Ride the fiscal cliff wave

PORTFOLIO POINT: The current price action could be the best opportunity in years for cash holders to reposition their portfolios into other asset classes.

Last Friday I presented some solid reasons why cash is becoming just a little too unattractive given the bizarre combination of rising inflation and lower cash rates. The evidence in favour of being underweight cash is overwhelming. I’ve outlined over the months where I think better investments lay, and those views have served investors well.

However, for those who have already investigated some of those options or for others just starting that journey, we’re faced with a bit of a dilemma. Is now the time to buy, go overweight, or do we take profits and wait for a better entry point coming into the presidential election and the fiscal cliff? I’ll be honest – I’m quite nervous about what to do in the near term.

I thought a good place to start might be to take another look at what traders are doing. Not that this is in of itself a signal for the rest of us, but it’s valuable information to take on board coming into this period of uncertainty.

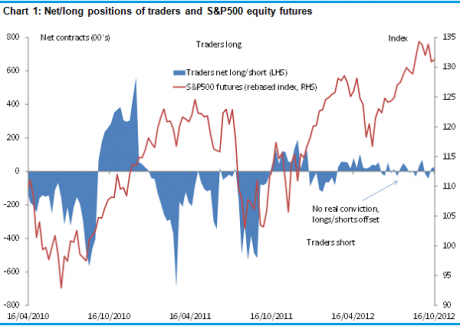

Looking first at equities, you can see from chart 1 that professional traders are basically evenly split in their conviction. You can see this because there are almost as many short as long positions being held (slightly more long). Indeed traders don’t seem to have held any strong conviction calls on stocks since 2011 – plenty of traders have missed out on this 12% or so rally since June and the 30% rally over the last year.

There is information content in that fact alone, because we know it’s not traders/speculators driving stocks at the moment, so it must be real money accounts (fund managers, pension funds and other investors). This matters because real money accounts are more stable, less prone to being spooked over nothing. Consequently, the rally we’ve seen over recent months is more likely to have legs. There may be 50% of the trading market who are short, but this is being offset by 1) traders who are long, and 2) real money managers who are long.

The fact that traders are not net short into the fiscal cliff is valuable information in its own right. It’s telling us that a large section of the market either doesn’t think we’ll get there, or that it won’t matter if we do. Recall my September 24 missive Don’t fall over the fiscal cliff, arguing that economically the cliff doesn’t matter.

This is important for my view as I was relying on a significant market reaction to the fiscal cliff theatrics in order to extend or overweight some positions. Now we find that the fiscal cliff issue may pass as a non-event. Certainly the market appears to be resilient in the face of it now. At the very least it may be the case that in order for sentiment to deteriorate we may actually have to go over the cliff.

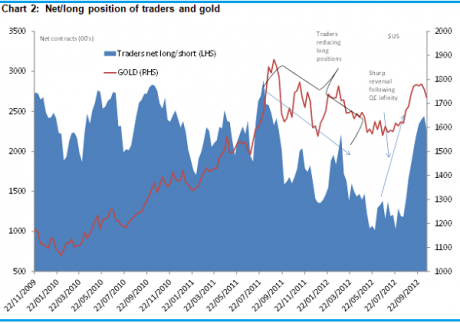

Turning our attention to gold, things are a little more straightforward. There has been a strong conviction buy on gold pretty much since the GFC, when major central banks cranked up the printing presses. The most recent change occurred from mid-2011 to mid-2012, when some of those positions were pared backed – still a strong conviction buy, but there was less enthusiasm. You can see the net effect has been for gold to range trade from $1600 to $1800. Big range, but a strongly held one.

As I discussed in my note of October 15 (Why gold won’t fold anytime soon) the big influence on the gold market at the moment is central bank printing presses. Currencies globally are being debased and so gold is much more attractive to investors and other central banks alike (the ones not printing money).

For mine, that decline in enthusiasm came from a short-lived belief that there might be some limit to Quantitative Easing. Indeed just before the Fed embarked on its open-ended QE policy on September 13, there was even talk that the Fed may be at or near the end of further money printing given the economy looked to be recovering (albeit at a pace that was slower than some would have liked).

In any case, the pick-up in net long gold positions occurred almost immediately after the Fed’s decision. Open-ended QE (with a focus on MBS at this point) was widely interpreted as a signal that the Fed would again start purchasing treasuries outright (actually printing money and monetising US debt) in the not too distant future, probably around the fiscal cliff and the end of Operation Twist. So the fiscal cliff, if anything, has seen traders become more bullish on gold.

