Reconsidering 'success' in carbon markets

Most birthdays are celebrated with cake and funny hats, but America’s first functioning cap-and-trade program marked five years of carbon dioxide allowance auctions by raising over $US100 million for clean energy efforts across the northeast US.

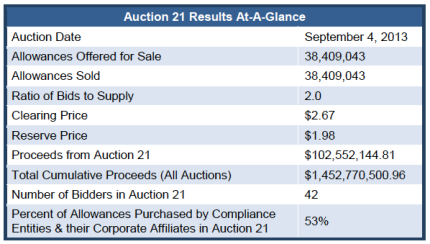

The Regional Greenhouse Gas Initiative sold over 38 million carbon allowances early last week during its 21st carbon auction at a clearing price of $US2.67, generating $US102.5 million for the nine participating member states.

Despite selling 100 per cent of all allowances offered for sale, prices in this auction swooned a bit from the record high set during RGGI’s previous auction in June. This raises an important question – if carbon markets are driving clean energy investments while emissions fall, does the auction price even matter?

Carbon market swings belie overall stability

RGGI held its first auction in 2008, and since then prices more or less remained steady until the shale gas revolution and economic recession cut power demand and emissions, with prices generally hovering around $US2 for a permit to emit one ton of carbon beyond the system’s 'cap'.

Available allowances built up as demand fell, and the market was soon oversupplied. In response to these changing market dynamics, RGGI member states agreed to reform the program earlier this year, cutting the system’s cap by 45 per cent starting in 2014, with an additional 2.5 per cent decline every subsequent year from 2015-2020. This response to market conditions, it should be noted, is the type of flexibility the European Union’s Emissions Trading System has had trouble enacting.

The market responded in turn, and auctions held in March and June rebounded by selling out of all available permits at climbing clearing prices of $US2.80 and $US3.21, respectively. With cap-and-trade concern at an all time high due to the Australian market’s pending rollback and slow recovery of prices in the EU ETS, RGGI’s price stumble could be cause for concern by some – especially as carbon prices slip in California’s nascent carbon market.

What if 'success' isn’t a high price on carbon?

But here’s the thing: So what if allowance prices in RGGI (or any carbon market) stumble? The value of any single allowance only reflects what the polluting entities and market participants think their emissions and emissions reductions measures are worth under the cap.

When the system’s functioning, that cap will be consistent with the trade occurring within the market. And when the system’s functioning well, it will drive investment in the kinds of technologies that cut emissions across the board. Put another way, 'success' may simply be the fact that there’s a working carbon market in place, providing incentive to either cut pollution or pay for clean energy.

That’s important, especially considering the investment constraints currently facing clean energy developers, generally declining public funding for renewable projects, and the political challenges setting and maintaining the 'right price' on carbon. Jesse Jenkins recently laid out this theory in a thorough and well-reasoned piece, from which I’ll borrow a key quote:

Accumulating the social benefits of carbon through markets

Bingo. Cumulative proceeds from RGGI auctions currently total $US1.4 billion dollars, and that amount may hit $US2 billion as early as 2020. Those dollars are divvied up and invested in initiatives chosen by each member state like energy efficiency, renewable energy, utility bill assistance, and greenhouse gas abatement programs.

Since 2008, RGGI has seen a 30 per cent reduction in regional power sector emissions and 84 per cent of all allowances have been sold to electricity generators and their corporate affiliates. System investments have already returned $US1.3 billion in energy bill savings, offset 27 million megawatt-hours of electricity generation, and prevented 12 million tons of emissions – all at the same time member states increased GDP twice as fast and cut carbon 20 per cent faster as other states. Is it any wonder the northeast US routinely ranks at the top of energy efficiency lists?

The same trend is apparent in California’s carbon market. The system’s value has boomed to an estimated $US1 billion dollars, generated hundreds of millions of dollars earmarked for clean energy and emissions reduction, and routinely sold out of available allowances during auctions.

All of these points illustrate that in a well-functioning cap and trade system, the social cost of carbon is paid by those who create the emissions, while revenue from those sales creates direct economic and environmental benefits for the people who bear the burden of that carbon pollution.

It’s kind of the ideal outcome during a period where political action on climate is almost non-existent and private investment in decarbonisation is far from abundant. Analysts often focus on considering the price of carbon within a market as the ultimate indicator of its health, but with 60 carbon pricing systems underway worldwide and international linkages starting to take hold, maybe it’s time to reconsider exactly what we consider 'success' in carbon markets.

Silvio Marcacci is principal at Marcacci Communications, a full-service clean energy and climate-focused public relations company based in Washington, DC.

Originally published by CleanTechnica. Republished with permission.