Research Watch

| Summary: Investors globally are hoping for more stability in 2013, but opinion is divided on which way markets will trend, and where the strongest growth will come from. This article maps out a number of different scenarios, including that this year could be one of the last great buying opportunities. And David Bowie makes a surprise appearance. |

Key take-out: Markets are trending higher, but a Chinese hard landing could bring everything undone. And Iraq joins the IPO trail. |

Key beneficiaries: General investors. Category: Portfolio management. |

Research Watch is back for another year and, in keeping with the predictive theme this week, relaying some of the first big calls for 2013. One analyst argues the coming 12 months could present the last great buying opportunity for years to come, while others map market-moving growth and geopolitical forecasts. And while the consensus view is that China’s new leadership will keep the economy strong this year, one investment house imagines the effects of a so-called ‘hard landing’ on a basket of exposed assets. Also this week, the great rotation back into equities may have begun, David Bowie offers a lesson in the economics of retirement, and China produces its own Jim Cramer. On video, an Indian businessman goes long on gold in the pursuit of love.

The last great buying opportunity for years to come...

“An interesting slide from BofA/ML technical analyst Mary Ann Bartels, who sees a risk of a 10-15% ‘correction’ in 2013: ... ‘We expect the equity market to remain strong into early 2013, but the S&P 500 has been in a secular trading range since 2000. Based on the secular trading range shown below, the S&P 500 is not expected to break out until 2016. ... Using data going back to 1928, the average bear market decline for the S&P 500 is 35%. The good news is that the S&P 500 is in the later stages of its secular trading range, and late stage trading range pullbacks tend to be below average bear markets. Using monthly high-low data for the Dow Jones Industrial Average, the average secular range pullback is 22.2%. If the S&P 500 does not break above the mid-September high of 1475 and follows the historical pattern, a late-stage secular range pullback in the S&P 500 of 18% to 24% would equate to a decline into the 1200-1100 area. A move above 1475 in 2013 moves this projected downside support area higher. We view any pullback in 2013 as the last major buying opportunity within the secular bear trading range.’” (Mary Ann Bartels of Bank of America Merrill Lynch via Business Insider, January 14)

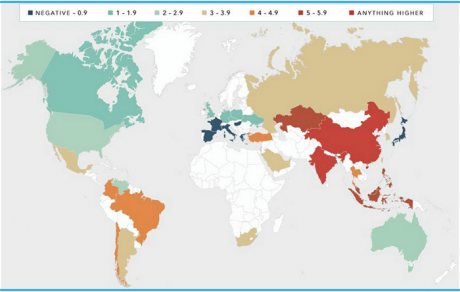

Growth drivers in 2013...

(Credit Suisse, January 10)

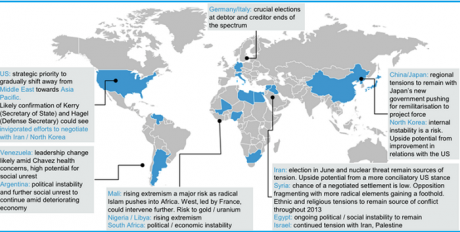

And geopolitical hotspots to keep an eye on...

(Deutsche Bank, January 14)

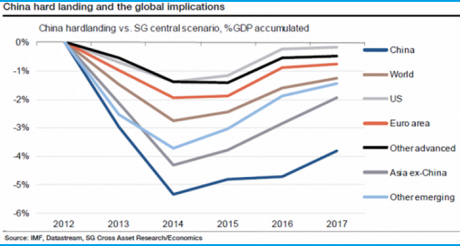

The costs of a hard landing in China...

