Research Watch

PORTFOLIO POINT: This is a sampling of this week’s best research notes. In a world of too much information, we hope our selection helps you spot the market’s key signals.

As Australian bank stocks breeze past their global counterparts, there are new suggestions our Big Four could grow their returns yet. With capital ratios met, UBS says investors might soon be treated to a special dividend. For those weighing a move into cash, Warren Buffett offers a novel way of thinking about the supposedly low-return asset class: for him, it’s a call option with no expiration date. Bernstein Research also uses the Oracle of Omaha – and a dog – to call out all those forecasters arguing China’s demand for commodities will continue to grow rapidly, amid warnings Apple’s industrial problems at its Chinese manufacturing plant might be a sign of things to come. Meanwhile, the Federal Reserve is apparently considering ways to bolster its latest round of stimulus, while Europe’s monetary easing has exposed the one thing Germans fear above all else. Elsewhere, when to sell gold, investors take the rest of the year off, and pirate insurance is selling cheap. On video, deep thoughts from Jim Chanos.

Betting on better bank payouts...

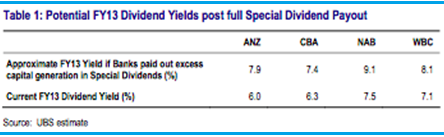

“Over the last few weeks many of the banks have indicated that they are now comfortable with their capital ratios as Australia moves towards the accelerated implementation of Basel III. … While the debate continues as to which ratio is appropriate and what the minimum level should be, we think the more relevant implication is that banks are now approaching levels where management and boards are comfortable with capital ratios and no longer believe they need to accumulate higher levels. As a result of (1) mid-teen levels of ROE; (2) low credit growth; and (3) relatively benign asset quality, the banks are now strong generators of free cash flow. Given the franking credit regime in Australia and shareholder’s desire for yield investments, we believe there is a significant incentive for the Boards to return much of this free cash flow to shareholders in the form of higher dividend payout ratios. … Given the desire of the banks to (1) avoid excessive volatility in dividends (especially cuts); (2) distribute franking credits wherever possible; and (3) to reduce capital accumulation and deleveraging in a low growth environment, we believe banks should consider more active use of Special Dividends. We see special dividends as a useful tool given that shareholders would be likely to see this as a reward for strong profitability in a benign environment.”

(Jonathan Mott and Chris Williams of UBS, September 25)

Weighing the cash option...

“To [Warren] Buffett, cash is not just an asset class that is returning next to nothing. It is a call option that can be priced. When he thinks that option is cheap, relative to the ability of cash to buy assets, he is willing to put up with super-low interest rates, said [Alice] Schroeder, who followed Mr. Buffett for years before she became his biographer. ‘He thinks of cash differently than conventional investors.... This is one of the most important things I learned from him: the optionality of cash. He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price.’ It is a pretty fundamental insight. Because once an investor looks at cash as an option – in essence, the price of being able to scoop up a bargain when it becomes available – it is less tempting to be bothered by the fact that in the short term, it earns almost nothing. Suddenly, an investor’s asset allocation decisions are not simply between earning nothing in cash and earning something in bonds or stocks. The key question becomes: How much can the cash earn if I have it when I need it to buy other assets that are cheap, versus the upfront cost of holding it?” (Globe and Mail, September 24)

What Buffett and a dog tell you about China...

“Warren Buffett’s net worth over the last couple of years has fallen… from $47 billion to $44 billion. That decrease stands in stark contrast to the performance over the same period of my dog. Quantifying the increase in Patches’ net worth over the last two years is difficult, but the sniff test suggests the improvement in his circumstances exceeds Warren’s by a wide margin (Exhibit 1).

Because we all read a mountain of analysis on China, we know that, given those four data points, it is only a matter of time until Patches is as rich as Warren Buffett. Let’s give Buffett the benefit of the doubt and assume his wealth holds at the current level. And let’s assume – conservatively – that Patches is on a run rate of ~1,000% from the lowest possible base (his outlook literally could not have been worse pre-adoption in 2010). We are therefore only talking about a decade and a half before Patches’ wealth eclipses Warren’s. If you haven’t already, I would enrol your kids in fox terrier classes. The only real risk to my analysis is demographics: all the strays available for adoption at Hong Kong Dog Rescue seem to be four years old.” (Michael Parker and Alex Leung of Bernstein Research, September 24)

The Chinese manufacturing squeeze...

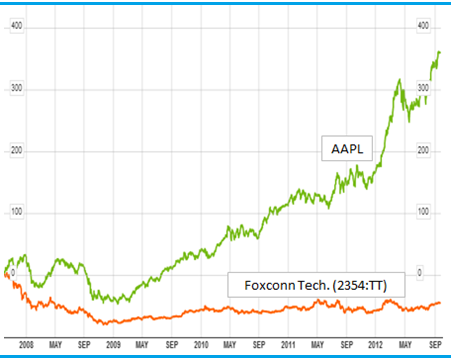

“Foxconn employs some million workers in China to meet this demand for Apple’s as well as Amazon’s, Nintendo’s, and Microsoft’s products (iPad, iPhone, iPod, Kindle, PlayStation 3, and Xbox 360). With its massive manufacturing capabilities and Apple as a major client, one would think that Foxconn’s shares should have benefited at least somewhat from AAPL’s parabolic growth. But they haven’t.

