Research Watch

| Summary: This week’s Research Watch includes a range of investment snippets, including the die-hard bear, back to the 80s, hedge funds get full, no cheap buys, Dow 36,000, and the Forbes billionaires list. |

| Key take-out: US hedge funds are estimated to have raised their net equity market exposures by 10% to $US418 billion notional in the fourth quarter of 2012 – setting a new record. |

| Key beneficiaries: General investors. Category: Portfolio management. |

As bulls gorge on market gains, one bear refuses to die—Dylan Grice is back with his first note for his new firm, and he’s found plenty of misery to feed on. Central bankers are devaluing society, he argues, and the rising risk of war is something he is increasingly worried about. There’s no shortage of optimists to balance that view, though: hedge funds are now fully invested, Richard Bernstein thinks we’re in a 1980s-style raging bull market—even Richard Russell is advising his readers to buy. So strong is the rally that the author of the spectacularly wrong ‘Dow 36,000’ seems comfortable repeating that prediction, and The Economist is almost defending it. Also this week, what’s cheap, the importance of recession forecasting and, on video, Forbes introduces the top 10 richest people in the world.

Would the real Peter and Paul please stand up?...

“Loose monetary policy by central banks around the world has made us sick, according to Societe Generale’s former strategist Dylan Grice, who says that cheap money has caused divisions in society and in some cases could even add to the risk of war. ‘When central banks play the games with money of which they are so fond, we wonder if they realise that they are also playing games with social bonding. Do they realise that by devaluing money they are devaluing society?,’ Grice, now a research director at investment firm Edelweiss Holdings, said in a research note. Quantitative Easing had increased revenue for these governments, Grice added, but inflation and a lack of spending power will mean the people furthest away from this new money are the ones that will end up losing out. ‘Deliberately impoverishing one group in society is a bad thing to do. But impoverishing a group in such an opaque, clandestine and underhanded way is worse. It is not only unjust but dangerous and potentially destructive,’ he said. ‘With their crackpot monetary ideas, central banks have been robbing Peter to pay Paul without knowing which one was which.’ … Unaware victims of the redistribution don’t know who the enemy is, so they create an enemy, he said. ‘The 99% blame the 1%; the 1% blame the 47%. In the aftermath of the Eurozone’s own credit bubbles, the Germans blame the Greeks. The Greeks round on the foreigners. The Catalans blame the Castilians.’ … Meanwhile in China, that centrally planned mother of all credit inflations, popular anger is being directed at Japan, and this is before its own credit bubble chapter has fully played out,’ he said. ‘The rising risk of war is something we are increasingly worried about.’“ (CNBC, March 12)

This looks like the raging bull market of the 1980s...

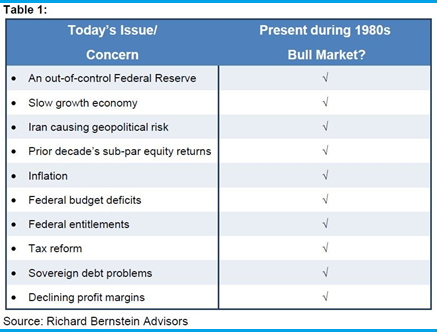

“The table highlights some of the issues that caused investors to forego for many years investing in the 1980s bull market. The irony is that they are largely the same as today’s concerns.

Of course, there are subtle differences between the 1980s concerns and today’s. In the 1980s, investors were worried that the Fed might tighten too much. Today, investors are concerned the Fed might ease too much. In the 1980s, it was Democrats who were concerned about budget deficits. Today, it is Republicans. The sovereign debt problems during the 1980s were largely associated with Latin America. Today, such concerns generally focus on Europe. In the 1980s, investors were concerned with Social Security bankrupting the nation. Today, it is Medicare and Medicaid. Focusing on these differences, though, may miss the point. Investors were scared about a broad range of issues during the 1980s bull market, and the list of concerns is nearly identical to today’s list of concerns. Despite what many might suggest, the uncertainties associated with the current cycle are not unique.” (Richard Bernstein Advisors, March 7)

Indeed, hedge funds are fully invested...

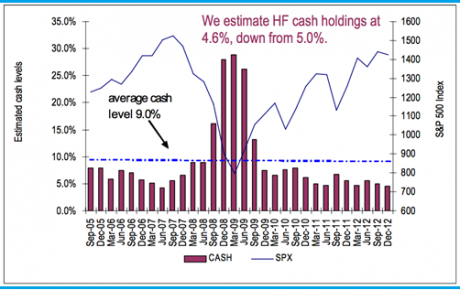

“Based on the quarterly 13F filings and estimated short positions of the equity holdings of 895 funds, we estimate that hedge funds raised net exposure by 10% to $418 billion notional in 4Q12 – setting a new record. Percentage-wise, we put equity net exposure at 55% at the end of 4Q12, compared to the 2Q07 peak of 59%. … Meanwhile, cash holdings fell to 4.6% from 5.0%, below the historical average of 8-10% but above the 2007 trough of 4.3%.” (Mary Ann Bartels of Bank of America Merrill Lynch, March 12)

Even Richard Russell is bullish...

