Research Watch

PORTFOLIO POINT: This is a sampling of this week’s best research notes. In a world of too much information, we hope our selection helps you spot the market’s key signals.

After a month of unprecedented central bank intervention, Society Generale’s Dylan Grice – never known for rosy outlooks – is at his most bearish. He warns the debasement of money results in the debasement of society, drawing parallels with some of history’s most violent revolutions and genocides: “I am more worried than I have ever been,” he writes. One currency that has benefitted from the great debasement is the Australian dollar, whose value continues to be debated. A broad new measure still has the Aussie trading in range with our terms of trade. Meanwhile, Saul Eslake illustrates just how much power international investors have over Australian markets, while David Rosenberg points out the Federal Reserve is losing control over equities in America. Elsewhere, October marks the end of what is traditionally the worst six-month period for stocks, exchange-traded funds may have grown too big, too fast, and we introduce the world’s largest hedge fund you’ve never heard of. On video, Allen Stanford’s estate is up for sale.

The Great Disorder...

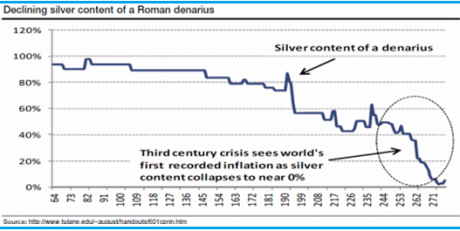

“History is replete with Great Disorders in which currency debasement has coincided with social infighting and scapegoating. This debasement of currency also coincided with a debasement of society. Factions grew more suspicious of one another. Communities fragmented. And one part of the community bore the brunt of the fears. … Third Century Roman inflation (and implicit currency debasement) sparked a rapid turnover of emperors as the scapegoating over the systemic debasement saw Romans turned on Christians with a great violence which lasted throughout the period of the currency debasement but peaked with Diocletian’s edict of 303 AD.

… A similar dynamic seems evident during Europe’s medieval inflations, only now, the confused and vain effort to make sense of the enveloping turmoil saw the blame focus on suspected witches.

… Were the same dynamics at work during the French Revolution of 1789? … The political violence was justified in part by blaming nobles and counter-revolutionaries for galloping inflation in food prices.

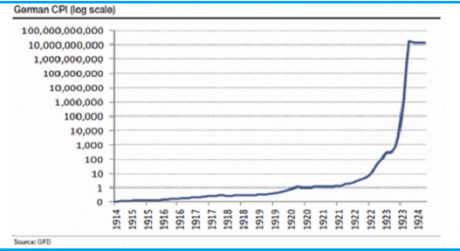

However, the most tragic of all the inflations in my opinion, and certainly the starkest example of a society turning on itself was the German hyperinflation. Like other Axis countries on the wrong side of the War and now in the grip of hyperinflation, Germany turned viciously on its Jews.

… So I keep wondering to myself, do our money-printing central banks and their cheerleaders understand the full consequences of the monetary debasement they continue to engineer?” (Dylan Grice of Society Generale, October 2)

Does the Australian dollar have a Caterpillar problem?...

“The 30-day correlation between Caterpillar stock and the Australian dollar-US dollar exchange rate is currently 0.85, where 0 means there is absolutely no discernible pattern between their movements and 1 means they move in lock-step. The correlation between the pair has surged higher in recent weeks jumping from 0.47 just over two weeks ago... With that strong correlation, Caterpillar’s recent stock price slide [following a profit warning] should be concerning for holders of the Aussie. Since reaching a 2012-high in February, Caterpillar stock is down a whopping 26%. … Contributing to the guidance cut, Caterpillar cited weaker demand for construction and mining equipment. The firm is a manufacturer of construction and mining equipment, industrial engines, turbines and locomotives--in essence all the essential ingredients of the Australian mining economy.” (Wall Street Journal, September 28)

Or is it at fair value?...

