Research Watch

| Summary: This week’s Research Watch includes a range of investment snippets, including central banks losing control, the rational rally, the Shiller ratio's bear scare, Black Swans return, an ETFs warning, Bon Jovi's penthouse sale, and invest like an actress. |

| Key take-out: The problems caused by excessively loose monetary policy may first appear in areas where ‘whatever it takes’ central bankers have limited or no control, writes Gerard Minack of Morgan Stanley. |

Key beneficiaries: General investors. Category: Portfolio management. |

As stocks continue to advance, there are new questions about where exactly central bank liquidity is flowing: Societe Generale examines why commodities have lost their QE crutch, while Gerard Minack worries new bubbles could be forming outside the realm of central bank control. Equities are still popular, though, with new blessings from Alan Greenspan and long-time bear Meredith Whitney – just watch out for the black swans listed below. Elsewhere, John Bogle warns on ETFs, John Bon Jovi lists his swanky Manhattan apartment and, on video, Mila Kunis rotates from cash to stocks (sell signal?).

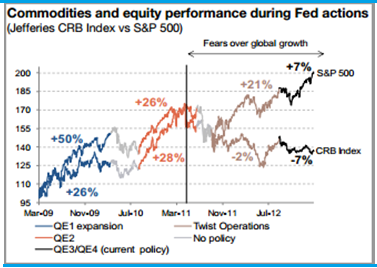

Central banks have lost control of commodities...

“The effect of QE on commodities vanished earlier than for equity markets. During each of the first two quantitative easing phases carried out by the Fed, commodities appreciated by over 25%. However, following the announcement of QE3 in September 2012, commodity prices declined (-7% for the CRB index), a reminder that they remain largely driven by economic cycles rather than central bank actions (gold being the notable exception). In fact, equity markets now seem to be the only asset which benefits from abundant central bank liquidity. Conclusion: The all-time high reached by US equity markets last week can be attributed to the fact that the only major asset class which benefits from the current “risk-on” mood of investors is equities in developed market.” (Societe Generale via Pragmatic Capitalism, March 18)

And they may not be able to contain the next crisis...

“I think that the problems caused by excessively loose monetary policy may first appear in areas where ‘whatever it takes’ central bankers have limited or no control,' writes Gerard Minack of Morgan Stanley. 'Emerging market debt or developed market high-yield corporate debt are two segments that could be a source of stress.' The high-yield, or junk bond, market has become increasingly popular as investors search for income in this low-interest-rate environment. This has made it very cheap and easy for companies with low credit-quality to borrow more money. … 'For now, servicing debt is not troublesome due to solid earnings and low rates,' he continues. 'However, the rise in leverage in the US is now occurring against a backdrop of slowing earnings growth.'

'The point, however, is not that these are sectors of imminent stress,' he writes. 'The point is that these are areas that could see more dangerous mis-pricing of risk emerge in coming quarters because monetary policy is likely to remain loose, liquidity plentiful, and investors will continue to hunt for yield.' Some have argued that this mis-pricing is actually a bubble in the junk bond market. 'More to the point, these are parts of the financial system where developed market central banks would likely be unwilling or unable to ‘do whatever it takes’ to prevent a serious setback. The question would then be whether setback and stress in these sectors could be contained in a world of high leverage.'” (Gerard Minack of Morgan Stanley via Business Insider, March 20)

For now, though, the rally appears perfectly rational...

“Although blue-chip stocks are hitting all-time high after all-time high, former Fed Chairman Alan Greenspan told CNBC that 'irrational exuberance' is the last term he'd use to describe today's market. Greenspan said stocks by historical standards are 'significantly undervalued' even considering the recent moves higher. He added that the payroll tax increase didn't dent spending because of rising asset prices. Addressing the future of low interest rates — which the current Fed has engineered — he said, 'The markets will change first and then we will become unaddicted [to low rates]. It always happens that way and I think it's going to happen that way again.' Greenspan coined the phrase 'irrational exuberance' in 1996, when he was asked a question about soaring stocks at that time. The year 1996 was coincidentally the last time the Dow Jones Industrial Average had its last 10-session winning streak.” (CNBC, March 15)

Indeed, stocks still look cheap...

