ago Alan Kohler wrote an article on the most important commodity of them all – water. In “Water: blue gold”, Kohler identified the crucial importance of water, and its increasingly scarcity, and said it was “clearly going to be a major investment theme around the world for at least the next decade”.

More than half a decade later, it’s worth taking another look at water as an investment, where there have been some distinct stories of success and failure.

One thing that hasn’t changed over the years is the view of water as a critical investment class, in a long-term sense.

“A potential bottleneck to globalisation,” was what Morgan Stanley’s chief economist Steve Roach called it back at the start of 2007. Two years later, a comprehensive UNESCO report said “the availability of water resources and their management are determinants of a country’s growth strategy”. “The single-most important physical-commodity based asset class,” was what Citi chief economist Willem Buiter said water was becoming last year.

But how exactly does one invest in water, and what are the returns like?

The international scene

Nikko Asset Management splits water investment into three categories – owning water directly, owning infrastructure and owning treatment services. To this could also be added indirect exposure to water, through derivatives or other unorthodox means.

There’s a weather derivatives market in the US, famously pioneered by that investing success story Enron, but this is more of a way for energy companies to hedge against peak demand than to take a punt on it raining.

One of the simplest ways to get some exposure to water has been through exchange-traded funds. The first water ETF was launched in 2005, and three providers run a total of four ETFs at the moment dedicated to tracking various water indices, the largest worth about $US780 million.

These are typically made up of US and European privatised or semi-privatised water utilities and general industrial companies that have some exposure to water treatment, both before and after use. All are listed on the NYSE Arca exchange, and are accessible to Australian investors through plenty of brokers here.

For investors who have jumped on board with water ETFs, performance has been perfectly adequate.

| Water ETFs Returns (%) | |||

| Fund | YTD | 1yr | 3yr |

| Powershares Water Resources (PHO) | 8.14 | -5.52 | 8.09 |

| Powershares Global Water (PIO) | 6.98 | -16.89 | 5.12 |

| Guggenheim S&P Global Water (CGW) | 9.34 | -3.68 | 11.28 |

| First Trust ISE Water Index (FIW) | 11.3 | 5.17 | 11.09 |

But there are two flaws. Firstly, the underlying assets in many of these ETFs are quite similar. Each attempts to track a different water index, but all of those indices are made up of several dozen companies that are deemed to be reasonably exposed to water and in many cases there is overlap.

For example, the top three companies held by the CGW fund are currently Geberit, United Utilities and American Water Works Co. The PHO fund’s top three are Flowserve, American Water Works Co, and Pentair, and the PIO top two are Flowserve and United Utilities. Out of the top 10 companies currently held by the FIW fund, five are in the PHO top 10 as well.

Invesco Powershares’ senior fixed and equity income product strategist Joseph Becker agrees the options for investors are somewhat limited, and says the market has been fairly stable.

“I would not say that it is getting easier to find pure water exposure,” Becker says. “There is a limited set of ETFs and mutual funds focused on water and there have not been any new products to come to market in the past several years.”

While Powershares changed the underlying index its two water ETFs track earlier this year, this was more to do with the corporate relationships in the background than drastically shifting the method of water exposure.

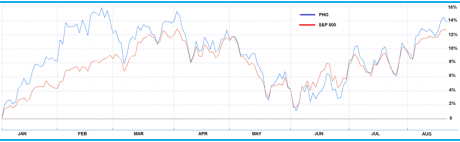

Secondly, as might be expected with ETFs made up of large industrials and utilities, performance has been broadly in line with the US market. This is the PHO (US-focussed) fund’s performance against the S&P 500.

And this is the PIO (globally-focussed) fund’s performance against the S&P 500 and the S&P Emerging Markets Index.

Source: Google Finance

Given the US is in the grip of one of the most severe drought episodes for some time, with more than half the nation designated a disaster area, some impact should be expected from water investments.

Becker backs this up, saying: “To the extent that the drought in the US increases the relative demand for clean water, water transportation and irrigation services and equipment, companies specialising in these businesses stand to benefit.” But the relatively close performance to broader markets suggests the influence of water-related factors may be outweighed by other corporate and macroeconomic inputs.

Of course, while the same 10 or 15 names keep cropping up in water investments, there have been some standouts, suggesting water provision – particularly in emerging markets – may be a useful theme for investing.

