Research Watch

| Summary: This week’s Research Watch covers a range of investment snippets, including the top dividend destinations, banks vs resources, small caps, the Nikkei and short skirts, Dow 15,000, Dr Copper, and Buffett’s market forecasts. |

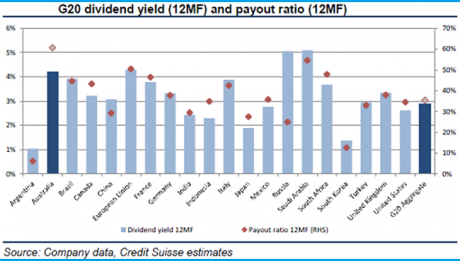

| Key take-out: Credit Suisse analysis shows the Australian market offers the fourth highest dividend yield and the highest payout ratio within the G20 markets. |

| Key beneficiaries: General investors. Category: Portfolio management. |

Despite all this talk about the “hunt for yield”, it turns out you don’t need to venture too far at all. Credit Suisse has just named Australia among the top dividend destinations in the developed world, and lists the individual stocks that will help you capitalise. There aren’t any banks on that list, which could give weight to Goldman Sachs’ call to make the “switch from hell” – out of our big four, and into mining shares – although others suggest you should be thinking much smaller. Meanwhile, what Dow 15,000 means for you, and what Nikkei 13,000 means for a pop group that uses the index as a wardrobe cue. Dr copper looks ill and margin debt is hitting new highs, leading hedge fund manager Leon Black to sell everything that’s not nailed down. But on video, fresh from Berkshire Hathaway’s annual meeting, Warren Buffett makes a case for stocks at record levels (he remembers Dow 100).

The best dividend stocks in one of the best-yielding markets...

“The Australian market offers the fourth highest dividend yield and the highest payout ratio within the G20 markets. … We have screened Credit Suisse coverage according to whether they offer high and sustainable dividend yields. Predictably, Banks, A-REITs, Healthcare and defensive exposures screen well on this basis. In addition, we have asked Credit Suisse stock analysts which of these stocks could deliver an upside dividend surprise in the short term. … Companies present in both the capex and upside screens: Adelaide Brighton (ABC), AGL Energy (AGK), Brambles Limited (BXB), Fantastic Holdings (FAN), OrotonGroup (ORL), Pacific Brands (PBG), Premier Investments Ltd (PMV), Qantas Airways Ltd (QAN), Rio Tinto (RIO).” (Credit Suisse, May 7)

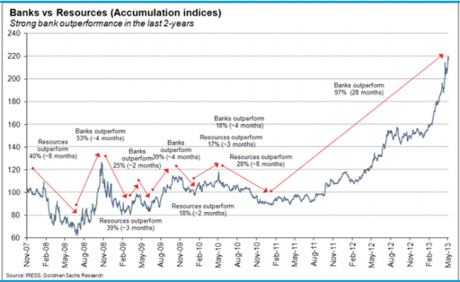

Avoid the bank bubble with the ‘switch from hell’...

“The banks will go higher if the US keeps running, but their long period of outperformance – for the banks – I’d say it’s over or very near an end. Banks have outperformed resources by 97% in the last 28 months and it’s time to chase these (very) cheap resources. … For me it’s time to begin the switch from hell – time to go back into those beaten up resources – do you seriously see this going too much further!!!!” (Richard Coppleson of Goldman Sachs, May 6)

But don’t neglect the small caps...

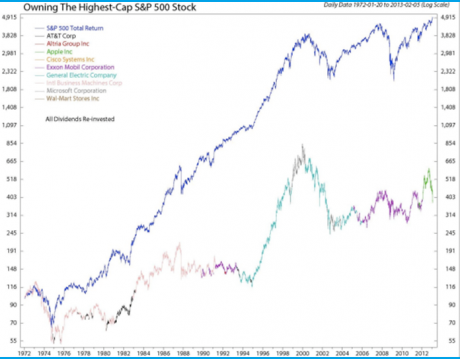

“Since 1972, the S&P 500 increased nearly 5,000%. Yet, owning the top stock in the S&P 500 by market capitalisation increased in value approximately 400%.” (John Del Vecchio of The Active Bear ETF, May 1)

Long bets, short skirts…

“Kanon Mori, Yuki Sakura, Hinako Kuroki and Jun Amaki have been following the Nikkei 225 stock average obsessively since Prime Minister Shinzo Abe took office in December. The oldest of the foursome is Mori, but she is still only 23. The youngest is Kuroki, 16 and still in high school. None of them are studying for a degree in economics, let alone playing the stock market. Instead, the four are members of a new idol group, Machikado Keiki Japan, and stocks play an important part in their performances. ‘We base our costumes on the price of the Nikkei average of the day. For example, when the index falls below 10,000 points, we go on stage with really long skirts,’ Mori explained. The higher stocks rise, the shorter their dresses get. With the Nikkei index ending above 13,000, the four went without skirts altogether on the day of their interview with The Japan Times, instead wearing only lacy shorts.” (The Japan Times, May 2)

What does Dow 15,000 mean?...

