Rio's iron safety net

PORTFOLIO POINT: The recent softness in iron ore is a long-term positive for Rio. It can still reduce costs while remaining well placed to fill future demand.

The reported recovery of the Chinese economy as 2,270 delegates gathered in Beijing for the Chinese Communist Party’s 18th Congress was timely.

In what may have appeared to be some sort of celebratory economic fireworks display, the Chinese Administration was able to declare that its economic growth indicators had begun to accelerate again. These economic pronouncements were certainly supportive for my growth portfolio investments Rio, BHP and Mineral Resources.

The Chinese economic growth is real and clearly to Australia’s benefit. Of significance is that the price of iron ore has now climbed back to a three-month high in stark contrast to the unrelenting negative forecasts. Further and importantly, in the first 10 months of 2012 Chinese iron ore imports increased by 8.9% above the previous corresponding period. Also steel product exports were 27% higher than a year earlier.

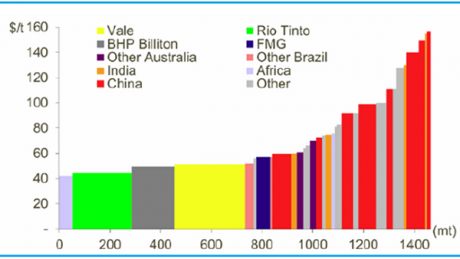

The fact remains that China continues to grow and it continues to demand more iron ore from Australia. The adjustment of the iron ore price to current levels appears to be a natural market adjustment reflecting supply and demand. The demand for iron ore is increasing but so is potential supply. Some potential supply has become real in the last year, whilst other possible supply lines are not coming to market. An important consideration is the cost of production and many second-tier iron ore producers are simply not viable if iron ore dips below $80 per tonne. While that is a perceived risk by financiers, new mines will not open because capital is not available.

So while there is a change in the outlook for the resources sector it is not negative on all fronts. Rather, there is a focus on the extension or maintenance of established mines as opposed to the development of new ones. This will negatively affect some supply and service companies while maintaining a positive outlook for others.

The outlook for iron ore in the context of China

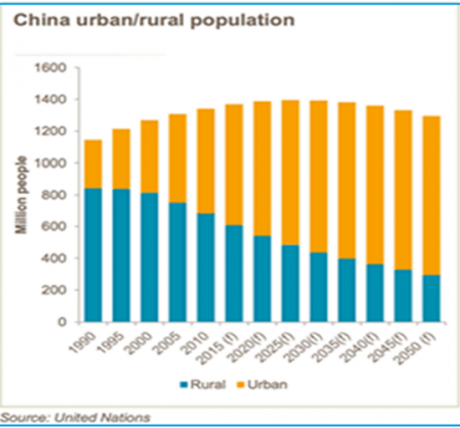

It is well documented that the demand for iron ore is driven by the production of steel in China that supports its economic evolution. Steel production is dynamically changing from a focus upon infrastructure (necessary to support urbanisation) to one that is focussed upon consumerism resulting from urbanisation. The dynamics of this change have been recently documented in an outlook report by the Rio economic unit. Looking at the use of steel per capita, Rio has analysed how much more intensely countries use steel as they become wealthier.

China urban/rural population & Chinese household steel intensity

Source: United Nations; Rio Tinto

While some may claim that the Rio outlook is particularly bullish, it does provide some factual and historical observations which suggest that:

- China will not evolve and grow for decades;

- Its per capita GDP will grow at a faster rate than its total GDP; and

- This feature of industrialisation and urbanisation leads to growing needs for steel.

Rio notes that the steel use per capita is still very low in China at about 200 kilograms per head. Historically, when countries attain wealth of $20,000 per capita (adjusted for purchasing price parity), their consumption generally tends to settle around 600 kilograms per person. This was the case for the US and Germany, when they attained per capita wealth of $20,000 in the 20 years after the Second World War. China’s per capita wealth sits at about $6,000 and its steel industry is in its infancy.