Companhia de Saneamento Basico do Estado de Sao Paulo, a Brazilian water and sanitation company also listed in the US, has about a 5% weighting in the holdings of all four funds. A stellar performer to date, shares in the company have gained 30% in the past three months, 75% in the past year and 115% in the past five years.

The performance of American Water Works has also been well above the market. With the US market up about 7% for the year to date, American Water Works has put on 17%. The company’s share price has added 37% in the past 12 months and 76% in the past five years. Both of these companies are reporting average returns on equity above 10%.

Water in Australia

Australia, in contrast, has provided a very different water investment environment from the rest of the world.

Not only in physical supply – two months ago Australia announced it was officially drought free for the first time in a decade, but water is generally scare and depleting here – but also in that real water can be bought and traded.

It’s far from a perfect market though, and anyone looking into water investing in 2007, when Australia was in a decade-long drought and just shy of the global financial crisis, would have been in for a rocky ride.

The Murray Darling Basin spans four states and is the largest water market in the world. What’s more, water use is governed by a detailed system of entitlements (the actual right to an amount of water) and allocations (how much of that can be used at any given time, currently set on the first and fifteenth of every month), and the use of a price and market-based system to organise these assets. This makes water allocations, and what is known as the “temporary water market”, an investable and tradable asset.

In a drought year, the entitlement may be sufficient for an irrigator – but they might only be able to use a limited allocation of that entitlement, and that’s where the temporary market comes in. Water allocations in the basin are highly fungible across regions, so allocations can even be traded interstate. According to Australian Water Investments, $3 billion of water licences were traded in 2009-10.

But when the rain started to fall in 2010, this volatile market completely crashed. Water prices as high as $1,200 a megalitre on the temporary market have come down to lows of $5-10 a megalitre as demand disappeared.

Percat Water is one of four water brokers in Australia, and manager Dina Drapaniotis says there has been appetite from investors in spite of this.

“There’s been a lot of interest in water licences as a diversification from the sharemarket,” she says.

“We've had quite a few enquiries since the GFC looking at alternative investments. The water market is a niche area, which is becoming a lot more attractive.”

Drapaniotis says a reasonable stake in water assets for trading would set investors back a minimum of $50,000, and that the price of temporary water was linked to a number of supply and demand factors including the price of commodities, what irrigators can afford to pay, and determinations by regulating authorities. There’s also the ongoing fight over possible environmental reform of the Murray Darling Basin.

“Unfortunately the negativity of the Murray Darling Basin plan has caused a lot of uncertainty, especially with investors. People are looking at their portfolios and there’s still concern that there may eventually be mandatory cuts to licences, even though the Commonwealth [government] has said repeatedly that there wouldn’t be,” Drapaniotis says.

A recent paper from the major Japanese funds manager Nikko Asset Management found investing in Australian water entitlements to be highly favourable.

The paper found that the market is “uniquely structured allowing investors to capture water price risk”, and is well positioned to take advantage of “the resource scarcity theme”.

Nikko argues the static supply of 18,500 gigalitres of MDB water entitlements combined with growing agricultural, industrial and urban demand – coupled with government buybacks – is a “market condition that can only be expressed through price”.

The paper also said political risk was diminishing, as “governments at both a state and federal level are united that when water is being used for commercial gain … the allocation mechanism for this scarce and finite resource should be price and price alone.”

It said the long duration of the investment, the low correlation to traditional asset classes and the fact it was backed by real assets were all reasons supporting Australian water investment.

Finally, while it is true that state water utilities have not yet been privatised in Australia unlike the companies mentioned above in the US and Brazil, the recent sale by the NSW government of the Sydney desalination plant to a consortium of funds (including two Hastings infrastructure funds and a Canadian pension fund) suggests this may not always be the case. There are six Australian desalination plants at present, and numerous water utilities that could eventually come on the market here, as they have elsewhere.

Rainmaker or drain?

There is no doubt fresh water will continue to be a vitally important part of global growth and development, and an important commodity for investment as a result. The fourth World Water Development Report from UNESCO is due this year, a major study released every three years, and it’s not like we’re going to stop needing water any time soon.

But for investors, pure exposure has either been difficult to achieve at best and a risky rollercoaster at worst.

But where good infrastructure and utilities can be found, there is obviously investment upside and the arguments supporting water investment are strong. As in investment, water may be just a drop in the ocean right now – but it won’t stay that way forever.