“We define a hard landing in 2013 as one where the official, full-year, real GDP growth rate plummets to below 6%, which we see as the minimum level needed to keep the job market stable and avoid systemic financial risk. ... Our China hard landing scenario assumes a 10% dollar appreciation in the first year, and this despite additional QE from the Fed. It does not take any great stretch of the imagination to paint an even bleaker scenario in which a China hard landing triggers outright currency wars and protectionist measures on trade flows. ... [There could also be an] almost 50% drop in base metals: Our demand model suggests that a Chinese hard landing would drive prices sharply lower over the first two to three months. ... The demand model suggests that Brent would drop about 30% (which equates to approximately a $30 decline given the current value of Brent). ... The impact of a Chinese hard landing on gold demand is the most complicated to forecast. Our impulse response model suggests prices would rise around 15% to over $1900/oz but then drop very quickly. This would repeat the pattern of 2008-09, in which gold originally rallied on a flight to quality, but then retraced.” (Societe Generale, January 8)

David Bowie and the economics of retirement...

“David Bowie’s new single raises an important economic point – that perhaps young people who aren’t saving for their retirement are behaving more rationally than the so-called experts claim. For many of us, I suspect, this release corroborates David Hepworth’s point that we don’t love new music by our favourite artists as much as we loved their older work, even if the two are indistinguishable to a neutral listener. What’s going on here is partly a framing effect; the pre-Tin Machine era Bowie was so brilliant that anything short of one of the greatest pop singles of all time would be disappointing. But there’s something else going on. It lies in the concept of consumption capital ... When we bought and listened to Bowie records in the 70s and 80s we accumulated a stock of consumption capital. And the utility we derive from this is so great that a new addition to it naturally has low marginal utility. In other words, what we think of as consumption is, in many cases, a form of saving – something that gives us utility in future years. Just as saving builds financial capital which we can draw on in future, so spending builds up a stock of satisfaction which we can draw upon in the future. Does anyone really think the money they spent on Hunky Dory would have been better invested in the stockmarket? And herein lies a reason why it might be rational for young people not to save in the conventional sense of the word. In spending money, they are building consumption capital. Now, I appreciate that youngsters today don’t believe in spending money on records. But there are many types of consumption capital. Spending on holidays and nights out accumulates a stock of happy memories. Spending on guitars and music lessons gives us a stock of leisure skills which give us future satisfaction. And so on. ... High spending and low (financial) saving does not necessarily mean that people aren’t preparing for the future. Our wellbeing today isn’t increased merely by our past saving, but sometimes by our past spending.” (Stumbling and Mumbling, January 8)

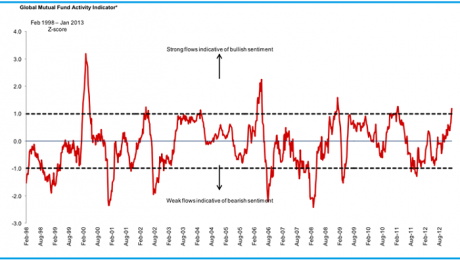

And a great rotation...

“Investors this week poured the most money into equity funds in more than five years, as global shares surged and a compromise deal on the US fiscal cliff boosted confidence. Net inflows into equity funds monitored by EPFR, the funds research company, hit $22.2 billion in the week to January 9 – the highest since September 2007 and the second highest since comparable data began in 1996. Record inflows into emerging market and world funds drove much of the expansion. The figures capped a week during which global equity indices hit multi-year highs, encouraging speculation about a ‘great rotation’ this year out of safe, recession proof assets such as government bonds and into equity markets.” (Financial Times, January 11)

Which should give investors food for thought...

“Consider the following chart from Mark Diver at Nomura:

Yes, extreme moves like this are a contrarian indicator. Nomura’s model is showing the most bullish sentiment since February last year – and Diver says that extreme levels on the indicator have tended to prove a useful signal for equity market returns on a 12-week forward view. … Wise to tread carefully.” (FT Alphaville, January 11)

The 5 hottest stockmarkets in the world...

- “Kenya NSE: Up 39.3% in 2012. … Foreign inflows have provided an impetus for strong performance. This is best represented by Equity Bank, the best performing stock since 2006, in which foreign investors have increased their holdings and now own nearly 50% of the stock.