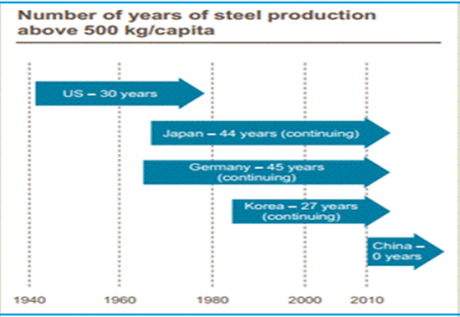

Number of years of steel production above 500kg/capita

Source: Business InsiderThese observable trends are just one part of Rio’s bullish assessment of continuing strong prices for commodities. China will drive the majority of demand over the next two decades, but at as China’s economy transforms to a more balanced one, other South-Asia nations like Vietnam and Indonesia will also become major producers and manufacturers of steel.

Leverage is an interesting force that appears beneficial when working in your favour, but highly disadvantageous when not. The market currently believes Rio’s leverage to iron is a negative; however I have a different view.

I believe the recent softness in iron ore is a long-term positive for Rio.

Mining is a commodity business where the lowest-cost producer will win over time. What the recent drop in iron ore prices has achieved is removing both cost pressures and future capacity from the market.

Miners across the WA region have reduced headcount, which we have seen on the front page and through discussions with industry members: retrenchment is a touchy subject. The operations and construction staff, who were in such high demand 18 months ago, are now finding they have more competition and less bargaining power. This has the effect of reducing the employee costs for the major miners, a statistic we will likely see flowing into future financial reports.

Noteworthy is that Fortescue has reduced its expansion targets down from 155 million tonnes per annum to 115mtpa. Uneconomical Chinese miners are slowly tapering off due to their production cost disadvantages and local marginal miners are very reluctant to push the capital expenditure button.

Rio has staying power and some of the lowest-cost bases in the market, which ensures it will supply a growing portion of Chinese demand, whether prices are $80, $120 or greater. The fact that current ore prices are soft allows Rio to solidify its market position and expand it while the weaker players fall by the wayside.

The value growth portfolio invests for the next five years, not the next five months or five minutes. Given Rio’s strong position in iron ore and the favourable long-term demand profile, it retains its spot in the portfolio.

John Abernethy is the chief investment officer at Clime Investment Management. Register for a free trial to MyClime – Clime’s online stock valuation service.

Clime Growth Portfolio

Return since June 30, 2012: 12.98%

Returns since Inception (April 19, 2012): 4.61

Average Yield: 6.92

Start Value: $111,580.24

Current value: $126,066.97

Clime Growth Portfolio - Prices as at close on 15th November 2012 | |||||||

| Company | Code | Purchase Price | Market Price | FY13 (f) GU Yield | FY13 Value | Safety Margin | Total Return |

| BHP Billiton | BHP | $31.45 | $33.12 | 5.18% | $43.25 | 30.59% | 6.90% |

| Commonwealth Bank | CBA | $53.10 | $58.69 | 8.45% | $61.37 | 4.57% | 16.55% |

| Westpac | WBC | $21.13 | $24.64 | 10.09% | $27.54 | 11.77% | 21.26% |

| Blackmores | BKL | $26.25 | $30.50 | 6.23% | $29.85 | -2.13% | 19.73% |

| Woolworths | WOW | $26.80 | $28.27 | 6.77% | $31.22 | 10.44% | 9.39% |

| Iress | IRE | $6.55 | $7.75 | 5.55% | $7.29 | -5.94% | 20.31% |

| The Reject Shop | TRS | $9.15 | $13.80 | 4.35% | $15.38 | 11.45% | 39.75% |

| Brickworks | BKW | $10.10 | $11.30 | 5.18% | $12.27 | 8.58% | 15.17% |

| McMillan Shakespeare | MMS | $11.82 | $12.23 | 6.07% | $13.66 | 11.69% | 6.97% |

| Mineral Resources | MIN | $8.95 | $7.55 | 9.65% | $12.32 | 63.18% | -8.25% |

| Rio Tinto | RIO | $56.50 | $56.82 | 4.30% | $66.68 | 17.35% | 1.95% |

| Oroton Group | ORL | $7.30 | $6.48 | 11.24% | $6.16 | -4.94% | -4.86% |