“... In spite of the seemingly cheap labor, the days of easy money in China’s tech manufacturing are over – it’s all about scraping by on lower margins. Foxconn has underperformed analysts’ expectations in 4 out of 5 past quarters. With high expectations for the second half of 2012, the pressure is on. … With Christmas season coming up, the ‘sweatshops’ will be operating around the clock, and the risks of further worker discontent and factory shutdowns are on the rise. As a longer term strategy, Apple and others must be considering alternate suppliers outside of China, which does not bode well for China’s manufacturing sector.” (Sober Look, September 24)

QE4?...

“The new approach would make the Fed’s policies more responsive to the needs of the economy – and likely more forceful, because what the Fed is planning to do would be much clearer. A key feature of the strategy could be producing a set of scenarios for when and how the Fed would intervene. ... Bernanke is studying the idea of declaring that the Fed will boost the economy until unemployment reaches a specific target or until inflation takes off. Some Fed officials have suggested that the central bank keep on stimulating until unemployment reaches 7% or inflation rises to 3%; others have proposed Fed action until unemployment reaches 5.5% or inflation rises to 2.25%. … While many top Fed officials agree with a far more detailed approach, the Fed has not reached final agreement on which new steps to take.” (Washington Post, September 23)

Germany’s greatest fear...

“Some fantastic perspective in a new article in Frankfurter Allgemeine Zeitung about Draghi’s bond plan, and its potential to create inflation. … Despite the fact that it’s in German, you can tell what’s going on: 63% of Germans are worried about inflation; 52% fear natural disaster; 46% fear illness; 39% feat terrorism and; 34% fear their kids get addicted to drugs. Bottom line: Germans are really worried about inflation.” (Money Game, September 23)

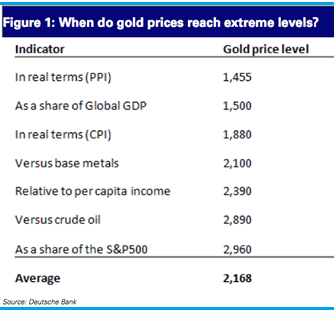

When to sell gold...

“The gold price would need to move above USD 1,880/oz to represent an all-time high in real terms. However, versus physical and financial assets, gold prices would need to rise to much higher levels to be considered excessive. Figure 1 examines the level of the gold price that would be considered extreme against a selection of indicators. On the seven measures we track, gold would need to hit USD 2,390/oz to reduce the purchasing power of an average G7 consumer to its lowest level on record. Moreover the gold price would need to hit USD 2,960/oz to represent an excessive valuation versus the S&P 500. We therefore view the latest gains in the gold price as sustainable.” (Deutsche Bank, September 24)

Is it time to cash out of stocks?...

“As 2012 heads to its final quarter, money managers who caught the year’s rally are sitting on percentage gains well into the double-digits on stocks. As they look ahead to what could be a choppy few months, some are considering watching the rest of the year from the sidelines. … It isn’t that these investors are turning bearish. But, with big gains on the books, they are thinking a little discretion is the better part of valour. ‘We’re growing increasingly cautious after the kind of rally that we’ve had,’ says G. Scott Clemons, who helps oversee $18 billion as the chief investment strategist for Brown Brothers Harriman in New York. The ‘market has gotten ahead of itself.’ … Mr. Clemons is leading clients to take some profits from their winning stocks. At the same time, he is letting the cash from those sales and dividends accumulate as dry powder for now. … Benjamin Pace, chief US investment officer for Deutsche Bank Private Wealth Management, which manages $350 billion, says he recently joked with his colleagues about taking the rest of the year off. The rally that began in June has benefited his clients’ portfolios, Mr. Pace says. But now, he says he has a hard time seeing room for stocks to push higher.” (Wall Street Journal, September 24)

Pirate insurance is going cheap...

“A dramatic fall in pirate attacks off the Somali coast is forcing down the cost of piracy insurance for commercial ships, taking the shine off a fast-growing and lucrative market for London-based insurers. International navies have cracked down on pirates, including strikes on their coastal bases, and ship firms are increasingly using armed guards and defensive measures on vessels including barbed wire, scaring off Somali seaborne gangs. That reduced the number of incidents involving Somali pirates to just 69 in the first half of 2012, compared with 163 in the same period last year, according to watchdog the International Maritime Bureau. … The drop in Somali pirate activity is weighing on the market for so-called marine kidnap and ransom insurance, which has grown for scratch to be worth about $250 million in little more than five years, according to informal industry estimates. Spending on marine K&R cover, which indemnifies shipowners against the cost of paying ransoms and recovering vessels and crew, has halved compared with two years ago, estimates Will Miller of Special Contingency Risks, a unit of insurance broker Willis.” (Reuters, September 21)

Video of the week: No shortage of shorts...

A detailed look at markets with Jim Chanos.

(Bloomberg, September 26)