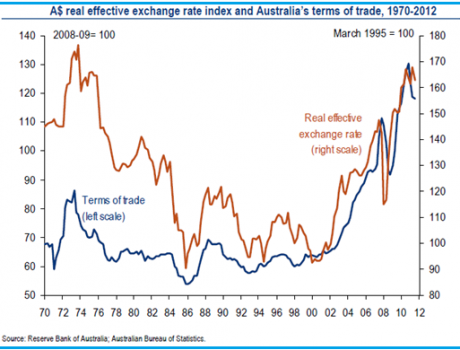

Shown here is the Australian dollar against a basket of currencies and adjusted for inflation in Australia and its trading partners:

(Saul Eslake of Bank of America Merrill Lynch, October 3)

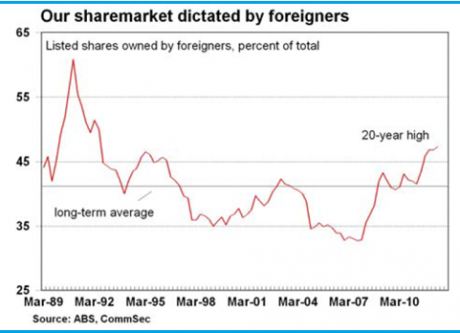

Australia becomes a foreign market...

(CommSec, September 27)

The end of the wealth effect...

“So the Fed is pinning its hopes on stimulating the economy via the wealth effect again, as it did when it revived the post-tech-wreck asset bubble in housing and credit in that now infamous 2003-07 period of radical excess. But ... we saw real disposable personal income decline 0.3% in August for the largest setback of the year. The QE2 trend of 1.7% is about half the 3.2% trend that was in place at the time of 0E2. … But it is the action in the equity market that is most telling. This is the first time after any major central bank incursion – QE1, QE2, Operation Twist and LTRO – that 13 (trading) days after the announcement, the stock market is lower.” (David Rosenberg of Gluskin Sheff, October 3)

Testing Spain’s limits...

(Pragmatic Capitalism, October 3)

October: jinx, or bear killer?...

“[October is] known as the jinx month because of crashes in 1929, 1987, the 554-point drop on October 27, 1997, back-to-back massacres in 1978 and 1979, Friday the 13th in 1989, and the meltdown in 2008. Yet October is a ‘bear killer’ and turned the tide in 11 post-WWII bear markets: 1946, 1957, 1960, 1962, 1966, 1974, 1987, 1990, 1998, 2001, and 2002. … The worst six months of the year also ends with October.” (Pragmatic Capitalism, October 3)

ETF providers got ahead of themselves…

“In recent years, investors have poured tonnes of money into exchange-traded funds, fuelling a boom in the industry. To meet the evolving demand, fund companies started offering all kinds of wild ETFs, sometimes employing extraordinary amounts of leverage. However, it’s possible that the industry might’ve gotten ahead of itself. … Despite the overall rise in assets (to a record $1.3 trillion), the total number of available funds fell to 1,441 [in September]. Six new funds were released in September, while twenty-four were liquidated. Last month was the highest on record in terms of fund liquidations.” (Birinyi Associates via Business Insider, October 3)

Apple and the world’s biggest hedge fund...

“The fund, which was at $117.2 billion as of June 30, and which has lately been growing at a pace of about $15 billion per quarter (which would put it at about $130 billion currently), is none other than Braeburn Capital, a Nevada-based asset management corporation. … Braeburn is a subsidiary of another far more famous company, which since 2006 has had one simple task: manage the cash of the parent company. … Of course, the parent company in question is none other than Apple, whose publicly reported cash hoard at June 30, 2012 was a whopping $117,221,000,000. This is the AUM of Braeburn. … When someone in the United States buys an iPhone, iPad or other Apple product, a portion of the profits from that sale is often deposited into accounts controlled by Braeburn, and then invested in stocks, bonds or other financial instruments... Then, when those investments turn a profit, some of it is shielded from tax authorities in California by virtue of Braeburn’s Nevada address. … While Apple for now uses Braeburn primarily in its capacity to find legal tax loophole all around the world and avoid paying taxes, there is no denying that with a cash balance that in a two years may be well over $200 billion, applying even a modest amount of leverage would make AAPL the best capitalised bank, mutual fund or asset manager in the world. What’s more, Braeburn has no reporting obligations... Not confined by the limitations of being a ‘long-only’, it is in its full right to hold any assets it feels like, up to and including CDS on housing, puts on Samsung, or Constant Maturity Swaps that pay if the 10 Year collapses. It just doesn’t have to report any of them.” (Zero Hedge, October 3)

Video of the Week: The Allen Stanford fire sale...

Your chance to buy the fraudster’s cricket memorabilia, jewellery – even his chequebook.