- Pakistan KSE: 49.3%. The Karachi Stock Exchange has tripled in value since 2008, and could soon eclipse 17,000.

- Egypt EGX 30: 49.6%. Egypt’s stocks have done well in spite of a bleak economic backdrop and volatility spurred by political unrest. Its exceptional YTD return in 2012 is primarily due to a ‘bounce-back’ effect...

- Turkey XU100: 53.3%. Hot inflows of $15 to $20 billion in foreign direct investment have fuelled this market’s growth. As well, after 18 years, Fitch’s recent upgrade has returned Turkey to investment grade territory.

- Venezuela IBC: 302.8%. Venezuela’s abysmal inflation rate, which stood at 19.9%, is helping to juice stocks. A massive increase in government spending in the run-up to October’s presidential elections spurred consumption.”

(Business Insider, December 26)

Iraq’s biggest IPO...

“Investors will get a chance to buy into the country’s oil-fuelled economic boom this month as Iraqi mobile telephone operator Asiacell seeks to raise at least $1.35 billion by floating 25% of its share capital on the Baghdad stock market. It will be the country’s largest-ever initial public offer of equity, and one of the Middle East’s biggest share offers in the last several years - the first major IPO in Iraq since a US-led invasion toppled Saddam Hussein in 2003. So it will be seen as a test of investor confidence in an economy that is recovering from years of war, political instability and financial sanctions. Officials hope a successful IPO will galvanise the stock market, luring foreign money into the country and helping make the market a useful tool for Iraqi companies to raise funds for expansion.” (Reuters, January 2)

Meet the Jim Cramer of China...

“Now 26, Hu Bin is China’s most popular online market commentator. His blog has gotten more than 400 million visits. His posts are equal parts outlandish and thoughtful, and employ liberal use of bolded, multicolored text and exclamation points. Hu writes under the name Yerongtian – a character from a real estate-themed Hong Kong soap opera – and ... has posted at least one picture of cats, and multiple pictures of himself wearing sunglasses to help illustrate his opinions. In 2009 the state-run newspaper China Daily listed him (under his alias) among the 10 people in the nation with the most influence on China’s stockmarket. … [The same year] he got into a spat with another stock commentator, a man named Hou Ning. The two made a 1 million yuan (roughly $160,000) bet on the future of the Shanghai Stock Exchange Composite Index, with Hu wagering it would reach 4000 by the end of the year. It didn’t, and Hu didn’t pay, but he got what he wanted out of the rivalry. ‘Who would have paid attention to me if I had said 3000?’ he asks. ‘Everyone already knew it would reach 3000.’ In 2010 he promised to throw himself off one of Shanghai’s tallest buildings if the SSE Composite Index didn’t reach 5800 by the end of the year. It didn’t: Hu is still with us. … Hu says he is not a financial rabble-rouser. Most laypeople, he says, should stay away from investing in individual stocks … but he knows the irresistible pull of equities on the newly wealthy, particularly in a country where there are few opportunities for investment. In effect, he’s giving advice to people he knows probably shouldn’t be in the market but are going to invest anyway.” (Businessweek, December 20)

Video of the week: Gold gets the girls...

“A Indian businessman has decided to invest his sizable fortune in something truly worthwhile: Bling. ‘Unlike many, I have no passion for high-end luxury vehicles like Audi or purchasing something else that is fancy. I had money and wanted to invest in gold,’ said Datta Phuge of Pune. But what good is having a whole bunch of gold if you can’t show it off? So Phuge did the only sensible thing: He had 15 goldsmiths working for 15 days to construct a solid-gold T-shirt with six Swarovski buttons and a gold belt to match. ... The 14,000 golden flowerings and 100,000 shimmering spangles sewn onto a fabric base of white velvet set Phuge back a cool $230,000 — or a third of his estimated wealth. ‘I know I am not the best looking man in the world but surely no woman could fail to be dazzled by this shirt?’ he said.”

(Gawker, January 7)