“I checked with the latest statement by Fed head Bernanke, and it’s clear that come hell or high water, Ben Bernanke will do everything in his power to send this market higher. This market lives and dies by the latest edict from the Fed. … Yes, I know that this market is uncorrected during its long rise from the 2009 low, and I know that there are risks in buying an uncorrected advance that is becoming uncomfortably long in the tooth, but my suggestion is that my subscribers should take a chance (after all, Columbus took a chance) and take a position in the DIAs [Dow Jones Industrial Average]. If you buy the DIAs, I suggest that you place a mental stop loss 8% below your purchase price. Losses in investing are inevitable, but losses should always be limited. … Wait, I didn’t mean to place a sarcastic overtone on the above. I really believe that subscribers should take a flyer on this market. After all, after weeks of flirting with a new high in the Industrial Average, the Dow finally confirmed the previous record high of the Transportation Average. With the Industrials and the Transports both in record high territory, I think being in the market is justified under Dow Theory.” (Richard Russel via World King News, March 12)

But recession forecasting still matters...

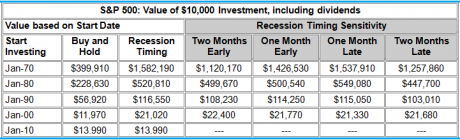

“Imagine if we could call recessions in real time, and if we could predict recoveries in advance. The following table shows the performance of a buy-and-hold strategy (with dividend reinvestment), compared to a strategy of market timing based on 1) selling when a recession starts, and 2) buying six months before a recession ends. For the buy and sell prices, I averaged the S&P 500 closing price for the entire month. I assumed an investor started at five different times, in January of 1970, 1980, 1990, 2000 and 2010.

… The ‘recession timing’ column gives the annualised return for each of the starting dates. Timing the recession correctly always outperforms buy-and-hold. The last four columns show the performance if the investor is two months early (both in and out), one month early, one month late, and two months late. The investor doesn’t have to be perfect!” (Calculated Risk, March 10)

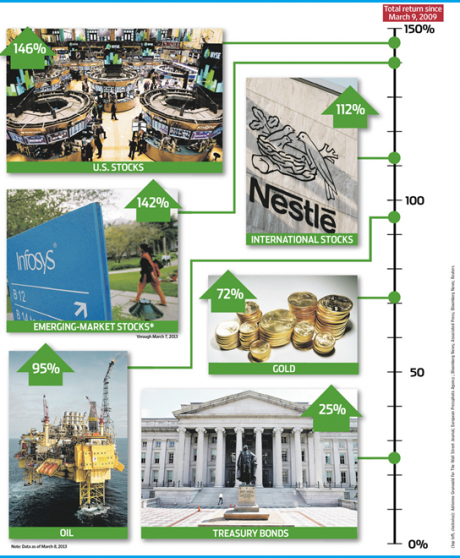

What’s cheap nowadays?...

“All of the major markets have had a huge run off of the lows (though they are barely flat since the 2007 peaks). What does this mean? Are markets too expensive, or are they better priced than last time?” (Barry Riholtz, March 11)

Dow to 36,000—again!...

“James K Glassman was the author of perhaps the most spectacularly wrong investing book ever: ‘Dow 36,000: The New Strategy for Profiting From the Coming Rise in the Stock Market.’ The book, which he wrote with Kevin Hassett, came out in 1999, when the Dow was around 11,000... the Dow fell to 7,300 by 2002. It then faced another massive sell-off in the global financial crisis, reaching a 15-year low of 6,547 four years ago tomorrow. Glassman is back with a Bloomberg View op-ed, arguing... now, 14 years after the book, Dow 36,000 ‘is now clearly in reach.’ … Glassman points out that if the Dow were to rise over the next four years as much as it has, in percentage term, since its crisis-induced bottom four years ago, the stock index would reach 31,022, which is only 16% below Dow 36,000. Let me phrase that a different way: If the stock market rises as much between now and 2017 as it did coming off the bottom of the worst, most catastrophic crisis in modern history, then we would then only be 16% below the value that Glassman thought was justified for the market way back in 1999!” (Washington Post WonkBlog, March 8)

Is it really such a ridiculous prediction?...

“Well, we can guess that Mr Glassman is a glutton for punishment, or at least attention. The interesting thing, though, is that while the ‘Dow 36,000’ prediction ventured in 1999 was epically, spectacularly wrong, it wasn’t that ridiculously outlandish given historical trends. To have gotten to 36,000 from its 1999 level of around 11,000 would have required the index to more than triple (or to rise by about 230%). That seems nuts, no question. But that’s very nearly what the Dow did from 1994 to 1999. And it’s very nearly what it did from 1982 to 1987. If you were asking me to make a bet on the Dow hitting 36,000 within the next decade, in other words, I’d probably turn you down... I would feel extremely confident betting that continued increases in equity prices will lead to a growing (in frequency and volume) set of calls to rein in an inflating financial bubble. But whether there is a bubble or isn’t one or isn’t one and then is one is something we simply can’t know with any certainty. That, more than anything else, is the important thing to keep in mind whether the ticker symbols are running red or green.” (The Economist, March 7)

Video of the Week: The Forbes top 10...

Meet the richest people in the world in 2013.

(Forbes, March 8)