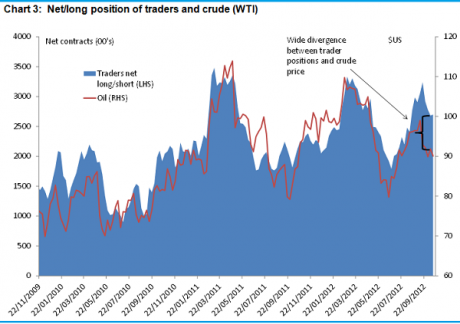

Now the market’s position on crude I find quite fascinating. Readers may remember I suggested investors take profits on crude in my September 28 piece Time to take profits in oil. That’s worked well, and prices came down. The problem is that, so far, traders remain unperturbed. This is important because, as you can see, there is a very good correlation between the futures market and oil prices. Causality changes, sure. So either the crude price will bounce back, or traders are going to go short in due course.

I’m going to watch this position closely. What I’m taking from this that the market has a very strong medium-term conviction buy. If the looming fiscal cliff or a significant price decline can’t shake them, not a lot will. Readers will know that fundamentally I’m bullish crude, and the market’s position gives me more confidence in that view. What I’m worried about now, seeing their conviction, is missing out on the rebound. For now I don’t think it will come given the fiscal cliff, and still think this offers the best opportunity to re-enter a long position. But this is something to watch very closely. Any sign the cliff will come to nothing could see prices rebound quickly and my view come to nothing.

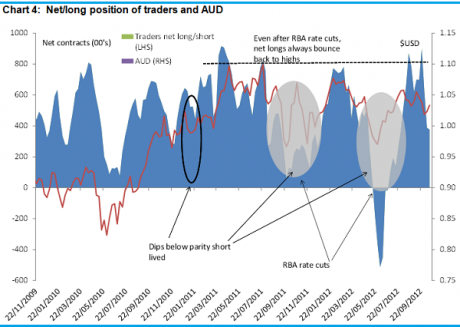

The next chart shows that traders obviously reduced their long positions on the A$ going into RBA meetings (where a rate cut was being entertained). It’s almost like a pavlovian response. Central bank cuts rates, currency depreciates. But you can see the impact is always short lived and once the excitement dies down, traders pile back into their long $A positions.

In fact one of the most important things to note is traders seem to do this without any moderation in their conviction. Have a look at the chart.

You can see that after a relatively short period the number of net longs returns to pretty much where it was prior to the currency’s decline. So people are trading around the RBA’s decision, but their outlook on the $A is not being influenced by it. This tells us that unless the RBA starts to print vast amounts of money, there is no point being short the $A and dips will continue to be short lived. We can’t say that there is much upside to the unit though from the positions of traders, as despite the conviction of net longs, the $A is still below $1.10. The main take then is that any dip due to the fiscal cliff or other concerns will be short lived.

Last but not least we can see there has been a significant change in positioning on US Treasuries. For most of the last few years the market has been short, sometimes very short. But you can see from chart 5 that the market has completely capitulated here, and is now holding the most longs since just before the GFC.

Don’t be spooked by this. This isn’t an ominous sign that the economy is about to deteriorate. I think it’s more the case that the market has underestimated the extent to which the Fed and other central banks would print money. The Fed’s latest announcement for an open-ended QE program changed that expectation and you can see the long positions developing as this option was more widely discussed.

Remember, the Federal Reserve is the biggest player in the US Treasury market at the moment – at times taking 100% of bonds being issued and it holds more US bonds than either China or Japan.

I must stress that I don’t view this as a signal to buy government bonds though. I haven’t changed my view on the government bond market. Keep out. Professional traders may have been forced to go long, but, and as I have advised investors for some time now, I would steer absolutely clear.

I can see that returns have been strong, but this is a false return driven entirely by central bank printing presses. It’s not that I am biased, by nature or employment, against the bond market. It’s just that I don’t think it’s advisable for anyone to be invested in a market that is almost entirely subject to political whim – in this case the decision to print money. When the printing presses stop, capital losses will be huge, without any income offset to inflation.

Summing it all up then, and coming into the fiscal cliff, the key surprise for me in looking at trader positions now is the absence of any underlying bearishness, or pick up in bearishness, creeping into equities or commodities more broadly. Trades are proving to be remarkably resilient in the face of what some claim is a huge cause for alarm.

This fact makes me nervous that I’m overestimating the opportunities that the fiscal cliff may provide. It’s an extremely important point because, if that is the case, then the price action we’re seeing now (the modest stock correction and downturn in some commodities) may be the best opportunity for cash holders to reposition their portfolios. This is especially the case given the fundamentals elsewhere are improving – Europe is stabilising and the global economy looks to be accelerating from a temporary mid-year lull. As history has shown us, when the rebound comes it will be rapid – and we don’t want to miss it.