“The S&P 500 rose to within 1% of its high last week, gaining 131% from its lows. The index trades at 15.4 times reported profit, below the average 19.9 reached in bull markets since 1962, according to data compiled by Bloomberg. … The price-earnings ratio averaged 18.1 in the five-year rally through October 2007 and 20.9 during the gains in the 1990s. While the bull market that began in 1990 started off with a multiple about 14, it exceeded 20 within a year. Valuations during the 2002 advance didn’t fall below the 16.4 historical mean until the cycle’s fourth year … The only time stocks were cheaper as the index rallied to a high was in 1980, when they traded for 9.1 times profits.” (Bloomberg, March 17)

Even Meredith Whitney is bullish...

“Meredith Whitney, the banking analyst who accurately predicted Citigroup's woes prior to the financial crisis, said stocks are a safe place for investors to park their money, especially as the Cyprus bailout rekindles worries about Europe’s debt crisis. 'You have to be bullish on US equities here because you have so much offshore money coming into the US looking for some place safe and sound,' said Whitney, founder and CEO of Meredith Whitney Advisory Group … Whitney, known for her bearish views on the market, and in particular bank stocks, is now singing a different tune. When asked whether she would buy stocks now, even as the Dow has hit a series of record highs this month, she said 'without a doubt.' 'I have not been this constructive, this bullish on the US, on equities in my career,' Whitney said.” (Wall Street Journal, March 18)

But keep an eye on the Shiller ratio...

“It is the terminal valuation that determines the degree of damage done in the subsequent bear market. Value must be reset, and the higher the starting point, the worse the decline when the bull driver ends. …Bear markets from Shiller ratios above 20 are nasty. … [Here's] a chart illustrating the cyclical P/Es at the peak before the 20% declines in the S&P 500 since its inception in March of 1957 … The regression is a linear 'best fit' though the nine data points. Only four of the nine are tight fits to the regression. The three bear markets in the 1950s and '60s were less severe. The savage decline linked to the surge inflationary surge following the Arab Oil Embargo in 1973 was an outlier to the downside, as was the bear market associated with the Great Recession – the one still vivid in our memories. I highlighted the market trough in 1970 because the cyclical P/E ratio of its preceding peak in November of 1968 was 22.2. That's the same as the latest ratio in February of this year.” (Doug Short of Advisor Perspectives, March 20)

Watch out for black swans...

(Click here for the full-size image)

(Societe Generale via Money Game, March 19)

And be careful with ETFs...

“I remain positive on the [ETF] concept, but only when (a) the right kinds of ETFs are used; and (b) used for investment and not speculation. I’m decidedly negative about the remarkable range of foolish extremes that have characterised their implementation. … The record is clear that many of the broad-market ETFs (such as those based on the S&P 500 Index) are used – albeit, far too rarely – by individual investors with a long-term horizon. But more than one-half of all ETF assets are held by financial institutions – not individuals – who trade them with alacrity. Those realities explain why I believe that ETFs are like the famous Purdey shotgun: great for big game hunting in Africa, but also great for suicide. … ETFs have become a means for hedge funds to speculate on the market throughout the trading day. Like a hyperactive child, the finance sector can never let a good thing be … I’ve often described the ETF as the 'greatest marketing innovation' of the fund industry so far in the twenty-first century. I stand by that statement. … Whether it is the greatest investment innovation remains to be seen.” (John Bogle via Minyanville, March 14)

Live like a rockstar...

“Jon Bon Jovi has put his sweet Soho penthouse on the market for $42 million. … This place is huge, sun-filled, and has 11-foot ceilings in parts, arched doorways and three terraces. Oh, and a wood-burning fireplace where you could light one big blaze of glory. Since selling something this pricey might not be a bed of roses, to sweeten the deal, all of the furniture and audiovisual equipment come with the pad. … Just imagine, you could play Guitar Hero on Bon Jovi's very own PlayStation. You know, if he has one. Will the apartment get its ask? That would be quite the miracle.” (Curbed, March 20)

Video of the Week: Invest like an actress...

FT Alphaville notes the bullish views of celebrities like Mila Kunis are once again gaining attention in the mainstream financial media — could it be a contrarian indicator?