“Technically: Technically, there’s isn’t much to the mark. These big, round numbers don’t mean anything technically, as Tomi Kilgore pointed out. The Dow is already above its 50-, 100- and 200-day moving averages, three closely watched technical markers. … Psychologically: The effect of something like Dow 15000 usually is more psychological. Big, round numbers always attract interest. The difference is that during the past few decades, it was an article of faith that the market represented the economy, or even that the market was the economy. The aftermath of the Crash of 2008 has severely disabused most everybody of that notion, one reason why interest in the market, and trading volumes, remain so lacklustre even as the indexes hit fresh records. It’s hard for most people to get excited about new highs in the stock market when they’re still trying to rebuild the wealth they lost from the 2000 and 2007 stock crashes... Valuation: We’ve become so bubble battered over the past 13 years, that it’s natural to think any rising asset must be in a bubble, but it’s relatively easy to make a case that stocks are fairly valued. The simple forward-year PE ratio on the S&P 500 is a hair under 15, roughly in line with the long-term average.” (Wall Street Journal Money Beat, May 7)

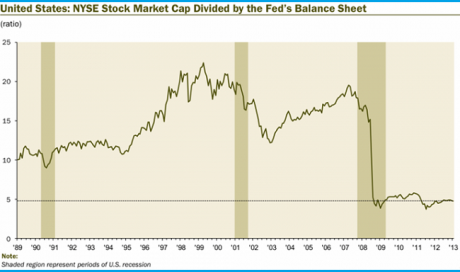

Perhaps it’s not such an impressive record after all...

(Dave Rosenberg of Gluskin Sheff, May 5)

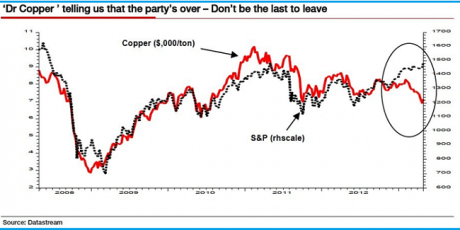

As Dr Copper falls ill...

“Edwards’ central argument is that just as both the US and Europe are slipping towards outright deflation, investors have convinced themselves they just have to participate in the liquidity fuelled frenzy offered by unlimited QE. But the copper price is saying something different – and it offers a solid reminder that liquidity itself can disappear very quickly indeed, as it did when Edwards’ last drew our attention to ‘Dr Copper’ … back in January, 2007.” (Albert Edwards of Societe Generale via FT Alphaville, May 2)

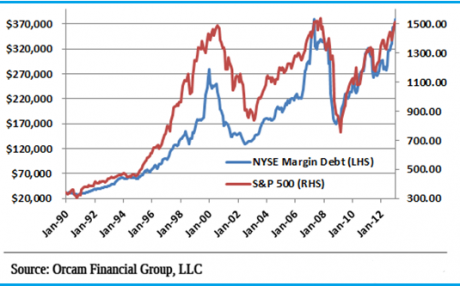

And with leverage running hot...

“It’s rather alarming to see NYSE margin debt just shy of its all-time high as of the March reading. My guess is we’ve actually already surpassed the all-time high though we won’t officially know until April data is released. Fun times knowing we live in a world that is built on such a fragile foundation.” (Pragmatic Capitalism, May 5)

It might be time to sell ‘everything that’s not nailed down’...

“‘It’s almost biblical. There is a time to reap and there’s a time to sow,’ Leon Black, chairman and chief executive of Apollo Global Management declared to the Milken Institute’s global conference in Los Angeles, alluding to that same Scriptural passage. ‘We are harvesting,’ he added pointedly. That is, the private-equity giant is a net seller because things simply can’t get much better. ‘We think it’s a fabulous environment to be selling,’ he says, noting Apollo has sold about $13 billion in assets in the past 15 months. ‘We’re selling everything that’s not nailed down. And if we’re not selling, we’re refinancing.’ That’s because there has never been such a good time to borrow -- which is raising warning flags for Black. ‘The financing market is as good as we have ever seen it. It’s back to 2007 levels. There is no institutional memory,’ he observed, referring to the peak of the last credit bubble. That was when then-Citigroup CEO Chuck Prince famously said that as long as the music was playing, bankers had to keep dancing -- which they did, with disastrous consequences when the band stopped.” (Barron’s, May 4)

Video of the Week:

Although Buffett says markets will go a lot higher...

“You’ll see numbers a lot higher in your lifetime,” says Buffett, joking about watching the Dow cross 100.

(Click here to watch the video: CNBC, May 6)